In a previous article, I delved into the myriad dividend ETF strategies available to Canadian investors, highlighting three principal types: high-yield dividends, dividend growth, and dividend quality.

I also touched on the growing field of hybrid strategies, which meld two or more of these approaches to create a more robust, dynamic income-generating portfolio.

Such hybrid strategies have gained considerable traction in the U.S., with industry leaders like WisdomTree pioneering innovative, factor-based ETFs that offer a nuanced blend of dividend growth and quality, among other attributes.

The good news is that Canadian investors need not look south of the border to access these groundbreaking investment vehicles. Thanks to strategic partnerships between Canadian and U.S. asset management firms, such specialized ETFs are increasingly accessible in Canadian dollars.

Today, we're going to take a deep dive into one such Canadian-domiciled ETF offering from CI Global Asset Management, made available through their collaboration with WisdomTree – the CI WisdomTree Canada Quality Dividend Growth Index ETF (TSX:DGRC) (DGRC).

DGRC breakdown

Unlike many traditional Canadian dividend equity ETFs, which primarily screen for factors like above-average yields or consecutive years of dividend growth, DGRC employs a more elaborate, fundamentals-based methodology via its underlying index, the WisdomTree Canada Quality Dividend Growth Index.

Companies are initially selected based on market capitalization, but the real innovation lies in its "Growth and Quality Rank," where firms are scored based on a blend of estimated earnings growth, 3-year return on equity, and 3-year return on assets. This allows the ETF to target companies that are not just profitable but are also expected to grow—providing a dual engine of potential returns.

Moreover, DGRC takes a detailed approach to weighting, emphasizing a "Cash Dividend Factor" that combines a company’s annual gross dividend with the number of common shares outstanding. This method gives an accurate reflection of and emphasis to a company's real-world dividend-paying capacity, rather than a snapshot based on yield alone.

The ETF also employs multiple capping rules to minimize concentration risk. For example, individual security weights are capped at 5%, and sector caps are applied, limiting any single sector to a maximum of 33.3% of the portfolio, with real estate capped at 15%. These measures ensure diversification and reduce the ETF's vulnerability to downturns in any single sector or stock.

At an expense ratio of 0.23%, the ETF is priced in line with existing competition. Since its inception in 2017, DGRC has attracted around $610 million in assets under management.

DGRC historical performance

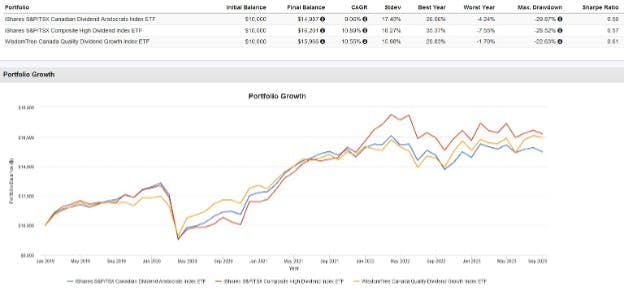

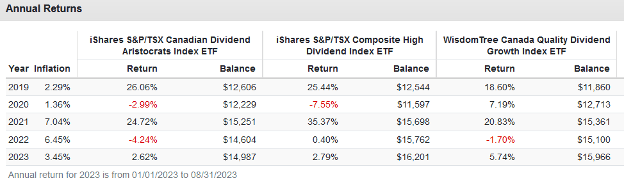

Here's a backtest of DGRC against the iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (CDZ) and the iShares S&P/TSX Composite High Dividend Index ETF (XEI), representing both dividend growth and high-yield dividend strategies respectively:

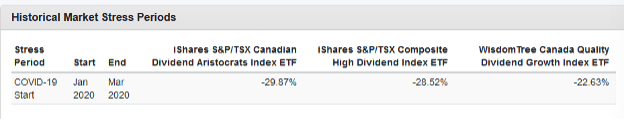

Despite lagging XEI slightly, DGRC has posted a better risk-adjusted return, with a Sharpe ratio of 0.61 versus 0.57. Notably, the ETF had a lower standard deviation of 15.98% along with a smaller maximum drawdown of -22.63% during the COVID-19 crash, pointing to the effectiveness of its quality screener.

Also, DGRC was the only ETF of the trio to post a positive return during 2020, a historically poor year for Canadian equities and most dividend-focused strategies.

This content was originally published by our partners at the Canadian ETF Marketplace.