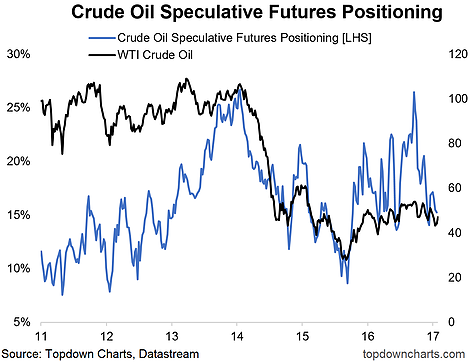

Following up on a previous post on Crude Oil tactical indicators, it's timely to check in on a couple of charts after about a 5-point move off the bottom. Speculative futures positioning has moved lower for WTI (note it has moved significantly lower for Brent crude oil), and is more of less around the point where you get contrarian bullish.

To be fair, a higher conviction contrarian-bullish case would be more consistent with an even greater fall in both price and positioning. The other indicator we looked at last time, crude oil implied volatility, has hardly moved - so there's not really any signal to add from that right now.

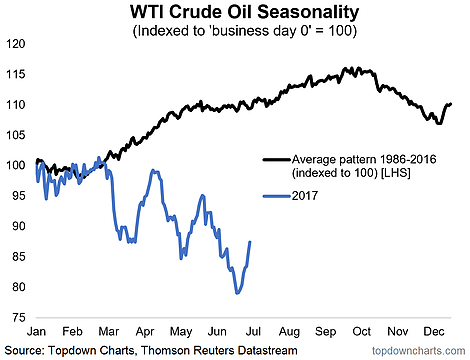

But the other chart that I bring in this time is that of crude oil seasonality. Seasonality tends to work a little better in commodity markets because it's basically the physical worldly seasons that are driving the activity and behavior that influence commodity supply and demand.

The historical tendency is that you see *on average* positive seasonality for crude oil prices from July through October (after that it switches over to negative seasonality). So all else equal, and assuming seasonality does hold (it doesn't always - averages can deceive!) it's a tick in favor of the oil price. When you get a positioning reset and positive seasonality, it's probably a good thing (at least a good thing for the bulls).

Crude oil speculative futures positioning has come down slightly in the latest reading - but bigger picture, it is down significantly since the peak in February.

Crude oil seasonality is about to go from neutral to positive. All else equal, and assuming seasonality actually works (caution: it doesn't always work), it's something to add to a bullish case.