CPI numbers are up again to 4% steadily rising from 3.3% in July and 2.8% in June. The heavy increase in inflation last month was led by gasoline prices, higher rents, higher mortgage payments, and steadily increasing food prices.

As the vicious cycle of interest rates and inflation continues to wreak havoc on prices, everyone is probably wondering where the inflection point will be to curb the demand. Which, after all, is the entire point of raising interest rates.

The Bank of Canada has mentioned more interest rate hikes are still on the table after last month's pause. With the August CPI reading, they may be getting worried and will continue to use their blunt edged tool to raise rates at least once or twice before the year ends.

The Condo Pile Up

Inventory for Condos in Toronto have been on a continuous rise. Since last month Toronto saw a 55% increase in 2 bedrooms and a 51% increase in 1 bedroom condo inventory.

Investors with variable mortgages and the inability to raise rents are feeling the most pain and many would rather sell now than continue to suffer negative cash flows. Many others may be selling in anticipation of higher mortgage renewals in the next 2 years.

Whatever the reason, there is now definitely enough supply to call it a buyer's market.

No More GST On Rental Housing

Earlier this month Bill-C56 was introduced to remove GST on new rental property constructions across Canada.

Here's a quick breakdown of what it involves:

-

Applicable to rental housing construction projects started between September 14, 2023 and December 31, 2030 and completed before December 31, 2035.

-

Previously there was a 36% rebate, now it's 100% regardless of value thresholds.

-

Applies to office to residential conversions or other non-residential to residential conversions.

-

Applies only to new rentals with at least 4 private units or at least 10 shared rooms.

-

90% of the units must be designated for long-term rental.

New York's Short-Term Rental Ban

New York has basically banned short-term rentals outright forcing Airbnb (NASDAQ:ABNB) to refund any bookings after Dec 31, 2023 that are for less than 30 days. The only way around it is for hosts to be present during the stays.

Are Toronto and Vancouver Next?

Toronto and Vancouver will most likely watch and see how it plays out in New York. Toronto's current short-term rental rules did not make a dent on long-term rents, the excess supply was simply gobbled up by the market within months and rent prices continued their meteoric rise to where we are today.

What we know for sure is that the hotels in similar cities are watering at the mouth for the prospects. As travellers have to re-book their upcoming New York STR stays in favor of hotels, hotel rates are predicted to skyrocket in the city.

Residential Rent Update

Rents have continued to rise or stay steady across the country. In St. John's, 1 bedroom rents have increased 33% from just a few months ago as the rental supply dwindles in the city.

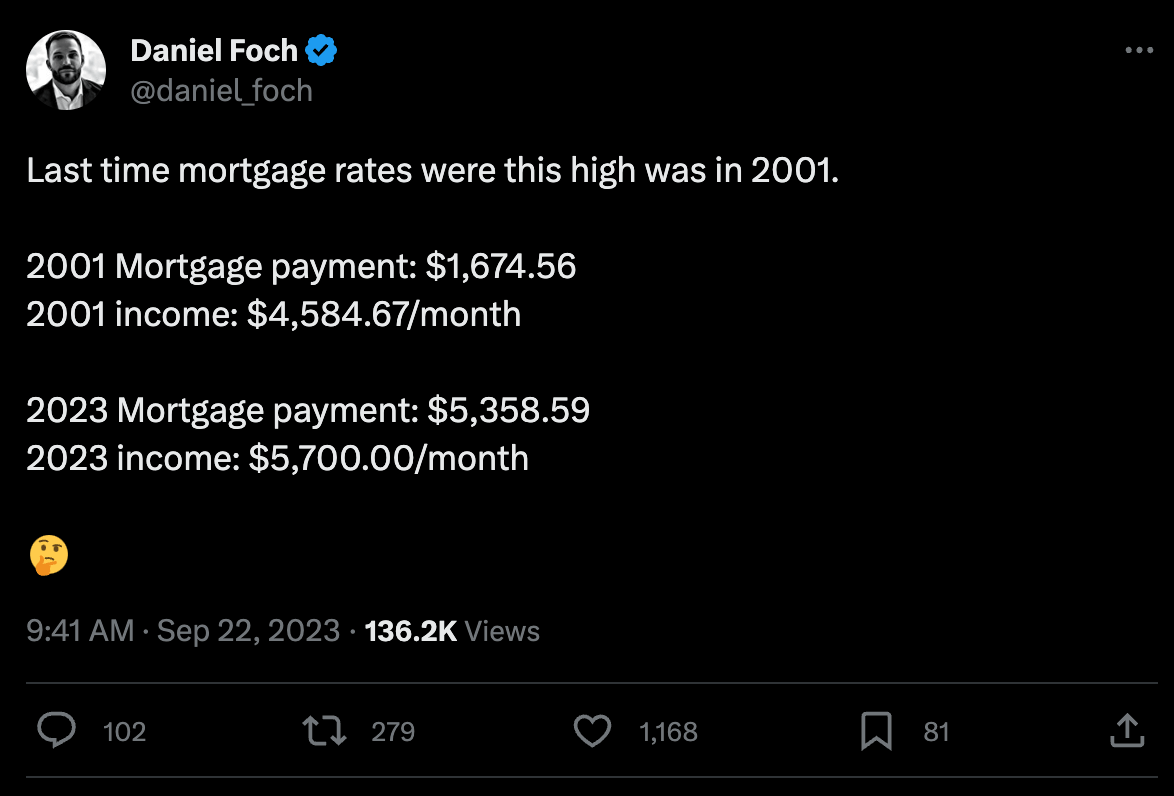

Tweet of the Week

If you enjoyed this edition of Market Pulse, please consider subscribing to our newsletter where we tell you everything you need to know about Canadian Real Estate in a 2-3 minute read.