In this Celestia (TIA) price prediction 2024, 2025, 2026-2030, we will analyze the price patterns of TIA by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

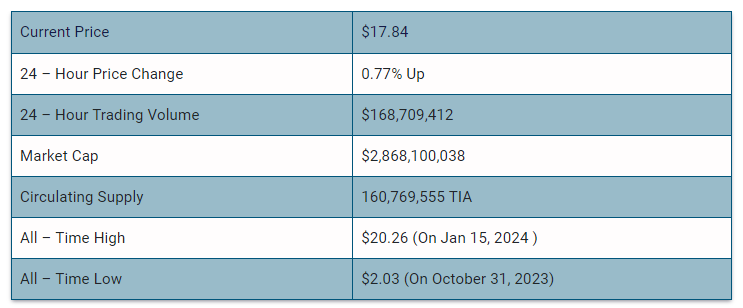

Celestia (TIA) Current Market Status

What is Celestia (TIA)

Celestia stands as an innovative cryptocurrency venture, concentrating on constructing a modular consensus and data availability layer. This framework forms a distinctive base for decentralized applications, fostering heightened efficiency and security. Notably, Celestia separates consensus from execution, resulting in improved scalability and adaptability for blockchain development.

Functioning as a modular blockchain network, Celestia provides developers with the essential infrastructure for constructing and sustaining blockchains. Its versatility is showcased as other blockchains can utilize Celestia as a data availability and consensus layer. In the role of a data availability layer, Celestia permits secure publication of transactions, ensuring the streamlined operation of nodes on expanding blockchains. As a consensus layer, Celestia’s network of nodes verifies and authenticates stored data.

Celestia introduced its native cryptocurrency, TIA, concurrently with its main net launch on October 31, 2024. TIA is integral for developers, serving as fees for Celestia’s data availability solutions, gas tokens for Celestia-based rollups, and staking in this proof-of-stake chain.

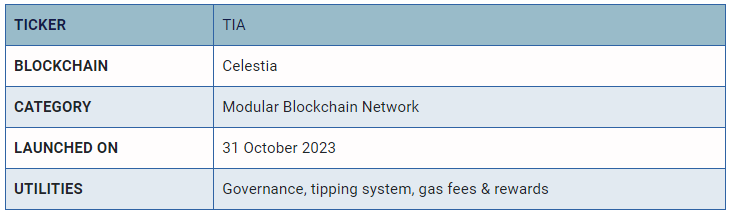

Celestia 24H Technicals

(Source: TradingView)

Celestia (TIA) Price Prediction 2024

Celestia (TIA) ranks 32nd on CoinMarketCap in terms of its market capitalization. The overview of the Celestia price prediction for 2024 is explained below with a daily time frame.

TIA/USDT Ascending Triangle Pattern (Source: TradingView)

In the above chart, Celestia (TIA) laid out an ascending triangle pattern. The ascending triangle is a characteristic pattern of an ongoing bullish trend. This triangle is formed by a horizontal upper trendline that connects the highs and a lower trendline that connects the rising lows.

If the trend breakout at the resistance level, the price will continue to move up in this ascending triangle pattern.

At the time of analysis, the price of Celestia (TIA) was recorded at $17.84. If the pattern trend continues, then the price of TIA might reach the resistance levels of $18.3357, and $23.7591. If the trend reverses, then the price of TIA may fall to the support of $16.6676, $15.1272, and $13.8278.

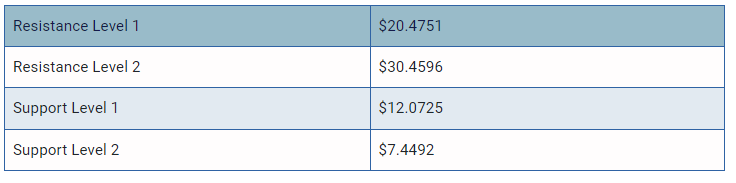

Celestia (TIA) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Celestia (TIA) in 2024.

TIA/USDT Resistance and Support Levels (Source: TradingView)

From the above chart, we can analyze and identify the following as resistance and support levels of Celestia (TIA) for 2024.

TIA Resistance & Support Levels

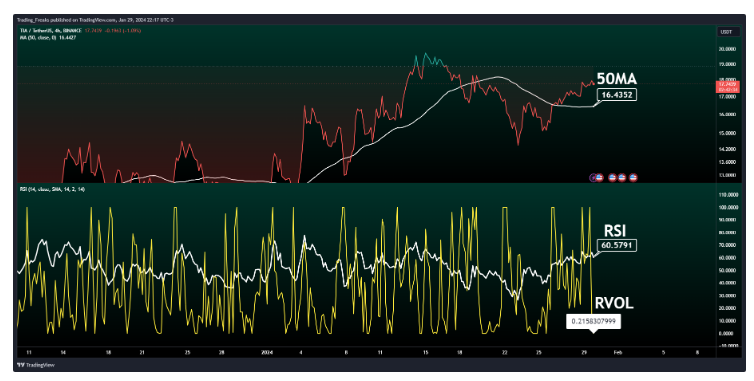

Celestia (TIA) Price Prediction 2024 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Celestia (TIA) are shown in the chart below.

TIA/USDT RVOL, MA, RSI (Source: TradingView)

From the readings on the chart above, we can make the following inferences regarding the current Celestia (TIA) market in 2024.

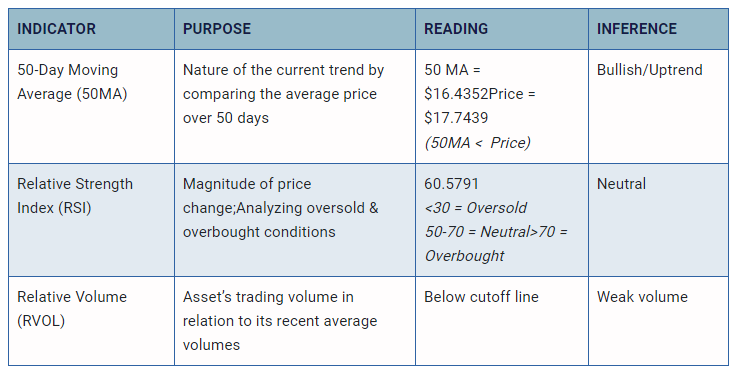

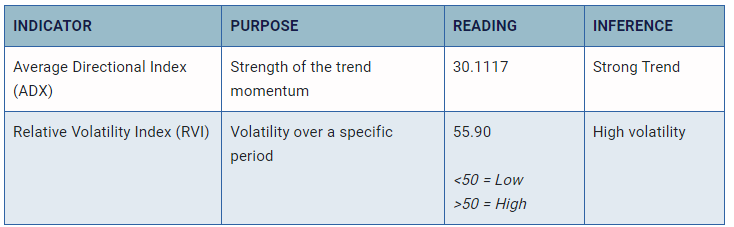

Celestia (TIA) Price Prediction 2024 — ADX, RVI

In the below chart, we analyze the strength and volatility of Celestia (TIA) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

TIA/USDT ADX, RVI (Source: TradingView)

From the readings on the chart above, we can make the following inferences regarding the price momentum of Celestia (TIA).

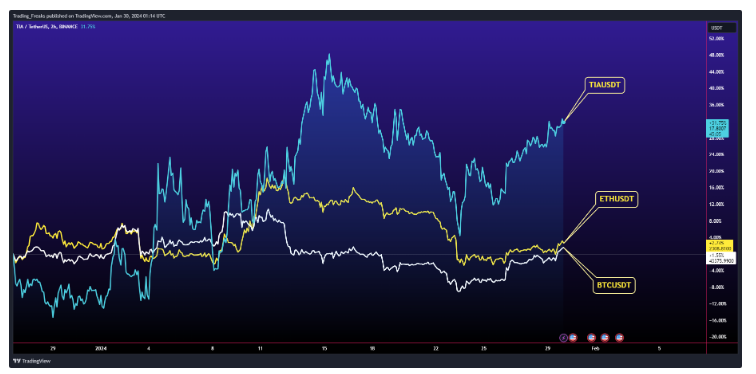

Comparison of TIA with BTC, ETH

Let us now compare the price movements of Celestia (TIA) with that of Bitcoin (BTC), and Ethereum (ETH).

BTC Vs ETH Vs TIA Price Comparison (Source: TradingView)

From the above chart, we can interpret that the price action of TIA is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of TIA also increases or decreases respectively.

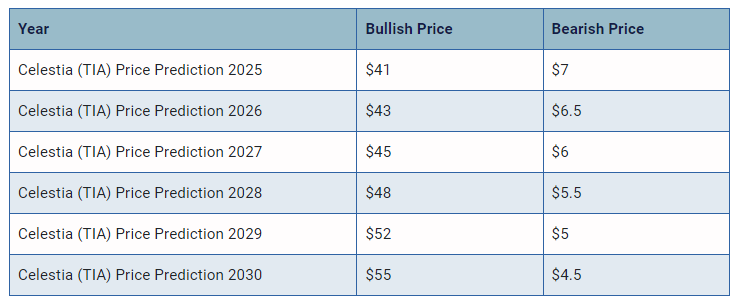

Celestia (TIA) Price Prediction 2025, 2026 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Celestia (TIA) between 2025, 2026, 2027, 2028, 2029 and 2030.

Conclusion

If Celestia (TIA) establishes itself as a good investment in 2024, this year would be favorable to the cryptocurrency. In conclusion, the bullish Celestia (TIA) price prediction for 2024 is $30.4596. Comparatively, if unfavorable sentiment is triggered, the bearish Celestia (TIA) price prediction for 2024 is $7.4492.

If the market momentum and investors’ sentiment positively elevate, then Celestia (TIA) might hit $35. Furthermore, with future upgrades and advancements in the Celestia ecosystem, TIA might surpass its current all-time high (ATH) of $20.26 and mark its new ATH.

This content was originally published by our partners at The News Crypto.