Cambiar Investors recently announced the launch of their first ETF, Cambiar Aggressive Value ETF (CAMX), created from the conversion of their Cambiar Aggressive Value mutual fund. The ETF will be actively managed and will maintain a relatively concentrated portfolio of 20-30 stocks. Due to the ETF’s active management and focused nature, the solution will have a high active share measure, as it will be distinctly different from its benchmark, the Russell 1000 Value Index.

What’s occurring with Value Investing?

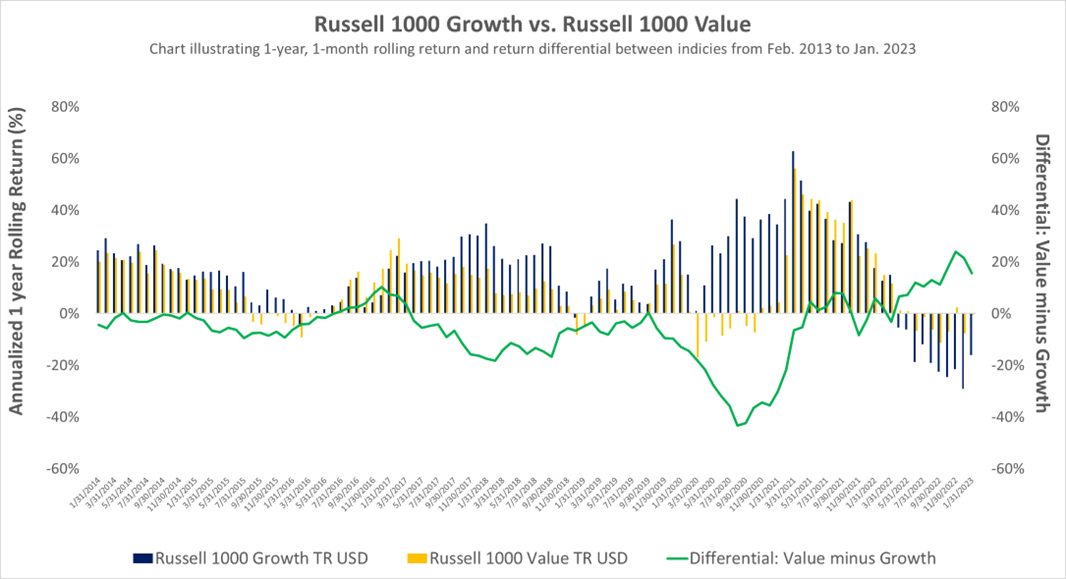

In looking at the decades-long performance, as of January 2023, of both the Russell 1000 Value Index and Russell 1000 Growth Index, proxies for Value and Growth style investing respectively, a style leadership change has occurred in recent years – as value investing is making a performance resurgence, post-2020. Against the backdrop of a higher interest rate environment and rising market uncertainty due to recessionary fears, investors are pivoting their portfolios towards defensive sectors that are normally associated with value style investing.

In their most recent meeting, the Federal Reserve once again increased interest rates and confirmed their inclination to continue doing so, albeit at a more modest pace, going forward. With the era of easy money coming to an end, many growth-focused businesses are now being forced to ‘right-size’ their organization, as evidenced by the numerous lay-off announcements occurring across big tech. Conversely, businesses and industries operating within the healthcare and consumer staples sectors are showing resiliency and providing investors with an avenue for investment growth within a tenuous market environment.

Capitalizing on an inflection point

As an investment solution, CAMX enables investors to have pure-play exposure to value-style investing within their portfolio. As a manager, Cambiar’s Quality, Price, Discipline (QPD) approach guides them in identifying and selecting equities for inclusion within the ETF – allowing only the ‘best ideas’ to be present in the solution. Given that the ETF is a conversion of their previous mutual fund mandate, interested investors are able to evaluate the efficacy of the manager’s strategy based on past performance, as referenced in the CAMX prospectus offering, here.

As the market environment continues to remain supportive of value style investing, CAMX provides investors with the opportunity to gain exposure to said investing style in a simplified manner.

This content was originally published by our partners at ETF Central.