- After an intense week of central banks, it is time to rethink investment strategies

- And in a volatile environment, it is essential to have a diversified portfolio

- Here's how InvestingPro can help you devise successful investment strategies

More hikes and a continued hawkish tone from the U.S. Federal Reserve (Fed) and European Central Bank (ECB) this year are supposed to bring down inflationary pressures.

Central banks have clarified that cutting interest rates is unlikely this year. Still, the equity markets have done well so far.

Experts warn that the Fed's restrictive monetary policy and the tightening measures implemented by central banks in Europe may push the U.S. and European economies into a recession by late 2023 or early 2024.

With inflation still high and the possibility of a hawkish monetary policy-induced recession looming, investors must prioritize sound risk management and focus on resilient stocks and sectors to ensure a diversified portfolio.

Access to accurate and timely market information is vital to navigating this volatile and uncertain market environment. InvestingPro provides firsthand data and insights on market factors that can impact stocks.

It empowers investors to make informed decisions and stay updated on market trends, enabling them to adapt their investment strategies accordingly.

Here are ways to use the tool to maximize your investment returns:

Ideas

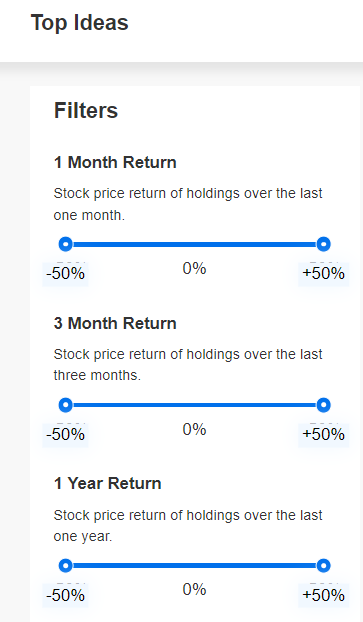

InvestingPro provides a range of features to help investors identify the best-performing stocks. One such feature is the ability to search stocks based on their performance over different periods, including the past month, quarter, or year.

Source: InvestingPro

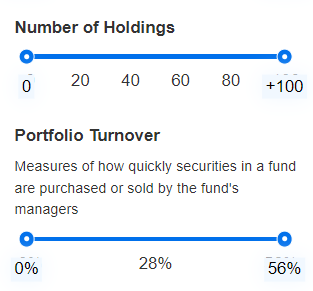

With InvestingPro, you can actively search for aspects related to portfolio turnover, i.e., the speed at which fund managers buy or sell securities within a fund.

Source: InvestingPro

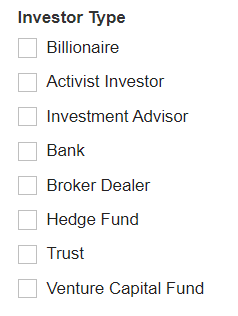

If you prefer to find bets by investor type, InvestingPro allows you to search by different profiles: advisors, brokers, private equity funds, banks, etc.

Source: InvestingPro

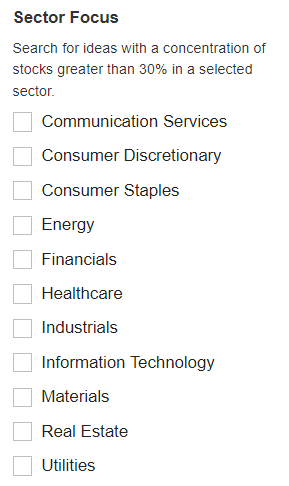

Additionally, InvestingPro enables you to search for investment opportunities within specific sectors actively.

By utilizing the tool, you can explore ideas with a certain concentration of shares; for example, you can search for ideas with a concentration of stocks greater than 30% in various sectors such as energy, consumer, health, industry, and more.

Source: InvestingPro

Filters

The InvestingPro professional tool also allows you to search for stocks by applying various filters, depending on the type of strategy.

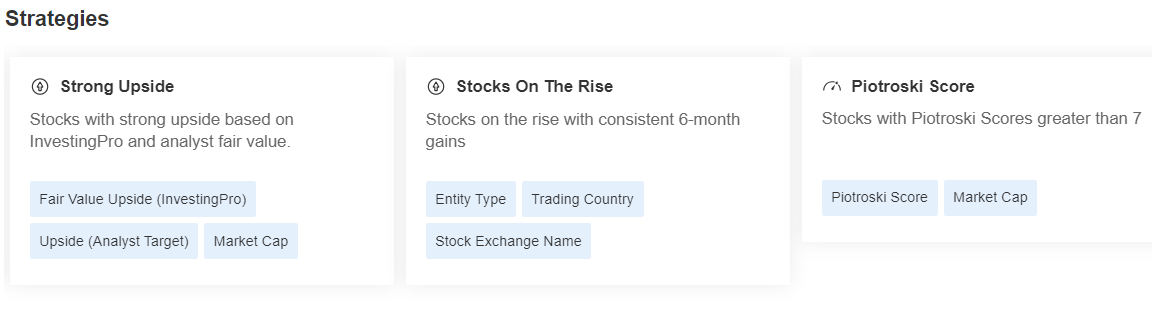

For example, you can search for stocks with a strong uptrend according to InvestingPro and analysts' fair value.

You can also search by benchmarking bullish stocks with consistent 6-month earnings growth or stocks with Piotroski scores above 7.

Source: InvestingPro

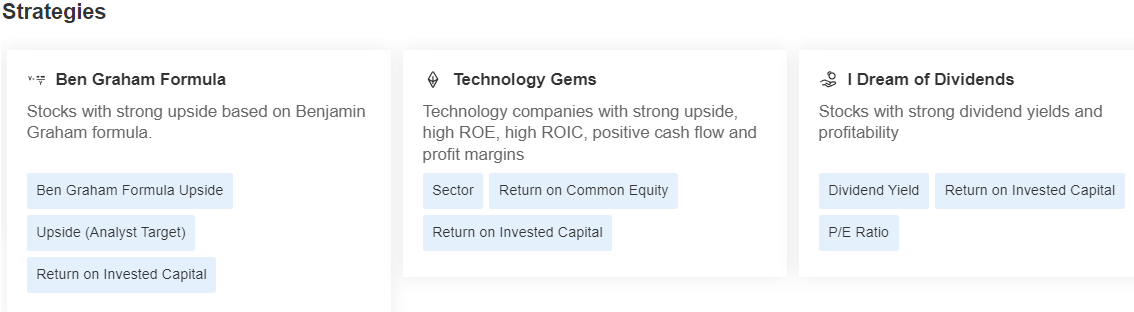

InvestingPro can search for stocks with a strong upward trend using Benjamin Graham's formula. It also provides options to identify stocks with strong dividend and earnings yields.

You can use InvestingPro to search for technology companies with upward trends, high ROE (Return on Equity) and ROIC (Return on Invested Capital), positive cash flow, and profit margins.

Source: InvestingPro

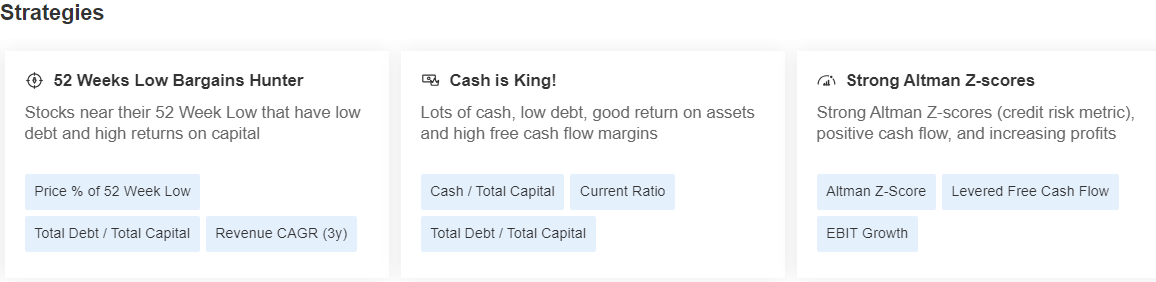

Another investment strategy search option offered by InvestingPro is to find stocks near 52-week lows with low debt and high return on capital and stocks with a good Altman Z-score (a credit risk metric), positive cash flow, and growing earnings.

You can also select stocks with high cash flow, low debt, good return on assets, and wide free cash flow margins.

Source: InvestingPro

Are you thinking of restructuring your investment strategy, adding new stocks to your portfolio, or getting rid of stocks you think are no longer profitable?

You can subscribe and try out the InvestingPro premium tool, which provides comprehensive tools for conducting in-depth analyses, allowing you to pick solid stocks that pay off in the long term.

The InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.