CAD To Remain Under Pressure in 2016 with Softer Commodity Prices

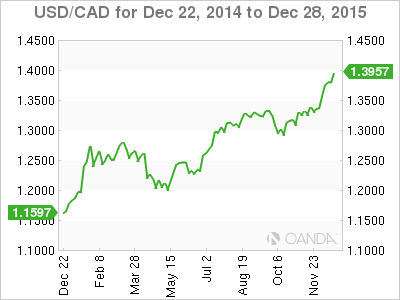

The Canadian dollar struggled in 2015 and was the worst performer amongst major pairs. The USD advanced 20 percent versus the CAD since the beginning of the year driven by the divergence of monetary policies between the two central banks and the drop in commodity prices. As a commodity currency the Loonie suffered downward pressure from the drop in oil prices as the crude supply glut drove prices to multi year lows coupled with the low appetite for gold in 2015. A new Prime Minister was voted into office whose campaign was focused on fiscal stimulus brings hope for the Canadian economy, but also the risk of growing the deficit in times of uncertainty.

The Canadian economy is facing multiple headwinds with the emerging market slowdown, which hit commodity prices, and the rate divergence trends that keep the currency level until there are indeed higher rates. The Organization of the Petroleum Exporting Countries (OPEC) unchanged production levels have had far reaching implications for the price of oil. Saudi Arabia is pumping at record levels to keep gaining market share versus competitors. The resulting supply glut has flooded the market and has the price of West Texas oil around $34.

The loonie must remain low to give a chance of economic recovery via competitive export prices, how to accomplish that depreciation is something the Bank of Canada and multiple analysts are pondering as variables keep changing and in the case of the ECB and the BoJ the players are misreading the market with volatile results.

Interest Rate Divergence to Help BoC Targets

After cutting the benchmark Canadian interest rate two times in 2015 to record low 0.50 percent the BoC Governor admitted for the first time near the end of the year that negative rates could be added to the monetary policy toolkit. Governor Poloz remains firm that the central bank has the right growth forecast on the Canadian economy, but the weakness of energy prices have expanded the time horizon for recovery. The most positive factor to Canada’s recovery is the fact that the U.S. economy has recovered enough to start a tightening cycle. Canada is well positioned to boost exports to its largest trading partner, but depends heavily on the sustained growth of the U.S. to recover.

The BoC was one of the most proactive central banks this year cutting the benchmark rate twice in an effort to devalue the loonie and give exporters a chance to offset the losses in the energy sector. The U.S. Federal Reserve has finally hiked the U.S. interest rate giving some breathing room to the BoC as the effects of that monetary policy decision are still working their way through the market.

The monetary policy divergence will pressure the CAD as it heads lower versus the USD in 2016. The Canadian economy fell into a technical recession after the second quarter results, but managed to bounce back in the third. Softer economic data is threatening to record another contraction as commodity prices keep falling with lower demand and vast supply in the market.

New Government Facing Challenging Economic Landscape

The Liberal party of Canada won a majority in parliament after the longest election campaign in modern Canadian history. Prime Minister elect Justin Trudeau was able to come back from a third place in polls at the beginning of the race to a win that seemed unlikely given the 2011 elections that left the party decimated.

The Finance Department announced the new Liberal government is facing a deteriorating economy that has turned the projected Conservative budget into a deficit in reality. This is all before the Liberals follow through in their promised stimulus to add a strong pace to the recovery.

The Liberal platform was built on fiscal stimulus and Mr. Morneau has reiterated that it is the only way that Canada will achieve faster growth. The Canadian economy is still under the effects of lower oil prices, while the loonie drop has not been able to boost exports to the point where it can offset the losses in the energy sector.

Canadian Oil Fate Tied to Global Growth

The Canadian economy enjoyed stability after the credit crisis thanks to the price of oil remaining above $100 until the summer of 2014. The sudden and continued drop to current levels of under $35 has taken out of the equation the strongest contributor to the Canadian economy. Trade agreements and a strong currency uprooted the manufacturing base in Canada and now with energy exports compromised the service industry will have to step up to offset losses. The Bank of Canada is expecting the weak loonie to help exporters increase their competitiveness. The oil industry was dealt another blow with the rejection of the Keystone pipeline that could have made it possible for producers to export their oil to further destinations other than the traditional American clients. The U.S. is now considering exporting its oil surplus reversing a decision from decades ago, while Canadian crude is to remain landlocked with no access to shipping ports. The price war between OPEC and non-OPEC members with Saudi Arabia and Russia as the most combative (and largest) oil producers could see energy prices drop to new lows as demand is not expected to grow fast enough to soak up all the excess crude currently in the market.

Russia and China Central Banks to Support Gold Prices

Gold is on track to record another negative year in 2015. The central banks of China and Russia along with Indian demand were the largest purchasers of gold this year keeping gold in current levels as global demand has shrunk. China and India account for two thirds of the global demand for gold. Chinese and Indian demand fell 25% and 3% respectively, but given the low prices there is room for opportunistic buys as investors in those nations look for alternative asset classes.

Global gold consumption dropped 12% in the second half of 2015, to six-year low, as key buyers in Asia lost their appetite for the metal. One buyer who has moved against the tide is the People’s Bank of China (PBoC) which has increased its gold reserves to 1,743 tons by the end of November. The central banks of China and Russia have increased their holdings and kept the price of gold from crashing below $1,000.

The fact that western central banks usually hold about 60 percent of reserves in gold compared to the paltry 1.6 percent of China translates to a assurance of further demand if the price continues to trade in the current range as the PBoC looks to diversify its reserves.

Gold Producers Have FX Silver Lining

With the price of gold dangerously close to $1,000 mining stocks are big losers as they have been forced to cut back to survive the reduction in revenue due to falling prices. There is a psychological level that gets mentioned that producers need at least $1,200 per ounce to break even on extraction costs. Mines located in emerging markets will provide better results due to the effect of a weaker currency on operating costs. With softer demand outside of the central banks of Russia and China forecasted the mining industry would have to seek further consolidations and find ways to reduce costs as it strives to survive another challenging year. Canadian mining companies that have invested in sites in emerging markets could get some cost savings both on their operating and head office costs as the Canadian dollar is expected to be under pressure next year.