The Canadian currency is lower against the U.S. dollar after the International Energy Agency downgraded their crude demand forecast a day after the Organization of the Petroleum Exporting Countries (OPEC) warned on oversupply from producers outside the group. The concerns about an oil glut in the short term put downward pressure on the price of crude and impacted the loonie.

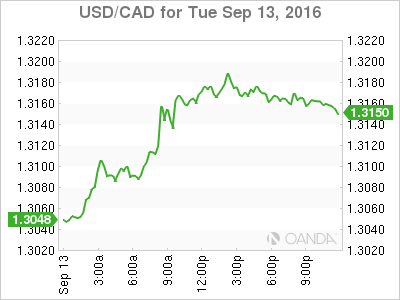

The Canadian dollar depreciated 0.9 percent as the USD rose as a hedge to falling commodity prices. The American currency struggled last week as comments from the Fed had been mixed on whether the central bank would hike interest rates in September. Influential Federal Open Market Committee (FOMC) voting member Lael Brainard delivered dovish remarks that have almost taken the rate hike off the table in the policy meeting next week. Citing data dependency Brainard would rather the Fed erred on the side of patience than move quickly.

Central banks have gone from shackling market volatility after the financial crisis of 2008 by showing a unified front to a diverging path starting in 2014. The U.S. Federal Reserve has broken ranks thanks to the positive growth of the U.S. economy but so far its tightening policy has left a lot to be desired. The lack of momentum in the last two years and market shocks like the Chinese equity sell-off and Brexit have reduced the probability of multiple rate hikes in 2016.

The European Central Bank (ECB) and the Bank of Japan (BOJ) have unleashed massive quantitative easing (QE) programs that at best have only managed to keep deflation at bay. The Bank of England (BoE) this week delivered further details on its corporate bond buying program. The lack of action from the Fed has stopped the USD rally more than once, but as long as there is a new easing announcement from a major central bank, the greenback will appreciate.

The USD/CAD gained 0.988 percent in the last 24 hours. The pair is trading at 1.3181 after a drop in oil prices has depreciated the loonie.

The Canadian economy has been hit by a drop in commodity prices even after the Bank of Canada (BoC) and the government have tried to diversity away from natural resources. The weakness of the currency has not done enough to boost exports in a macro environment where major economies are scrambling to find a solution for their growth dilemma.

The BoC is not expected to cut rates soon, but could be forced into action if the stimulus announced from the government in March is not deemed to have boosted growth. The price of oil, which forced the hand of Governor Stephen Poloz in 2015 acting in a preemptive fashion, is more stable this year but the oil output freeze agreement has been one of the few positives this year for crude prices.

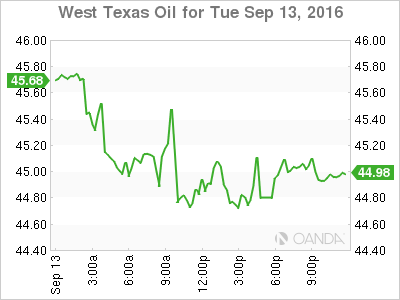

West Texas is down 2.48 percent in the last 24 hours. The price of oil tumbled after both the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC) revised forecasts showing a persistent glut of the black stuff in 2017. Oil is trading at $44.91 after global consumers and producers have changed their forecasts in the same week. OPEC members Saudi Arabia and Iran continue to increase their output ahead of the meeting in Algiers later this month. In order for the market to buy into a successful agreement between oil producers will first have to show there is harmony within the OPEC as the Doha talks ended in failure after Iran could not be persuaded to join the agreement and Saudi Arabia demanded an all-or-nothing OPEC commitment.

Weekly U.S. oil inventories will be released at 10:30 am. Forecasts call for a buildup of around 3 million barrels after the surprise drawdown of 14.5 million due in part by the disruption caused by a tropical storm in the Gulf of Mexico. If demand for oil failed to materialize in the same week that the IEA and the OPEC both forecast higher oil inventories globally the price of oil could suffer another setback ahead of the much awaited OPEC meeting in Algiers on September 26 to 28.