This article was written exclusively for Investing.com

…But in which direction?

Gold has been stuck in an ugly consolidation range for the past several months amid conflicting macro factors. But is it finally ready to move out of this consolidation and start trending?

The yellow precious metal has been unable move away from around its long-term 200-day average, which is precisely where it is currently residing ahead of the US jobs report. Though the outcome of the nonfarm payrolls will only impact prices in the short-term, what’s important is whether investors believe now is a good time to buy the dips, or whether they should continue to sell into the rallies.

More on that later, but let’s discuss the charts first.

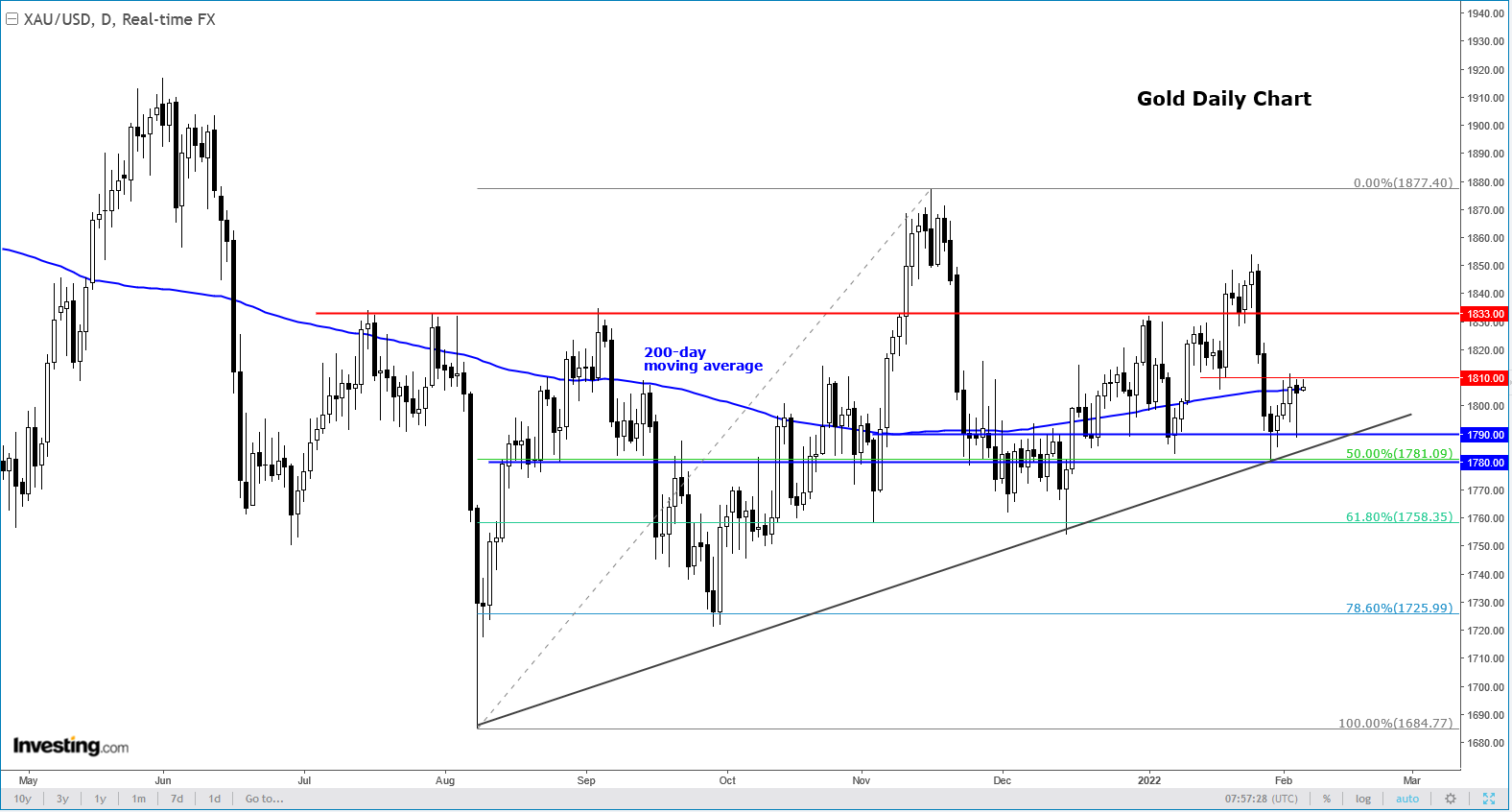

The daily chart doesn’t look very clear yet, although in a somewhat bullish development, gold’s hammer/doji candle off the 200-day average on Thursday—after the positively-correlating EUR/USD surged on the back of a hawkish ECB—is a welcome sign. Resistance at $1,810 needs to break decisively for prices to stage a more meaningful recovery.

The weekly chart looks more interesting than the daily. On this longer-term time frame, one can see that prices are converging inside converging trend lines. This means that in the next few weeks, prices will have to break in one or the other direction.

With the long-term trend bullish trend line providing consistent support, the likelihood of a bullish breakout is higher, in my opinion, than a bearish breakdown.

The incisiveness observed on the charts of gold reflects conflicting macro factors.

Gold proponents argue that the metal remains substantially undervalued. The very high levels of inflation around the world calls for higher gold prices. The metal is deemed by many as an effective tool against rising prices, with inflation continuing to erode the value of fiat currencies globally now—especially in countries such as Turkey where there is also a currency crisis. Yet, the impact of inflation on gold prices has been very minimal so far.

What’s more, monetary policy from the developed economies—although starting to tighten slightly as central banks react to inflation—has never been as loose as it was in response to the global coronavirus pandemic. Again, this caused investors to pile into the racier equity markets (and crypto currencies) rather than gold, although the yellow metal found support initially as it rallied to a record high of above $2,000 in 2020, before giving back a big chunk of those gains since.

However, with inflation showing no signs of easing, and US technology stocks starting to show a few cracks, gold may be able to withstand rising yields and break higher.