- Tesla's stock soared 75% post-Q1 earnings, driven by Elon Musk's announcements and positive developments like the Tesla Bot and Robotaxi.

- Inclusion in China's official purchase list is set to boost Tesla's revenues and could resolve access issues.

- Technical indicators suggest resistance near $260 and possible pullbacks to $220-230 amid recent gains.

- InvestingPro summer Sale is live! For less than $8 a month, unlock the AI-powered stock picks that are beating the market by 18.6% this year.

Tesla stock is up an eye-popping 75% since reporting fiscal Q1 earnings on April 23.

The uptrend that began with billionaire CEO Elon Musk saying the company is working on a more accessible model to compete against the growing threat from China's BYD (OTC:BYDDY), gained further traction amid several new developments, such as the Tesla Bot and the approval of Robotaxis in California and China.

More recently, the Chinese government added Tesla's cars to its official purchase list for the first time, which is expected to have a positive impact on the company's revenues.

The positive development is also said to potentially resolve the crisis of China's restriction of Tesla vehicles from entering some government and military zones in recent months, citing data security.

As a result, the EV maker's stock continued to rally - gaining another 25% over the past trading week - turning positive for the year.

But as the stock keeps amassing momentum, the question that investors are asking is - Where will the rally peak?

Let's take a look at the technical indicators for more clues on how to trade the stock going forward.

Technical View

In early 2024, Tesla faced a slew of delivery and production issues that initiated a downward spiral in its stock price. Experiencing a decline of over 45% within the first four months, the stock dipped below $140 in the week of April 22.

However, a swift recovery ensued shortly thereafter, driven by contrarian buys. Tesla's earnings report on April 23 marked the beginning of this rebound.

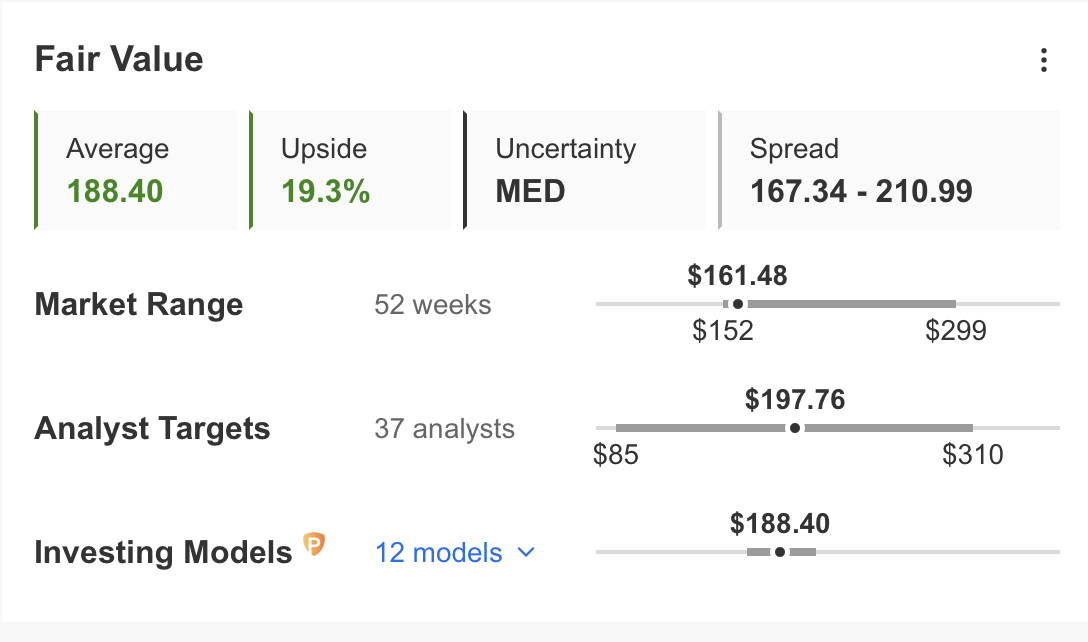

Despite overall pessimism surrounding the stock, InvestingPro's fair value analysis projected a price target of $188.4 for Tesla's shares back in April this year, reflecting a nearly 20% potential increase in the near term. Source: InvestingPro

Source: InvestingPro

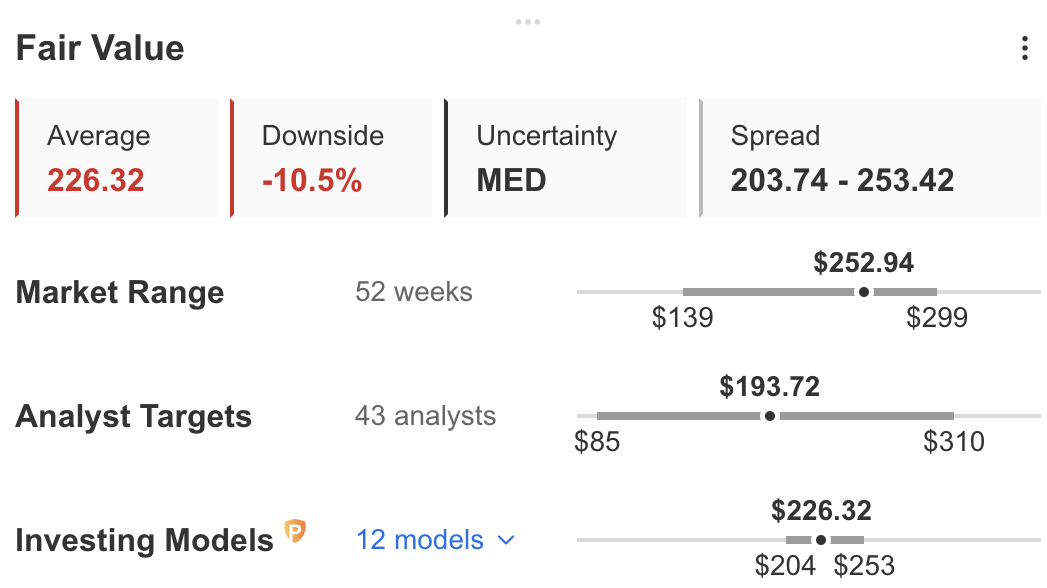

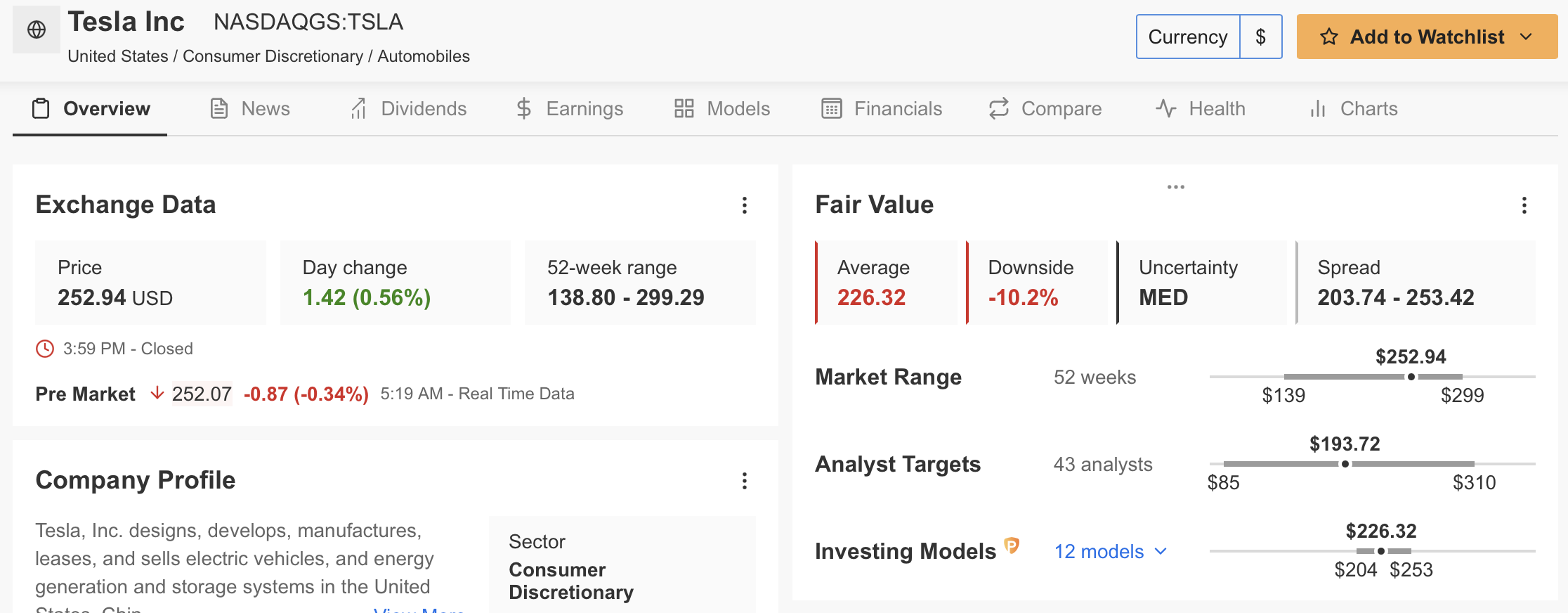

Fast forward to now, and even as the stock's price target has increased along with the rally, InvestingPro's flagship Fair Value tool now sees a 10.5% downside potential for the stock.

Source: InvestingPro

Source: InvestingPro

This means that, had you followed our Fair Value model calculator, you would have gained massively on the rally.

But worry not! Like Tesla, there are several other opportunities out there waiting to be scooped up today. Subscribe here for less than $8 a month as part of our summer sale and see them now!

Technical View: Which Levels Are Important?

Following the first quarter earnings report, which initially signaled a potential trend reversal, Tesla bolstered its momentum further with recent positive developments.

Analyzing the weekly chart reveals that the stock broke out of its long-term downward channel as of last week.

The stock tested the upper band of the channel three times over the past year and continued its downward trend following each test. However, a strong rebound this time caused a breakthrough above the upper channel line.

Evaluating the momentum over the past year, TSLA has now started trading above the Fib 0.618 level, which corresponds to $238 based on the decline line. Currently, this price level serves as crucial support for the stock.

At the upper end, $265 (Fib 0.786) marks a significant resistance level. Breaking this price level with substantial buying volume or sustained weekly closes could signal a continuation of the bullish cycle towards the $350-400 range, potentially approaching historical peaks.

However, it's important to consider the possibility of short-term profit-taking by investors after the rapid ascent. Such a scenario is often viewed as a back test following a significant level break in technical analysis.

As a result, a potential profit-selling phase could pull the price back to an average of $220-230. Notably, this range coincides with InvestingPro's current fair value forecast. Source: InvestingPro

Source: InvestingPro

Bottom Line

TSLA's potential continuation of its upward trend hinges on retracing towards the support zone before testing resistance around $260 and holding firm at that level.

Additionally, a short-term correction in Tesla's share price could alleviate the overbought condition of the Stochastic RSI observed on daily and weekly charts, fostering a technically healthier uptrend.

Further bolstering Tesla's upward momentum is the tendency of short-term Exponential Moving Averages (EMA) values on the weekly chart to surpass the long-term EMA value.

Despite these positive signals, a close below $220 on a potential pullback could undermine the bullish setup. Such a scenario might prompt TSLA to decline below $200 in the near future.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.