1: Introduction: Chevron is about to get bigger

Chevron Corporation (NYSE: NYSE:CVX) announced its earnings for the fourth quarter and full year of 2024 on January 31, 2025. This article updates my previous article published on Gurufocus on January 17, 2024. Chevron is a prominent oil supermajor currently ranked 28th in the S&P 500. The company is recognized for its consistent annual dividend increases, achieving 37 consecutive hikes. This qualifies it as a premium dividend aristocrat alongside its main competitor, ExxonMobil (NYSE:XOM). Berkshire Hathaway (NYSE:BRKa) (BKR.A, BKR.B) reduced its CVX position in 2024 but remained one of its top five holdings.

For the fourth quarter of 2024, Chevron raised its quarterly dividend by 4.9% compared to the previous quarter, increasing it to $1.71 per share. This increase results in a yield of 4.46%, offering investors a substantial and safe return.

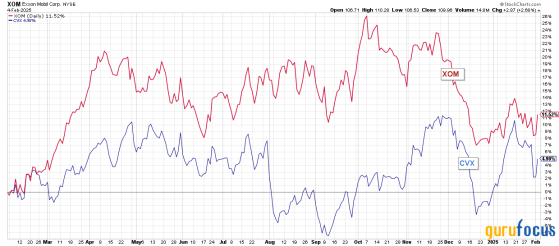

CVX has increased slightly year over year but has underperformed XOM over the past year, as illustrated in the graph below:

Like other major oil companies, Chevron operates across various segments, including upstream, downstream, chemicals (in partnership with PSX), midstream, and, more recently, renewable and emerging businesses. However, Chevron’s operations primarily focus on the upstream segment, which generates all of the company’s total earnings in 4Q24.

As shown below, downstream earnings were negative in 4Q24.

In my article about ExxonMobil, I also discussed Chevron Corporation and noted that both companies are comparable in terms of investment. Holding long-term positions in CVX (Chevron) and XOM (ExxonMobil) is the best choice in the oil industry, as it provides diversification while maintaining strong performance and solid dividends.

2: Chevron-Hess versus ExxonMobil: Production analysis

Chevron’s business model differs from that of ExxonMobil. Chevron primarily focuses on North America, particularly shale oil in the Permian Basin. While ExxonMobil’s merger with Permian Pioneer demonstrates a strong commitment to domestic production (mainly Permian), Chevron remains more specialized in the North American segment.

Chevron’s total oil equivalent production was 3,350 barrels per day in 4Q24. Production includes North America, South America, the Asian Pacific, Africa, and the Middle East.

The liquid price paid to CVX in 4Q24 decreased year over year. CVX received $53.12 per Boe, down from $58.69 in 4Q23.

U.S. production, which includes the Permian Basin, reached 1,646 barrels of oil equivalent per day, making up 49.1% of the total output in 4Q24.

The majority of production in the United States is focused in the Permian Basin, the Mid-Continent regions (such as Colorado, New Mexico, and Texas), and the Gulf of Mexico. With the upcoming merger with HES, CVX is set to enhance production in the Gulf of Mexico and contribute an additional 208,000 barrels of oil equivalent per day from the Bakken Basin.

The Chevron/Hess merger will significantly impact the current landscape. Approximately 52% of Hess’s total production495,000 barrels of oil equivalent per day in 4Q24comes from the United States (specifically the Bakken and Gulf of Mexico), Guyana (195,000 Boepd), and South Asia (62,000 Boepd).

Production from the Stabroek block in Guyana is set to become the company’s major source of oil. Yellowtail, the fourth project, is expected to begin production this year and will add approximately 250,000 barrels of oil per day. Hess’s stake in the bloc is 30%, which means that by the end of 2025, production from Guyana will reach 270,000 barrels of oil per day. Liquids represent 79.6% of Hess’s total production, as illustrated below:

Including Hess’s oil equivalent production, Chevron-Hess will produce slightly less total oil than ExxonMobil. However, in the USA, Chevron-Hess will be ahead with 2,048 Kboepd compared to ExxonMobil’s 2,011 Kboepd, as illustrated in the chart below.

3: A critical analysis of the fourth quarter results: Lower margins on refined product sales were to blame.

The company reported total revenues and other income of $52.23 billion, with revenues alone reaching $48.334 billion, exceeding analyst expectations.

On the other hand, the adjusted earnings per share of $2.06 fell short of expectations. This disappointing result was mainly due to the company’s first refining loss in years, caused by reduced margins on refined product sales and increased operating expenses. ExxonMobil experienced a similar situation this quarter.

As I said in my article about ExxonMobil, one effective way to evaluate a business is by examining its free cash flow. Despite facing challenges such as weaker refining margins and decreased global fuel demand, particularly in China, Chevron generated a robust free cash flow, estimated to be approximately $4.4 billion. Free cash flow is calculated using the formula: cash from operations ($8.7 billion) minus capital expenditures (CapEx) of $4.3 billion. Free cash flow represents the cash available to a company after it has made essential investments. In 2024, the average quarterly free cash flow was $3.75 billion, as shown in the chart below. The company is expected to pay about $3 billion per quarter in dividends, which leaves only limited funds available for debt repayment and share buybacks. Given the same trend in 2025, I am worried that the company is spending more than it can sustain. However, CVX said that CapEx will be reduced to $14.5-$15.5 billion, down from $17 billion in 2024, increasing free cash flow. Will it be enough?

The company plans to allocate between $10 billion and $20 billion for share buybacks in 2025. This strategy is not viable unless oil and gas prices increase significantly.

Chevron’s debt is a sensitive topic. The chart below shows that the company’s total debt before the merger was $24.54 billion. However, with the potential Hess acquisition, Chevron will increase its debt by $4.1 billion, representing the net debt Hess reported in the fourth quarter of 2024. Chevron has agreed to acquire Hess in an all-stock transaction. To complete the acquisition, the company will issue around 314 million new shares, increasing the total number of diluted shares outstanding to approximately 2,091 million, a 17.7% increase. This move increases the dividend burden and raises concerns about the viability of the buyback program. CVX announced its intention to sell its 20% stake in the Athabasca Oil (TSX:ATH) Sands Project and its 70% stake in the Duvernay shale to CNR for $6.5 billion in cash. As mentioned, CVX is also planning to reduce its capital expenditures (CapEx) for 2025. Will this be enough?

4: Technical Analysis: Symmetrical Wedge.

Note that the chart above has been updated to reflect dividends.

CVX forms an ascending triangle pattern, with resistance at $159 and support at $149.5 The Relative Strength Index (RSI) is at 52 and declining, suggesting strong support at $149.5 and a potential downside target of $141 or lower, depending on oil prices.

As a continuation pattern, the ascending triangle is slightly bullish here, indicating that a breakout may occur at the end of the pattern.

However, I suggest taking profits between $157 and $159 for a short-term trading strategy, with possible higher resistance at $163. Conversely, I recommend accumulating shares between $152.5 and $148, with an additional lower support level at $141.

The strategy involves using a short-term Last In, First Out (LIFO) approach for 50% to 60% of your total position while keeping a core long-term investment for greater returns. CVX offers a reliable dividend. Despite the potential short-term risks always present in the oil and gas sector, your investment is likely to generate substantial long-term gains if you are patient and take advantage of any price dips to accumulate more shares.

Note that the chart above should be updated regularly to remain relevant.

This content was originally published on Gurufocus.com