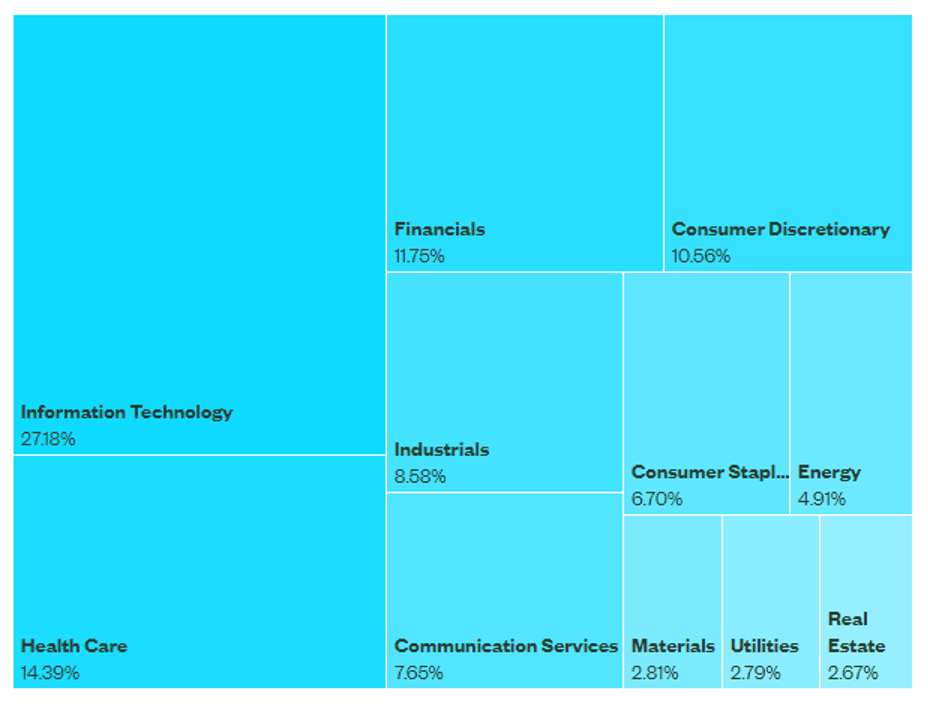

There has been a recent debate surrounding the returns of the S&P 500, with concerns that performance is too heavily reliant on a small group of companies in tech-related sectors. This has led some investors to question whether they are taking on more exposure to these companies than they would have in the past.

As of March 1st, 2023, the information technology sector accounts for more than 27% of the index, which could cause unease among investors who fear overexposure.

S&P 500 Sector Breakdown (as of March 1st, 2023)

ETFs that Focus on Dividend Growth Factors

One of the most popular style factors for ETFs is a dividend growth strategy, which concentrates on companies that not only pay dividends but also increase them over time. Historical evidence suggests that this strategy is linked to better overall returns. There are several benefits to using this approach:

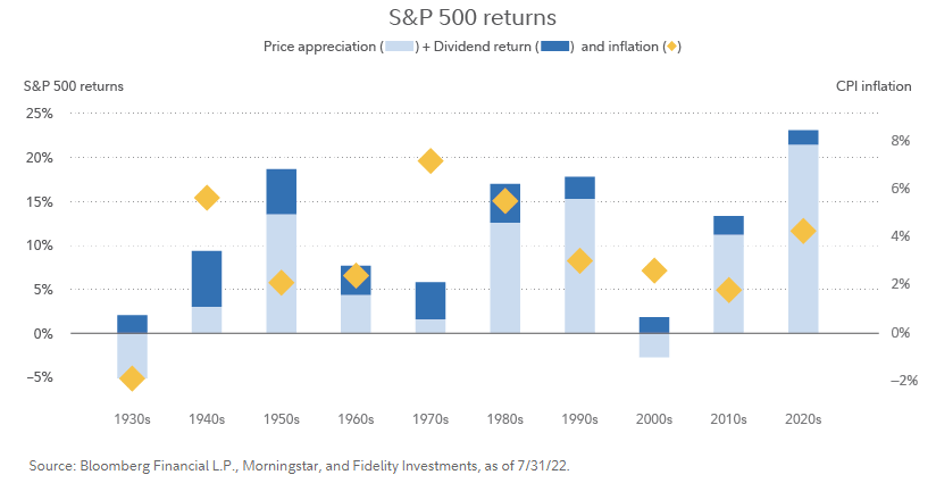

- Helps investors to better keep pace with inflation. Since the 1930s, dividends have accounted for approximately 40% of total market returns and close to 54% during periods of high inflation, such as in the 1940s, 1970s, and 1980s.

- Allows investors to earn a yield during years when the markets are flat or slightly negative. This can make the difference between a negative or positive year in their portfolios.

- Provides diversification across sectors beyond Real Estate, Utilities, and Financials, which have traditionally made up a significant portion of dividend-oriented funds.

The chart below shows the impact of dividend returns on total market returns, over the last century. We can see that in many cases, dividend returns (as depicted in dark blue) helped investors beat inflation and even saved them from a negative year on two occasions.

They really are built differently…

A solid dividend growth factor strategy is largely dependent on the manager's ability to identify stocks that are likely to continue increasing their dividend yield while remaining financially healthy. Although not all ETF providers share their methodology, those that do offer a look “under the hood” enable investors to get a better idea of how the funds are built.

Typically, holdings of a dividend growth-focused-ETF would be screened and selected according to the following key factors:

- Return on Equity

- Return on Assets

- Trailing 3-5 Year Earnings growth

- Strong balance sheets

- Sector-specific considerations

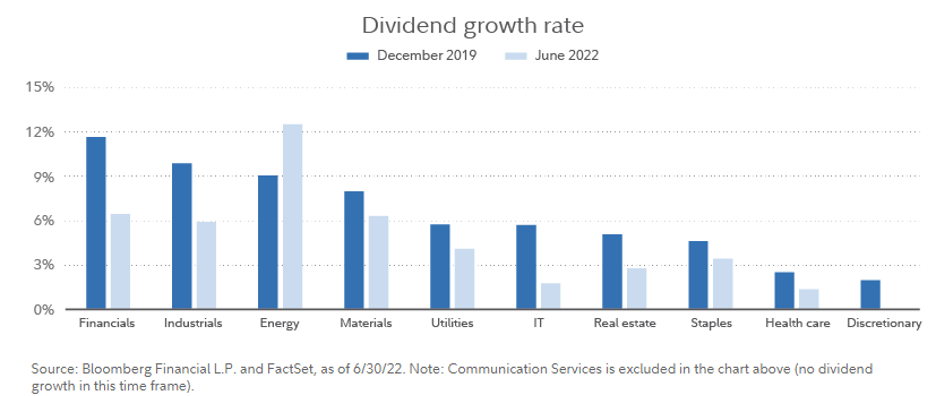

Traditionally this has meant a heavy allocation towards Financials and Industrials, however, due to rising oil prices and increased operational efficiency, especially in Canada, there has been a shift toward the Energy industry in the last two years.

Once the sectors and companies are chosen, each individual holding is then weighted based on the share of dividends they provide to the overall cash stream.

What Dividend Growth Factor ETFs are NOT

Investors who are thinking of allocating parts of their portfolio to a dividend growth factor strategy should understand that this strategy does not necessarily mean companies with the highest yields will be part of the portfolio.

The strategy relies on dividend growth, rather than abnormal dividend yields. High yields can result from sudden drops in the underlying stock price and can be misleading, or can be paid out at the expense of growth in the underlying business.

Gaining exposure to Dividend Growth Factor ETFs

Factor strategies have been around for quite some time but have been somewhat underappreciated in the face of the market returns investors had become used to over the last decade. However, with interest rates remaining high and the outlook for financial markets uncertain, it could be an opportune time for investors to consider this approach.

Canadian investors can gain exposure to dividend growth ETFs from a large number of providers and NEO’s ETF screener offers a convenient way to select and compare funds. Alternatively, CI Global Asset Management provides a comprehensive lineup of dividend growth ETFs, at relatively low cost, with exposure ranging across domestic, U.S., and international equities:

- CI WisdomTree Canada Quality Dividend Growth Index ETF (DGRC)

- CI WisdomTree U.S. Quality Dividend Growth Index ETF (DGR)

- CI WisdomTree International Quality Dividend Growth Index ETF (IQD)

This content was originally published by our partners at the Canadian ETF Marketplace.