-

The fierce competition between Chinese EV giant BYD and US-based Tesla intensifies as the former has outpaced Tesla in key sales metrics.

-

While Tesla faces production cuts amid BYD's aggressive price reductions, InvestingPro's tools offer insights into BYD's performance and growth potential.

-

BYD's financial health surpasses Tesla's, with projections indicating BYD's stronger growth prospects despite Tesla's dominance in the US market.

- Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

The rivalry between Chinese EV maker BYD (OTC:BYDDF) and its US counterpart Tesla (NASDAQ:TSLA) stands out for its intensity.

Tesla and BYD, known as the largest EV manufacturers globally, are fiercely competing, particularly in China.

Data reveals that BYD outpaced Tesla in hybrid vehicle sales in 2022 and also took the lead in all-battery electric vehicle sales in the last quarter of the year.

Eventually, Tesla had to announce production cuts at its factories in Berlin and Shanghai in the first quarter.

On the other hand, the Lunar New Year holiday in China along with consumer expectations for price reductions and new models impacted BYD's sales in the same period.

This turn of events has made sure that the battle between the two EV makers is as fierce as ever.

Meanwhile, as the Chinese EV maker looks to take the lead over Tesla, InvestingPro's powerful tools can help gain insights into the company's performance.

This allows us to assess potential opportunities and speculate on the company's trajectory in 2024.

With InvestingPro, You can identify winning stocks early on. Subscribe now and never miss out again!

Tesla Fails to Match BYD's Price Cuts

BYD's dominance in the EV market has been driven by aggressive price cuts. Although Tesla also slashed prices throughout the year, it couldn't match BYD's pricing strategy, allowing BYD to take the lead swiftly.

As Tesla prepares to halt its price cuts and some incentives, BYD is on the brink of opening its first EV factory outside China, indicating it's in a stronger position than Tesla as it continues to invest.

However, the price competition has adversely affected the shares of both companies. TSLA witnessed a decline of up to 30% in the first quarter of 2024.

Similarly, BYDDF experienced a downward trend, losing nearly 40% of its value from July to January last year.

Yet, with the expectation of new investments and sales growth, BYDDF began to recover from February onwards, signaling a positive outlook for the company.

BYD Growth Potential Higher Than Tesla

BYD surpassed its sales target last year, hitting over 3 million in full-year sales, while Tesla met its goal of 1.81 million. This year, BYD, backed by state support and competitive pricing, is poised to maintain its lead in the electric vehicle sector. However, the impact of its pricing strategy on the company's stock remains uncertain.

Meanwhile, Tesla continues to dominate the US market, where BYD hasn't entered yet. Despite losing its top spot in sales last year, Tesla's higher vehicle prices give it an edge in revenue. Additionally, anticipated interest rate cuts in the US could boost Tesla's sales options in 2024.

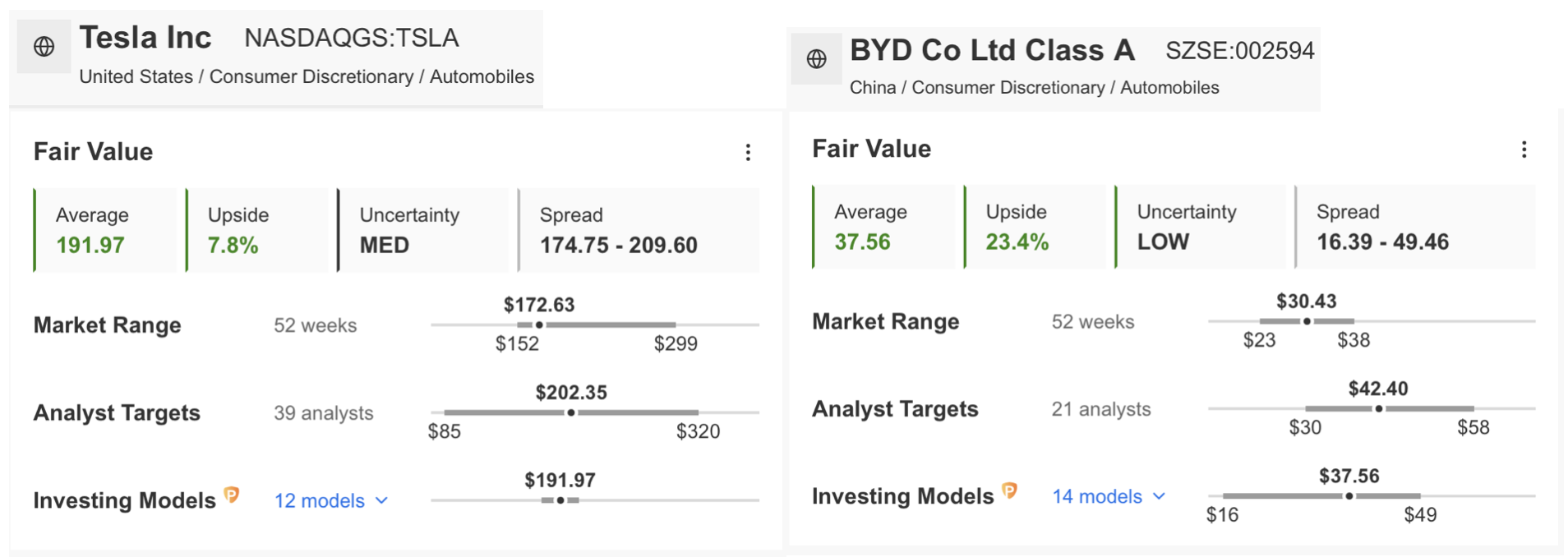

In financial terms, BYD appears to have more potential for growth compared to Tesla this year. InvestingPro's fair value analysis predicts a potential increase of around 25% for BYD, while Tesla is expected to rise by 7.7%.

Source: InvestingPro

BYD in Better Financial Shape Than Tesla

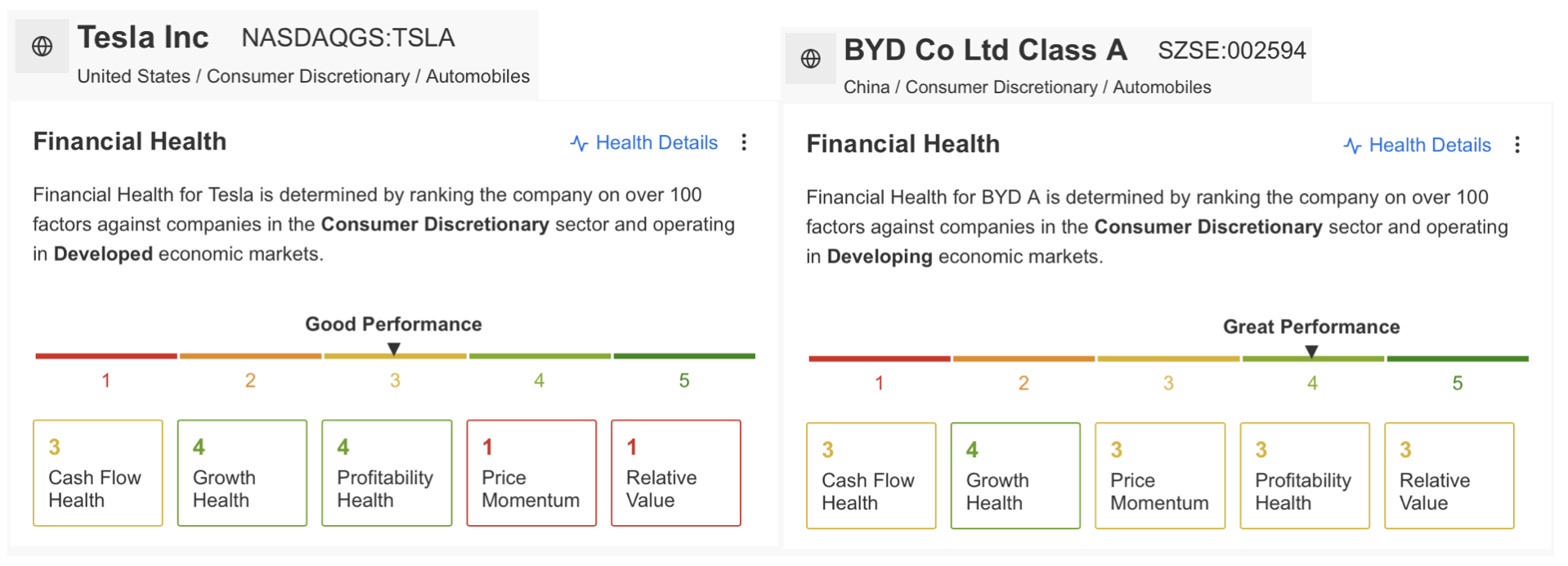

BYD is in a healthier financial position. BYD, which scored 4 points out of 5 in the InvestingPro financial health summary, can be said to be in a better position compared to Tesla's 3 points.

However, when the details of financial health are examined, it is seen that Tesla's rating is driven by price momentum due to the share price, which has seen serious corrections in recent months.

On the other hand, the company is in a very good position in terms of cash flow, growth health, and profitability. BYD, on the other hand, has a more balanced financial structure but still looks healthier.

Source: InvestingPro

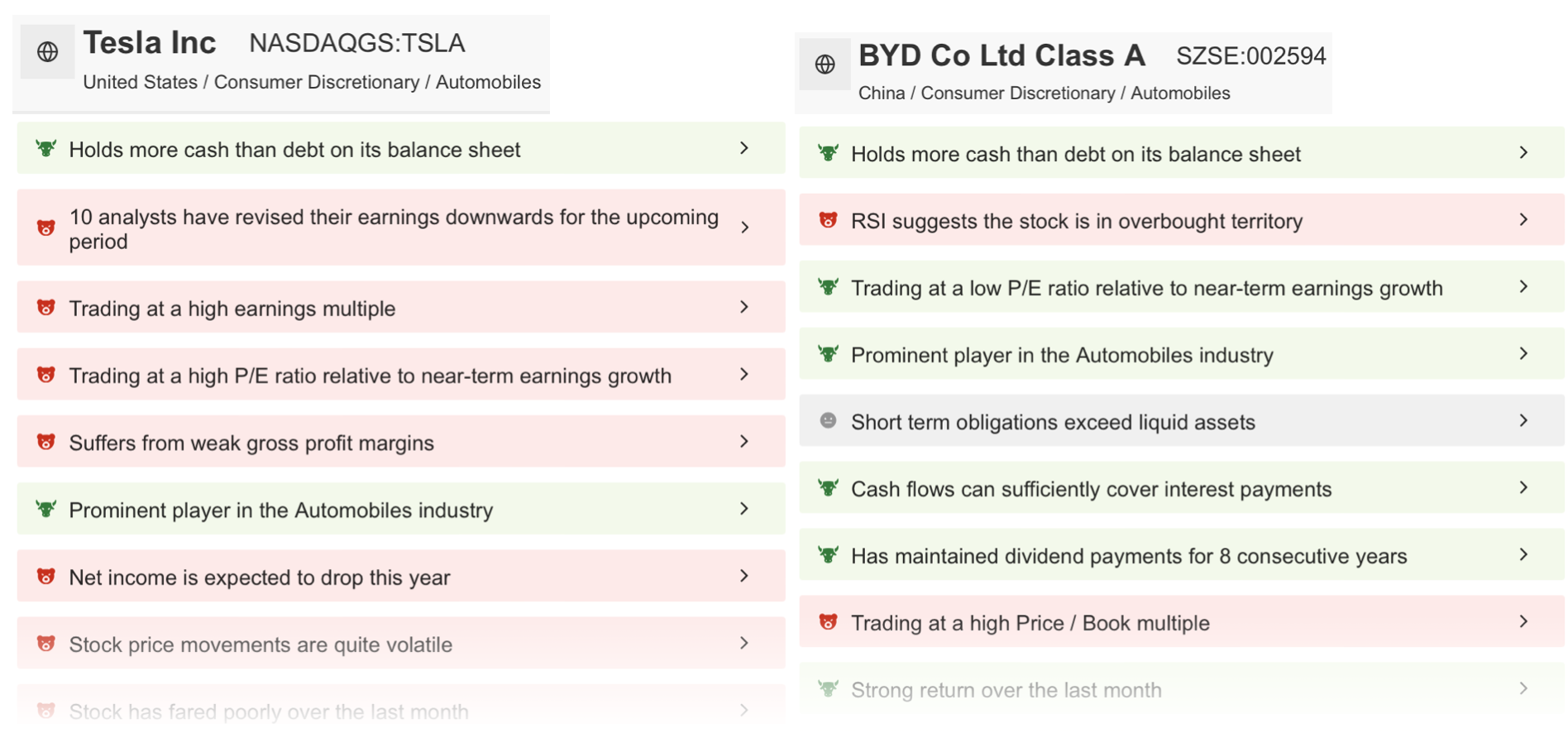

When we compare the ProTips summary of the two companies, we can see that BYD has more problems than Tesla in terms of fundamentals.

Source: InvestingPro

Tesla shows that it is resilient to a possible recession or short-term crisis by holding more cash than debt on its balance sheet.

However, the latest quarterly figures show that Tesla will struggle with some problems in the short term. Analysts have lowered their earnings expectations for the first quarter at Tesla. While the company's gross profit margins weakened and its P/E and P/B ratios remained high, this can be seen as a signal that the correction phase may continue in this stock.

On the other hand, BYD is a dividend-paying company compared to Tesla and has a low FCF compared to its short-term profit.

The company does not seem to have a problem in terms of cash flow, and its latest financials provide important evidence that it will continue to grow in 2024.

Source: InvestingPro

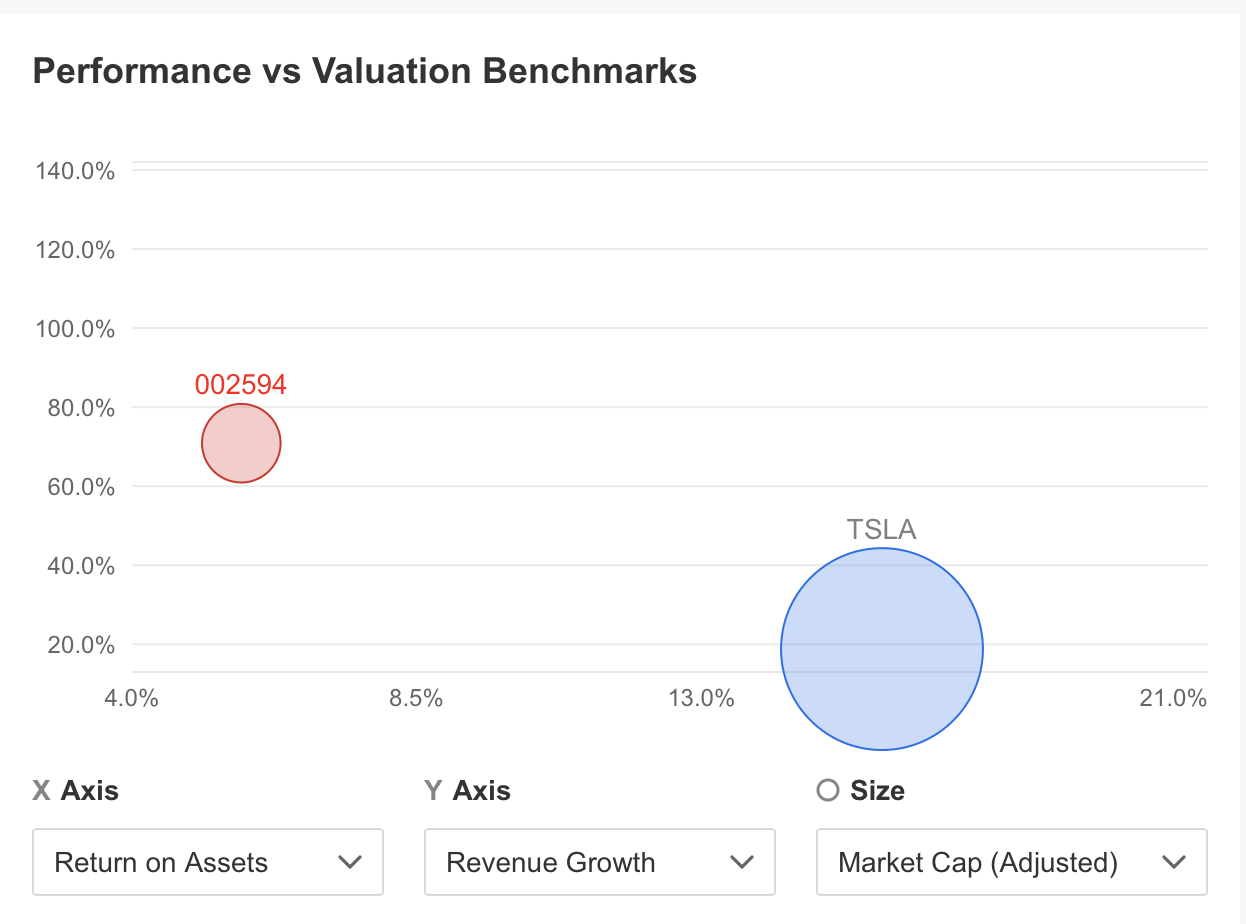

If we compare BYD and Tesla based on revenue and return on assets criteria, Tesla's return on assets of 15.8% is in a good position compared to BYD's 5.7%.

In addition, BYD's revenue growth rate of 70.9% in the last one year is significantly higher than Tesla's revenue growth rate of 18.8%. As can be seen in the chart, Tesla, with a market capitalization of close to $550 billion, is in serious competition with BYD, which has a market capitalization of $83.3 billion.

Current figures and sales strategies show that the two companies may face each other many times in 2024. While BYD continues its struggle to increase its market share with its aggressive pricing policy, Tesla's steps to reclaim its leadership in the electric vehicle market will be keenly watched.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.