The strong performance of U.S. equities, particularly that of the Magnificent Seven, has led investors to gain increasingly more exposure to the asset class in recent years. CI Global Asset Management (CI GAM) recently launched the CI U.S. 500 Index (Ticker: CUSA) Hedged, which is designed to reflect the performance of the largest 500 companies in the U.S. stock market.

This article will highlight the recently launched ETF and the value proposition it can provide to investors.

CUSA Explained

CUSA provides convenient, low-cost exposure to a portfolio of large-cap U.S. stocks. It also offers the added benefit of hedging to reduce the impact of foreign exchange fluctuations. The ETF is the latest addition to CI Global Asset Management’s CI Beta ETF Suite, a lineup of cost-competitive, index-based ETFs that investors can utilize as core holdings or as complements to smart beta or actively managed solutions.

CUSA: Hedged or Unhedged

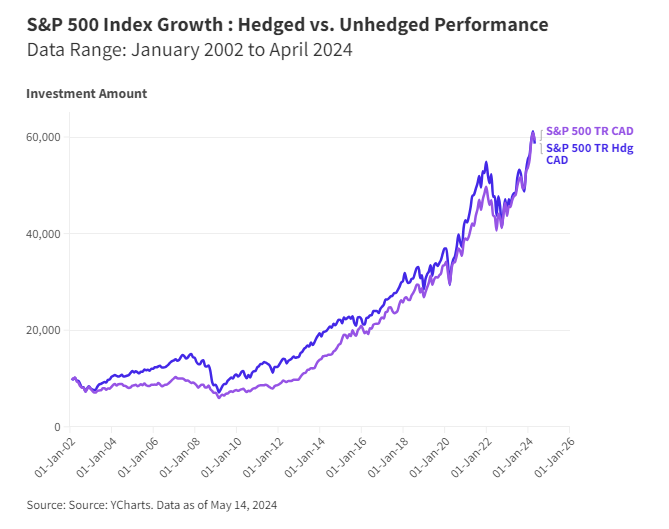

The launch of CUSA now provides investors with increased optionality, as CI GAM had an unhedged version of the ETF, CUSA.B, available since August 2021. Though both ETFs focus on the S&P 500 Index, the treatment of the currency exposure can result in a different investment experience; this is illustrated in the following chart.

Currency Hedging Explained

As an investor, when you buy an ETF that holds foreign equities, you are taking on two types of risk. The first relates to owning stocks, as the stock price can go up or down. The second type of risk is currency risk. This means you are exposed to the currency in which the stocks are denominated. If you hold U.S. stocks and (i) the USD moves higher against the CAD, you get a lift in returns, (ii) if the CAD moves higher against the USD, your returns decline.

Therefore, investors may want to consider a currency-hedged ETF to eliminate the second type of risk by removing the effect of fluctuating exchange rates.

Generally, when an ETF is Hedged to CAD, its portfolio managers use a tool called a “currency forward” to lock in a specific exchange rate on a future date. For Canadian ETFs holding U.S. securities, if the USD has fallen by that date, the ETF makes a gain from the contract, which offsets the value it lost from a falling USD on the portfolio holdings. If the USD has risen, the ETF nets a loss from the contract, which also offsets the value it gained from the rising USD.

In short, during any period when the CAD rises in value relative to foreign currencies, a hedged ETF will result in higher returns in the foreign equity part of the investments. When the CAD loses value relative to foreign currencies, an unhedged ETF usually performs better.

The goal of currency hedging is not to maximize returns but to reduce the impact of currency risk as much as possible.

CI GAM’s Growing ETF Line-Up

CI GAM’s ETF lineup is one of the industry’s most diverse with more than 80 ETFs spanning beta, smart beta, asset allocation, managed volatility, actively managed, liquid alternatives, digital assets, covered calls, cash management, ESG and other thematic mandates. CI GAM is Canada’s fifth-largest ETF provider, with approximately $21.5 billion in ETF assets under management (as of March 31, 2024).

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.