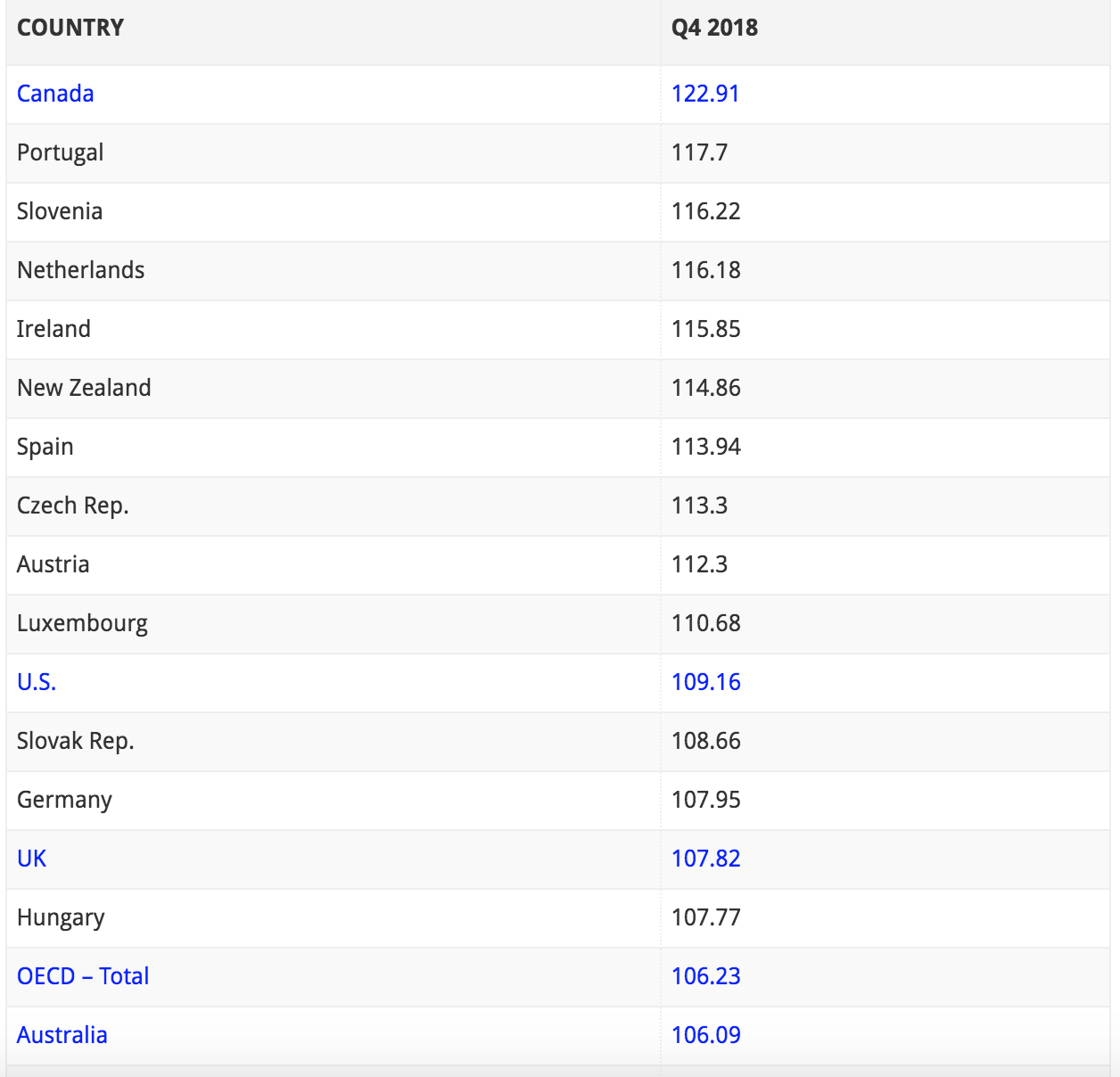

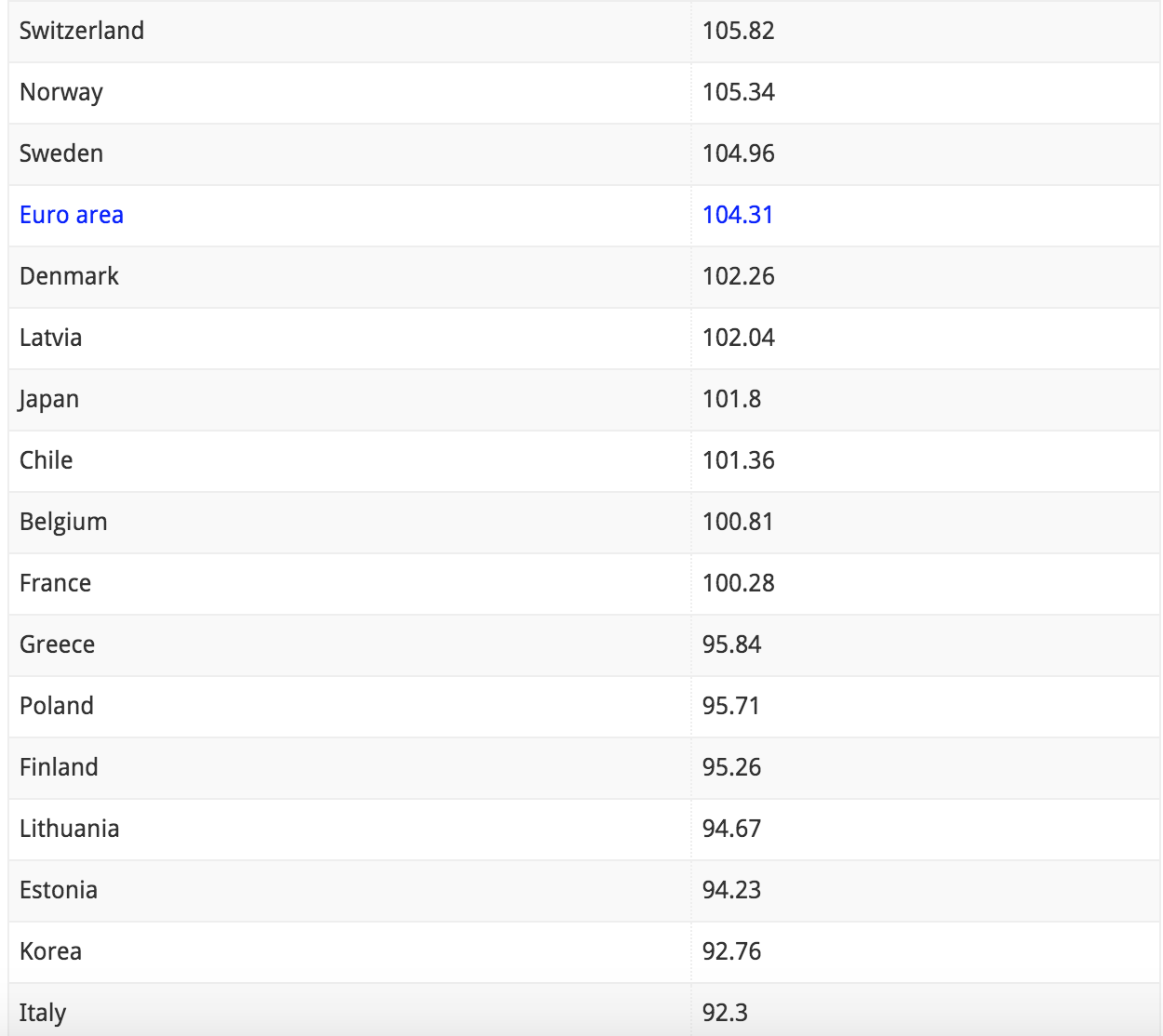

Canadian home prices have been growing at a break-neck speed, and incomes aren’t even close to keeping up. Organization for Economic Co-operation and Development (OECD) numbers show Canada topped the house price-to-income index.

House Price-to-Income Ratio Definition

The house price to income ratio is a basic affordability measure, to see if incomes are keeping up. To get the ratio, they take the cost of a median home, and compare it to median income.

- The lower the ratio, the better income growth is doing relative to house price growth.

- The higher the ratio, the worse income is doing compared with house price growth.

Lower ratios are more likely to support home prices, since incomes can more easily carry them. Generally, high ratios are only seen in bubbles and developing nations.

House Price-to-Income Ratio Methodology

Reading the index put out by the OECD needs a quick explainer, because it’s not a straight ratio.

House Price-to-Income Ratio Ranking of OECD Countries

Canada’s house price-to-income ratio is the highest in the world – by a large margin.