Why consider CGI?

CGI has an impressive very long-term performance record versus the Canadian market, with annual share price total returns of 8.9% (versus 7.5% for the benchmark) over the last 25 years, and 11.5% (versus 9.2%) over the last 50 years (source: MMA). This has been achieved by a measured investment approach, which was successful once again in FY23 with an NAV total return of 17.4% versus a benchmark 11.8% total return.

Eckel is ‘sticking to his knitting’, investing in high-quality companies that he can hold for the long term. Portfolio turnover is currently running at an annual rate of around 8%, which implies a c 13-year holding period, although some positions have been in the portfolio for considerably longer. The manager generally runs minimal cash positions.

CGI’s board employs a progressive dividend policy whereby annual payments have increased for the last 10 years, which qualifies the fund for inclusion in the AIC’s list of next-generation dividend heroes. While the company’s discount is wider than it has been in recent years, over the last decade CGI has generated comparable share price and NAV total returns; hence, the manager views the current valuation as an opportunity rather than a distraction.

NOT INTENDED FOR PERSONS IN THE EEA

CGI: Well-established Canadian equity specialist

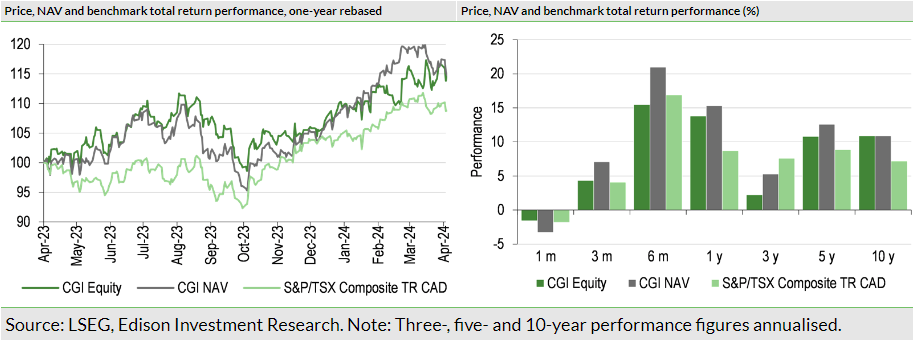

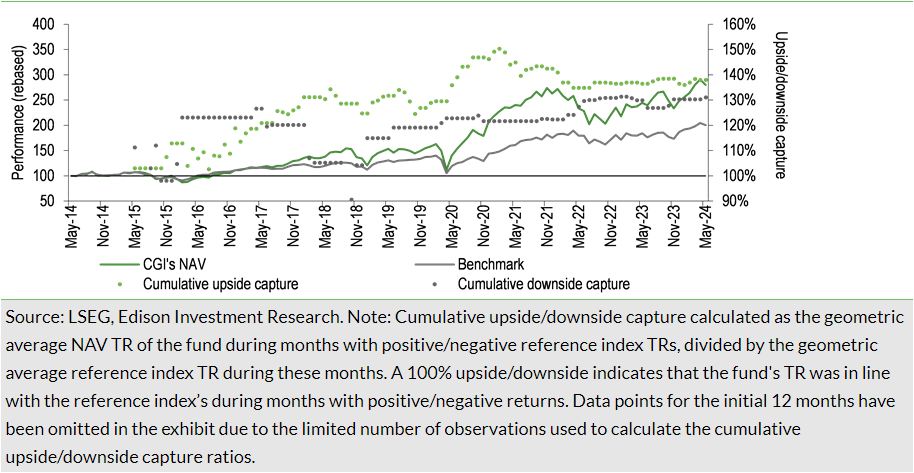

CGI is the second oldest closed-end fund in North America and offers a broad range of quality Canadian equities, along with up to 25% of the portfolio in US businesses that may not be available in Canada. Exhibit 1 shows CGI’s long-term admirable outperformance versus its benchmark. It also illustrates the benefit of compounding and having a long-term approach.

Market performance and valuation

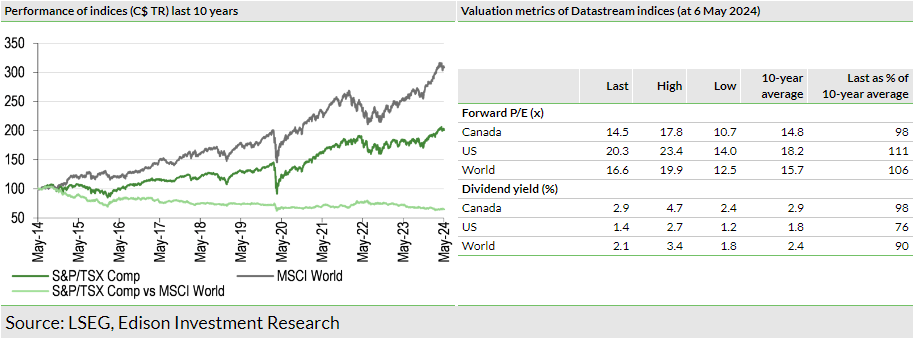

While Canadian stocks have not kept pace with the world market over the last decade (partly due to the strong performance of US large-cap technology stocks), they have delivered annual total returns of 7.2%, with compares favourably with returns on other asset classes such as bonds and cash. In aggregate, Canadian stocks continue to look attractively valued on a forward P/E basis versus the US and world markets and versus their history, and offer a notably higher dividend yield (as shown by Datastream indices in the right-hand side of Exhibit 2).

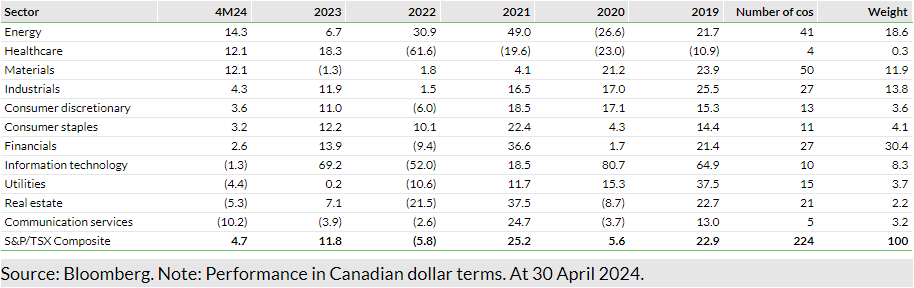

Performance of the Canadian market, by sector, is shown in Exhibit 3. The benefit of having a diversified portfolio is probably illustrated most clearly by looking at the energy sector, which in recent years has been either one of the best or one of the worst performing sectors. While Canada may have been traditionally associated with financial and commodity stocks, it should be noted that 43% of the companies, representing c 40% by market cap of the S&P/TSX Composite Index, lie outside of the financials, energy and materials sectors.

The manager’s view on the investment backdrop

Eckel suggests that is there is a 50:50 chance that the Bank of Canada will reduce interest rates soon. It is taking a cautious approach and observing how both the Canadian and US economies are progressing, particularly as a recent US inflation data point was higher than expected, thereby pushing out consensus expectations for a US interest rate reduction. The manager notes that the Canadian economy is weaker than in the US as higher Canadian interest rates are starting to have a negative economic effect. Retail customers are trading down, which is benefiting the discount retailers, such as portfolio company Dollarama (TSX:DOL), and there has been a reduction in consumer discretionary spending, evidenced by lower volumes at recreational vehicle company BRP (TSX:DOO), which is another of CGI’s investments.

Highlighting specific areas of the Canadian economy, Eckel says that the housing market remains tight, although in hot markets, while prices have held up, the number of transactions is declining. Canada has a long history of welcoming immigrants; however, this government policy has been toned down since COVID-19, as a rising population is exacerbating the Canadian housing shortage. The Canadian energy sector is benefiting from robust commodity prices, which are partly supported by Middle East conflicts. There has been a greater appreciation of the sector’s modest valuation, suggests the manager. He says the major Canadian energy companies are increasing cash returns to shareholders. Although annual production growth is a relatively low 3–5%, adding in share repurchases and dividends increases total returns to double-digit levels, while there is potential for multiple expansion given low sector valuations.

Current portfolio positioning

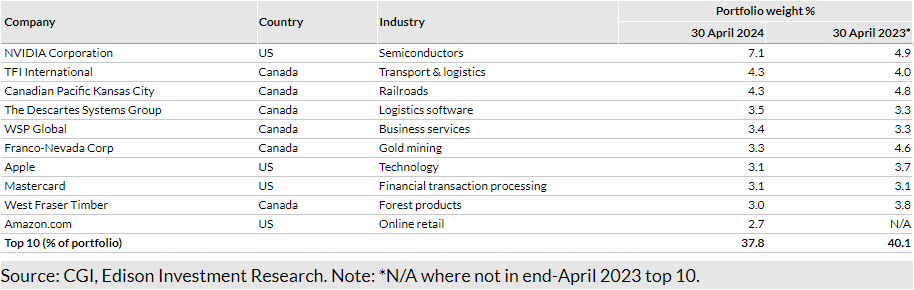

At the end of April 2024, CGI’s top 10 positions made up 37.8% of the fund, which was lower than 40.1% a year earlier; nine positions were common to both periods. The manager’s willingness to seek opportunities outside of Canada is shown by the fact that four of the top 10 holdings, including the largest, are US companies. There is a soft limit of a maximum 5% of the portfolio in a single holding, above which Eckel must regularly discuss the position with the board, while there is a hard maximum limit of 10% in a single holding.

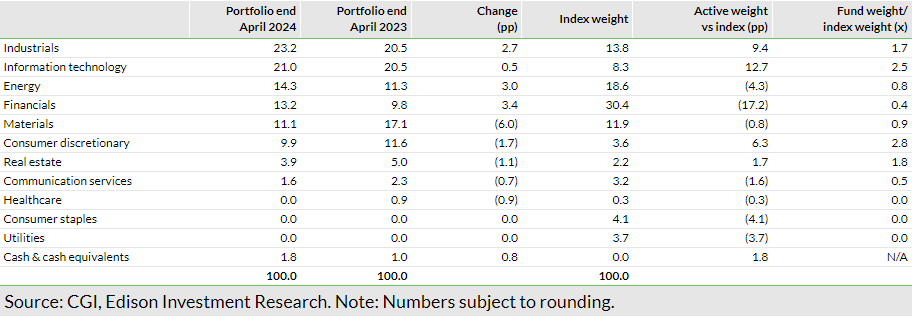

CGI’s sector breakdown is shown in Exhibit 5. Notable changes in the 12 months to the end of April 2024 are a lower allocation to materials (-6.0pp) with higher weightings in financials (+3.4pp) and energy (+3.0pp). Compared with the benchmark, CGI has a structural underweight position in financial stocks (-17.2pp), with notable overweight allocations to technology (+12.7pp) and industrial stocks (+9.4pp).

Discussing CGI’s technology exposure, Eckel says it is a volatile sector that rallied strongly in 2023 based on the growth potential in artificial intelligence (AI). While IT stocks could be due for a pause, the manager suggests that this is also true for other parts of the market, and the large-cap technology companies are generating good cash flow unlike during the dot.com bubble. Eckel notes that NVIDIA (NASDAQ:NVDA) has been a standout performer; it entered the portfolio in 2016 and since then until the end of last year, the manager has realised US$96m in profits, including US$44m in 2023. NVIDIA was purchased when its business was more cyclical, as semiconductors were not as widely used. Eckel says the company has a very strong management team and a competitive edge, having transitioned from being a leading supplier to the cryptocurrency and autonomous vehicles companies into the high-growth gaming, data warehousing and AI industries.

Recent portfolio activity

In H223, the manager initiated a position in Cameco (TSX:CCO), which is the world’s largest publicly traded uranium company. It produces very high-grade uranium from its flagship McArthur River and Cigar Lake mines in the Athabasca (TSX:ATH) Basin in northern Saskatchewan. The uranium industry has a complicated and checkered past in terms of success, which has deterred some investors. However, increased demand for nuclear fuels in an environment of decarbonisation and energy security may lead to a change in perception. Governments are reassessing their countries’ nuclear energy capabilities in terms of extending plant lifespans, restarting idled capacity or considering new builds. This higher demand could lead to a uranium demand/supply imbalance in coming years, especially as an extended period of lacklustre uranium pricing has deterred investment in new industry capacity. Eckel considers that with rising geopolitical tensions and a favourable uranium industry outlook, Cameco looks very well positioned either as an ongoing enterprise or as an acquisition candidate. Another uranium company, NexGen Energy (TSX:NXE), was added to CGI’s portfolio in 2024. The company has a major, very low-cost resource, which is the highest grade in the world; production is scheduled to start in 2029.

There are two other relatively new positions in CGI’s portfolio, Builders FirstSource and Stantec (TSX:STN). Builders FirstSource is a major player in the fragmented US building supplies industry, which provides opportunities for acquisitions as well as organic growth. The company is moving into higher-margin products such as prefabricated roof trusses and windows. Stantec is a Canadian supplier of engineering services that has moved its exposure away from the oil and gas industry and made a timely move into infrastructure and water sectors. More than 50% of the company’s revenues are generated in the US and, like Builders FirstSource, it has good growth opportunities from both internally generated and acquired growth.

Two of CGI holdings were sold, CCL Industries (TSX:CCLb) (Canadian label company) and Pool Corp (US provider of swimming pool supplies), not because the manager had lost confidence in these businesses; rather they were used as sources of funds to fund higher-conviction positions.

Performance: Very strong long-term record

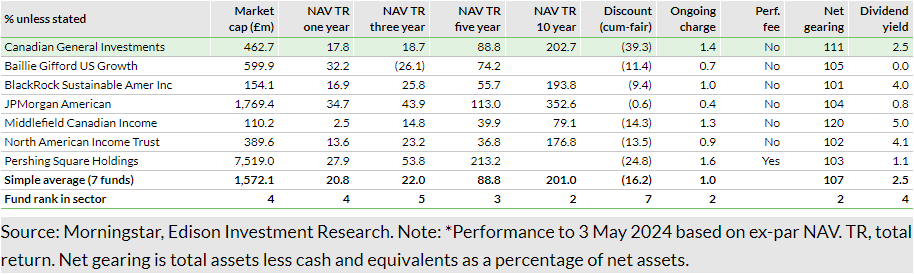

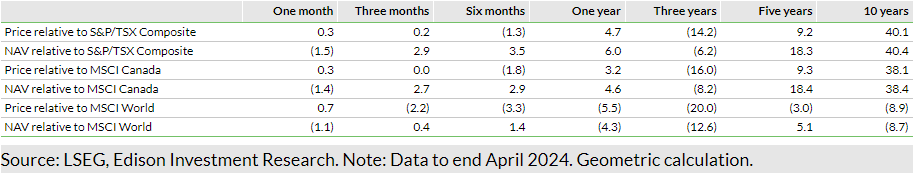

CGI is one of seven companies in the AIC North America sector (Exhibit 6) and one of two Canadian specialists. Comparing CGI to the whole sector, its NAV total returns are average over the last five years and modestly above average over the last 10 years, ranking second out of five funds. On 1 May, it had the largest discount in the sector, where only one fund was trading at a small premium. CGI has the second-largest ongoing charges and level of gearing. Its dividend yield is in line with the mean, ranking fourth and only surpassed by the three funds in the sector with an income bias.

Middlefield Canadian Income (MCT) is the only other Canadian fund in the AIC North America sector. However, the companies follow different strategies, with MCT’s income focus understandingly generating a higher dividend yield. Both companies can invest in US equities, but MCT has a much smaller (c 3%) allocation to these stocks. CGI has superior NAV total returns over all periods shown in Exhibit 6 and significantly so over the last five and 10 years. Its discount is much wider than MCT’s, which is perhaps due to its limited free float, and CGI has a slightly higher fee structure.

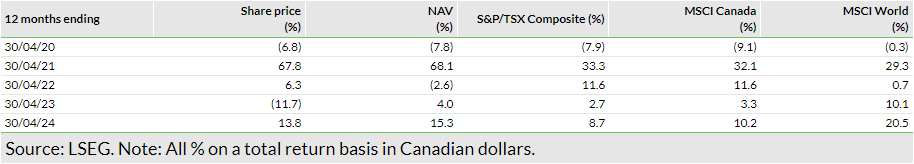

In FY23, CGI’s NAV and share price total returns of +17.4% and +9.5% compared with the benchmark’s +11.8% total return. The company benefited from its above-benchmark technology weighting, as the sector performed very well, with positive contributors including NVIDIA (share price +229%), Shopify (TSX:SHOP) (+119%) and Constellation Software (TSX:CSU) (+58%). Other stocks that added to CGI’s performance included Amazon.com (NASDAQ:AMZN) (consumer discretionary, +76%), TFI International (industrials, +34%) and goeasy (TSX:GSY) (financials, +52%).

Conversely, stocks that detracted from CGI’s performance included First Quantum Minerals (TSX:FM) (-61%) as late in 2023, its major asset, a copper mine in Panama was ordered to shut down by the Panamanian government. Franco Nevada (TSX:FNV) (-19%) was also negatively affected as it has a royalty stream on this mine.

Commenting on CGI’s performance, the manager said due to the company’s underweight energy position it underperformed in 2022, when energy was by far the best performing sector. Eckel notes that CGI’s diversified portfolio structure was beneficial in 2023. He believes that stock selection rather than a focus on the macroeconomic environment should come to the fore in 2024, a backdrop that should favour his investment approach. So far this year, stocks making a positive contribution to CGI’s performance include NVIDIA, Amazon.com, The Descartes Systems (TSX:DSG) Group, Enerplus (TSX:ERF) (which received a bid from US-based Chord Energy) and Canadian Natural Resources (TSX:CNQ). Detractors to CGI’s performance include the banks (although CGI has a major underweight position), lumber and telecom companies.

CGI’s upside/downside capture

Exhibit 11 shows CGI’s upside/downside capture over the last 10 years. Its upside capture rate of 139% suggests that the company will outperform its benchmark in months when Canadian shares rise. CGI’s downside capture rate of 131% means that the company is likely to underperform its benchmark in months when the Canadian market is weak, but to a moderately lesser degree. It is unsurprising that CGI does not move in line with its benchmark given the manager’s unconstrained approach to investing as well as the company having a relatively high level of gearing.

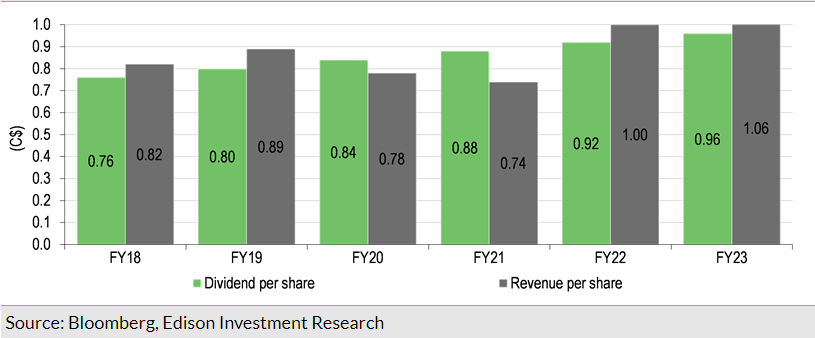

Dividends: Another C$0.04 increase expected in FY24

CGI pays regular quarterly dividends in March, June, September and December. The company historically also distributed special dividends, but none have been paid since FY17. In FY23, the annual dividend of C$0.96 per share (three regular taxable dividends of C$0.24 per share and one capital gains dividend of C$0.24 per share) was 2.1% higher than C$0.92 per share in FY22 (four regular taxable dividends of C$0.23 per share). Over the last five years, CGI’s dividend has compounded at an annual rate of 4.8%. The company’s 10-year record of consecutive higher dividends means that CGI now qualifies as one of the AIC’s next-generation dividend heroes (funds with 10 years but less than 20 years of consecutive higher annual dividends).

In FY23, dividend and interest income increased by 8.4% helped by special distributions from Tourmaline Oil (TSX:TOU) and Constellation Software, along with general dividend increases. The manager considers that given the company’s high level of unrealised gains (c C$0.9bn), the strategy of rising annual dividends is sustainable.

Valuation: Following industry trend of wider discounts

Generally, investment companies have wider-than-average discounts reflecting elevated investor aversion in an uncertain economic environment. CGI has the added consideration that it is unable to repurchase shares to help manage its discount as this would invalidate the company’s favourable Canadian investment corporation tax status. The company’s 39.3% discount is at the wider end its 20.1% to 41.8% 10-year range. It compares with the 37.3%, 33.9%, 33.0% and 30.8% average discounts over the last one, three, five and 10 years, respectively.

There have been brief periods when CGI’s shares traded at a premium to NAV; the last time was in 1998, while they traded very close to par in 2006, a period when CGI outperformed its benchmark and there was a commodities super-cycle and a rising oil price.

Fund profile: North American equity specialist

CGI was established in 1930 and is North America’s second-oldest closed-end fund. It has been listed on the Toronto Stock Exchange since 1962 and on the London Stock Exchange since 1995. MMA took over management of CGI in 1956; the firm has c C$3.0bn of assets under management for both private and institutional clients. Eckel has managed CGI’s portfolio since 2009, aiming to generate a better-than-average total return from a diversified portfolio of North American equities via prudent stock selection and timely recognition of capital gains and losses. While most of the fund is invested in Canadian companies, up to 25% may be held in US-listed businesses. The manager has an unconstrained approach, within the remit that a maximum 35% of the portfolio may be held in a single sector, and he invests without reference to the sector weightings of its benchmark, meaning CGI’s performance may differ meaningfully from that of the S&P/TSX Composite Index. Eckel has a medium- to long-term view, so some of the fund’s holdings have been in the portfolio for many years. The company is designated as an investment corporation under the Income Tax Act (Canada). This eliminates a layer of taxation, as capital gains are only taxed at the shareholder level, allowing them to be paid as dividends to shareholders. However, to maintain this favourable tax status, CGI is unable to repurchase its shares to help manage the share price discount to NAV. A maximum 25% of its gross revenue may come from interest income and at least 85% of gross revenue must be from Canadian sources.

Investment process: Bottom-up stock selection

Eckel’s stock selection process is primarily bottom up, although he does take the macroeconomic environment into account. The manager aims to generate an above-average total return for investors, seeking reasonably valued companies with favourable fundamentals and strong management teams; he also takes firms’ economic, social and governance credentials into account. While most of CGI’s portfolio is invested in Canadian companies, up to 25% of the fund may be held in US equities, which are primarily in niche operations or business areas that are under-represented in the Canadian market. The broad exposures at the end of April 2024 were 76% Canada, 24% US.

There are currently 58 holdings in the portfolio with a bias to large- and mid-sized stocks. Some of these are higher yielding, such as the Canadian banks, helping to support CGI’s own dividend payments. Eckel has a long-term focus – in FY23, portfolio turnover was 7.4%, which was modestly higher than the 6.8% five-year average (range of 2.1% in FY22 to 10.1% in FY20), which implies a c 14-year average holding period. However, positions are reassessed regularly to ensure they are sized correctly and investment cases are still valid. The manager has a history of successively backing good management teams that may move companies due to mergers and acquisitions.

Gearing: Margin borrowing facility

CGI has employed a leveraged strategy since its first issue of preference shares in 1998. Since then, to the end of March 2024, its total return has averaged 6.79% per year above its cost of debt. Its C$75m 3.75% cumulative Series 4 preference shares were redeemed in June 2023 and for economic reasons, CGI increased the amount borrowed under its margin facility rather than issue new preference shares.

The company has a C$175m margin borrowing facility via a prime brokerage services agreement with a Canadian chartered bank, at a one-month Canadian dollar offer interest rate plus 0.6% per year. During FY23, the amount borrowed ranged from C$75m, which was before the preference shares were redeemed, to C$175m. The use of leverage was additive to CGI’s total returns in 2023 in a rising stock market, having detracted in 2022 when the market declined. Eckel is happy to run a relatively high level of gearing (at the end of April 2023, net gearing was 12.0%), although this is at the lower end of the historical range. There is scope for a higher level of debt if deemed appropriate.

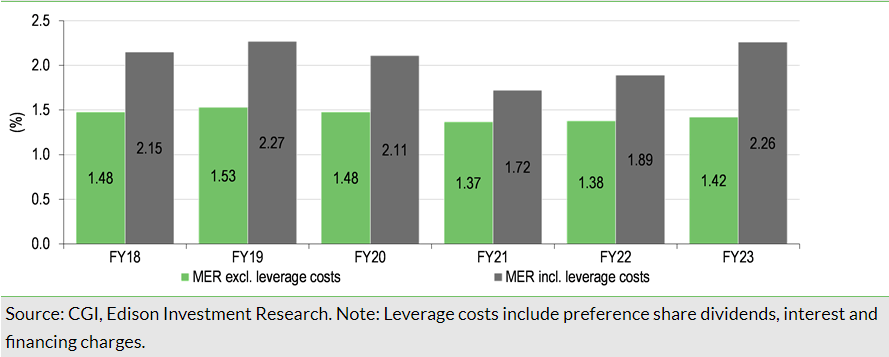

Fees and charges

MMA is paid a management fee that is calculated and paid monthly at 1.0% per year of the market value of CGI’s investments, adjusted for cash, portfolio accounts receivable and portfolio accounts payable; no performance fee is payable. In FY23, the annualised management expense ratio (MER) including leverage costs was 2.26%, which was 37bp higher than in FY22. Excluding leverage costs, which makes the MER more comparable with the ongoing charge figure used in the UK, in FY23 it was 1.42%, which was 4bp higher than 1.38% in FY22. Management fees in FY23 increased by 6.4% versus FY22 because of higher average portfolio assets over the period. Interest and financing charges increased by 206.1% due to higher borrowing rates and higher average borrowings compared with FY22.

Capital structure

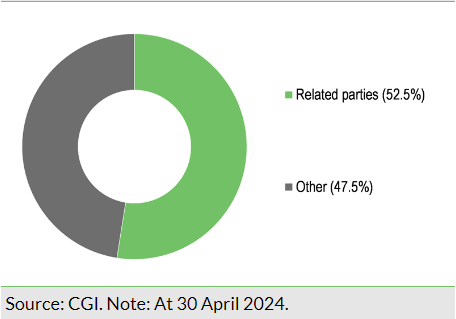

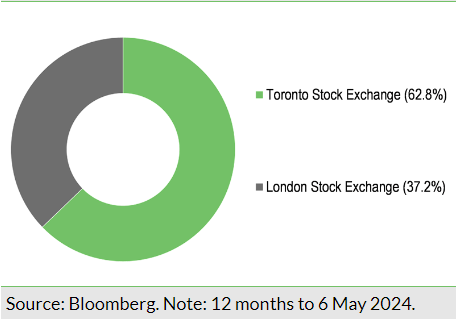

CGI has 20.9m ordinary shares in issue, 52.5% of which are directly or indirectly owned by two of the company’s directors, Jonathan Morgan and Vanessa Morgan. Hence, CGI has a free float of 9.9m shares (47.5% of the total) with these holders split broadly 35:65 between Canada and international. Over the last 12 months, the company had an average daily trading volume of c 6.6k shares on the Toronto Stock Exchange and c 3.9k shares on the London Stock Exchange. Volumes have increased following a greater focus on marketing the fund via articles in the financial press and podcasts.

The board

CGI’s board now has three non-independent and four independent directors, who collectively have an average tenure of around nine years. Vanessa Morgan is chair of CGI and president and CEO of MMA; she joined CGI’s board in 1997. Jonathan Morgan, president and CEO of CGI and executive vice-president and COO of MMA, joined the board in 2001. The four independent directors and their years of appointment are Michelle Lally (2015), Marcia Lewis Brown (2020), Michael Walke (2023) and Sanjay Nakra (2023). At CGI’s April 2024 AGM, James Billet retired from the board having been the long-time chair of the audit committee; his replacement is Michael Walke. Also, another non-independent director joined the board, Clive Robinson, who is head of MMA’s private wealth management business.

______________________________________

General disclaimer and copyright

This report has been commissioned by Canadian General Investments and prepared and issued by Edison, in consideration of a fee payable by Canadian General Investments. Edison Investment Research standard fees are £60,000 pa for the production and broad dissemination of a detailed note (Outlook) following by regular (typically quarterly) update notes. Fees are paid upfront in cash without recourse. Edison may seek additional fees for the provision of roadshows and related IR services for the client but does not get remunerated for any investment banking services. We never take payment in stock, options or warrants for any of our services.

Accuracy of content: All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable, however we do not guarantee the accuracy or completeness of this report and have not sought for this information to be independently verified. Opinions contained in this report represent those of the research department of Edison at the time of publication. Forward-looking information or statements in this report contain information that is based on assumptions, forecasts of future results, estimates of amounts not yet determinable, and therefore involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of their subject matter to be materially different from current expectations.

Exclusion of Liability: To the fullest extent allowed by law, Edison shall not be liable for any direct, indirect or consequential losses, loss of profits, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note.

No personalised advice: The information that we provide should not be construed in any manner whatsoever as, personalised advice. Also, the information provided by us should not be construed by any subscriber or prospective subscriber as Edison’s solicitation to effect, or attempt to effect, any transaction in a security. The securities described in the report may not be eligible for sale in all jurisdictions or to certain categories of investors.

Investment in securities mentioned: Edison has a restrictive policy relating to personal dealing and conflicts of interest. Edison Group does not conduct any investment business and, accordingly, does not itself hold any positions in the securities mentioned in this report. However, the respective directors, officers, employees and contractors of Edison may have a position in any or related securities mentioned in this report, subject to Edison's policies on personal dealing and conflicts of interest.

Copyright: Copyright 2024 Edison Investment Research Limited (Edison).

Australia

Edison Investment Research Pty Ltd (Edison AU) is the Australian subsidiary of Edison. Edison AU is a Corporate Authorised Representative (1252501) of Crown Wealth Group Pty Ltd who holds an Australian Financial Services Licence (Number: 494274). This research is issued in Australia by Edison AU and any access to it, is intended only for "wholesale clients" within the meaning of the Corporations Act 2001 of Australia. Any advice given by Edison AU is general advice only and does not take into account your personal circumstances, needs or objectives. You should, before acting on this advice, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If our advice relates to the acquisition, or possible acquisition, of a particular financial product you should read any relevant Product Disclosure Statement or like instrument.

New Zealand

The research in this document is intended for New Zealand resident professional financial advisers or brokers (for use in their roles as financial advisers or brokers) and habitual investors who are “wholesale clients” for the purpose of the Financial Advisers Act 2008 (FAA) (as described in sections 5(c) (1)(a), (b) and (c) of the FAA). This is not a solicitation or inducement to buy, sell, subscribe, or underwrite any securities mentioned or in the topic of this document. For the purpose of the FAA, the content of this report is of a general nature, is intended as a source of general information only and is not intended to constitute a recommendation or opinion in relation to acquiring or disposing (including refraining from acquiring or disposing) of securities. The distribution of this document is not a “personalised service” and, to the extent that it contains any financial advice, is intended only as a “class service” provided by Edison within the meaning of the FAA (i.e. without taking into account the particular financial situation or goals of any person). As such, it should not be relied upon in making an investment decision.

United Kingdom

This document is prepared and provided by Edison for information purposes only and should not be construed as an offer or solicitation for investment in any securities mentioned or in the topic of this document. A marketing communication under FCA Rules, this document has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This Communication is being distributed in the United Kingdom and is directed only at (i) persons having professional experience in matters relating to investments, i.e. investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "FPO") (ii) high net-worth companies, unincorporated associations or other bodies within the meaning of Article 49 of the FPO and (iii) persons to whom it is otherwise lawful to distribute it. The investment or investment activity to which this document relates is available only to such persons. It is not intended that this document be distributed or passed on, directly or indirectly, to any other class of persons and in any event and under no circumstances should persons of any other description rely on or act upon the contents of this document.

This Communication is being supplied to you solely for your information and may not be reproduced by, further distributed to or published in whole or in part by, any other person.

United States

Edison relies upon the "publishers' exclusion" from the definition of investment adviser under Section 202(a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This report is a bona fide publication of general and regular circulation offering impersonal investment-related advice, not tailored to a specific investment portfolio or the needs of current and/or prospective subscribers. As such, Edison does not offer or provide personal advice and the research provided is for informational purposes only. No mention of a particular security in this report constitutes a recommendation to buy, sell or hold that or any security, or that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

London │ New York │ Frankfurt

20 Red Lion Street

London, WC1R 4PS

United Kingdom