Renowned value investor Warren Buffett prefers to invest in companies that are reliable money makers, businesses that can withstand economic and corporate vagaries over time. With $122 billion in cash at his disposal as of Berkshire Hathaway's (NYSE:BRKa), (NYSE:BRKb) most recent earnings report, it stands to reason that retail investors and markets would want to know his latest porfolio holdings.

Inclusion in his Berkshire portfolio is considered a seal of approval for the stocks purchased or held. It's also why many retail investors follow his lead and markets react to what Buffet buys and sells.

Though Buffet has historically invested in financials such as American Express (NYSE:AXP) and blue chip stocks such as Coca-Cola (NYSE:KO), recently he's started purchasing in tech stocks, most notably a massive stake in Apple (NASDAQ:AAPL). Is this a sign his investment focus is shifting?

No one but Buffett can say for sure, but on Thursday, August 15, Berkshire Hathaway releases its 13F filing, the quarterly report required by the U.S. Securities and Exchange Commission (SEC) from all institutional investment managers listing all equity asset holdings under management, worth at least $100 million in value. It's a highly anticipated event, not least because it offers investors and markets a more detailed look into the mind of Buffett, and what he thinks is worth betting on now.

Ahead of the release, we've tried to predict what might have been Buffett's biggest trades this quarter.

New Buy: Why Not Microsoft?

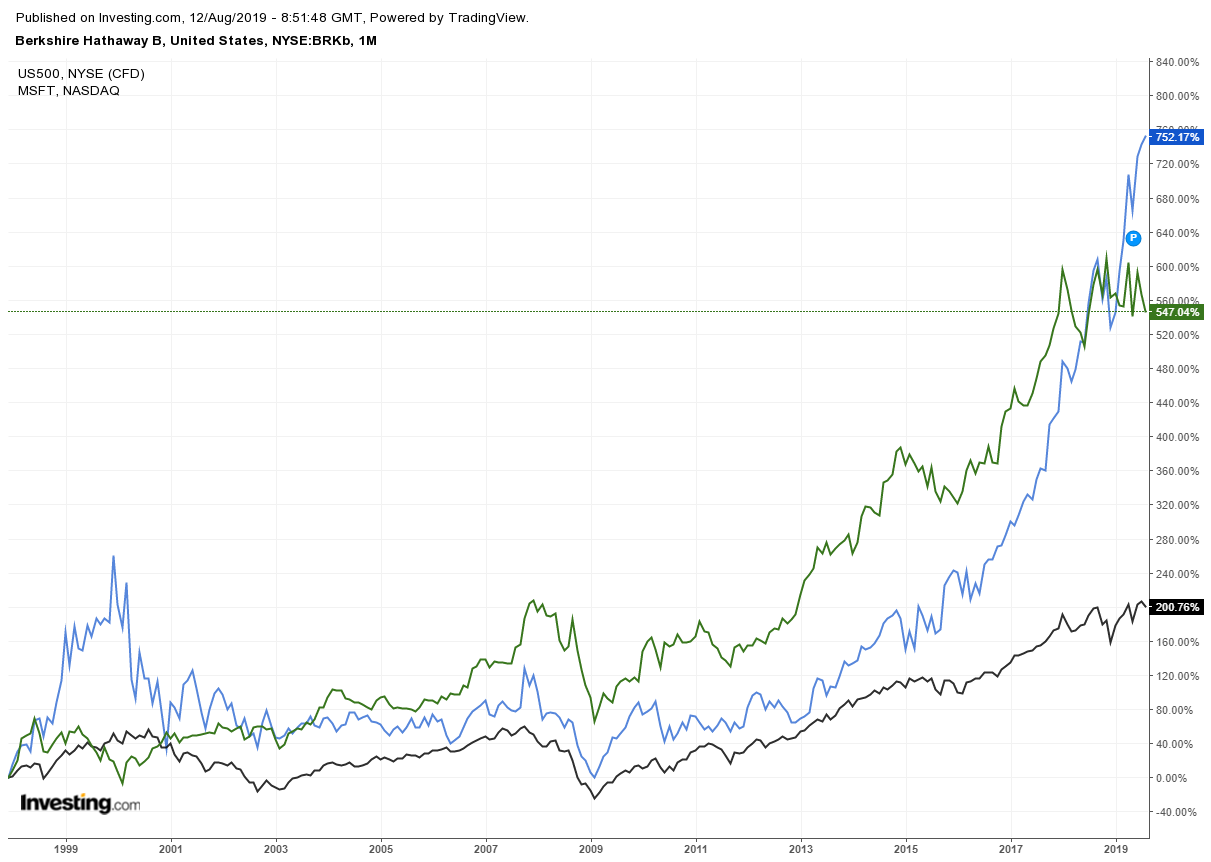

Each of the past three quarters featured a new, sometimes surprising position. In Q1 2019, Berkshire added Amazon (NASDAQ:AMZN) to its portfolio. In Q4 2018, Berkshire aquired shares of Suncor Energy (NYSE:SU), open source specialist Red Hat (purchased by IBM in October 2018), and fintech solutions developer StoneCo (NASDAQ:STNE). So this time, why not Microsoft (NASDAQ:MSFT)?

Though once famous for avoiding the tech sector, Buffett has lately reversed course. Berkshire Hathaway recently bought $860 million of Amazon shares and has made Apple the biggest position in its portfolio, with a stake now worth $47 billion. Among its recent tech moves, Berkshire—which tends to buy-and-hold positions—has, it seems made just one tech-related misstep thus far, when it bought and within three months, quickly sold its Oracle (NYSE:ORCL) position.

Since Buffett is known for relatively safe picks and Microsoft is currently one of the safest tech stocks available, this stake would make perfect sense. The software giant's latest earnings report showed growth across the board and it has a dominant market position. Arguably, that's Buffett’s #1 criteria when picking stocks.

Substantial Additions: Industry Leaders JPMorgan, Amazon

In light of Buffett's recent failure with Oracle, his comment at the time of the sale, that he was “amazed” at what Amazon and Microsoft have done in the cloud business, could be telling. Just a quarter later Buffett bet on the undisputed cloud leader, Amazon. He frequently mentions the importance of industry leadership; if this is what he's interested in, Amazon is a lock for a substantial position addition this quarter.

With regard to industry leadership positions, Buffett has always had a soft spot for banks and other financial sector shares. Right now they make up 45% of his portfolio, and two of his three largest holdings, Bank of America (NYSE:BAC) and Wells Fargo (NYSE:WFC), are second and third respectively after his Apple stake. Since the Wells Fargo scandals came to light, JPMorgan Chase (NYSE:JPM) has emerged as the top bank pick, plus it has a value-oriented PE ratio of 11, and an almost 3% dividend to boot. These are things Buffett is known to prize so a bigger JPMorgan position makes sense for Berkshire Hathaway.

Position Trim: Apple

Why would Buffet sell Apple after having acquired $47 billion in shares over the past couple of years? With the iPhone manufacturer now comprising 24% of Berkshire Hathaway’s portfolio, Buffett and company could definitely see themselves as overinvested in Apple. As well, Berkshire could have decided to trim this position, not because of a lack of conviction in Apple but rather because it might have gotten too big, something that's a common risk-management practice.

For comparison, the portfolio's largest position after Apple is Bank of America, which comes in at 12% of Berkshire's holdings, and no other position is larger than 10% of the portfolio. With that in mind, don’t get excited if Buffett sold some Apple shares this quarter. He's said before he's in for the long run, but nothing is more important than managing risk.

Sold: Phillips 66

In Q3 2016, Berkshire Hathaway held almost 81 million shares of energy company Phillips 66 (NYSE:PSX), now worth $6.4 billion. After continuously trimming that stake beginning in Q1 2018, and selling 50% of the remaining position last quarter, Berkshire now holds only 5 million Phillips 66 shares, worth a little over $500 million. Buffett recently agreed to invest $10 billion in Occidental Petroleum (NYSE:OXY), for which he'll also receive a preferred 8% dividend worth $800 million annually. That alternative oil exposure should make it easy to eliminate Phillps 66 shares entirely from Berkshire Hathaway’s portfolio.