Rate-sensitive sectors including tech remained steady after the CPI beat forecasts in April though it was still high at 4.93% on an annual basis. The annual rate of inflation has fallen sharply since hitting a 40-year high of 9.06% last June. Markets reacted positively to the news as it shows the Federal Reserve's efforts to quell inflation are paying off.

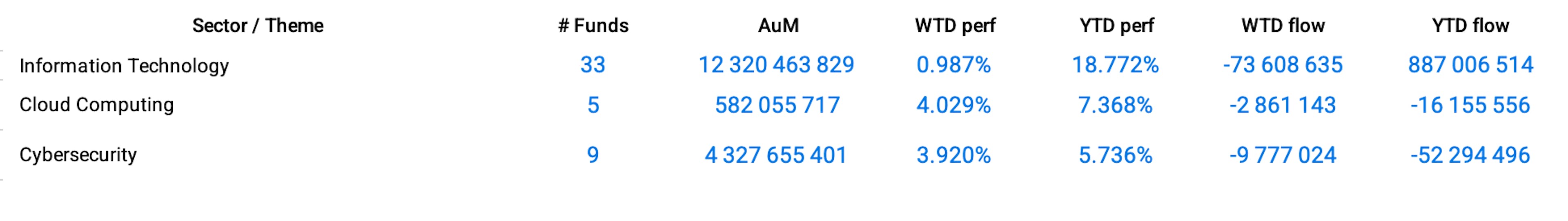

Tech-related themes such as Cloud Computing and Cybersecurity took advantage of this trend amid stabilization in Treasury yields to gain 4.029% and 3.920% respectively over the past week.

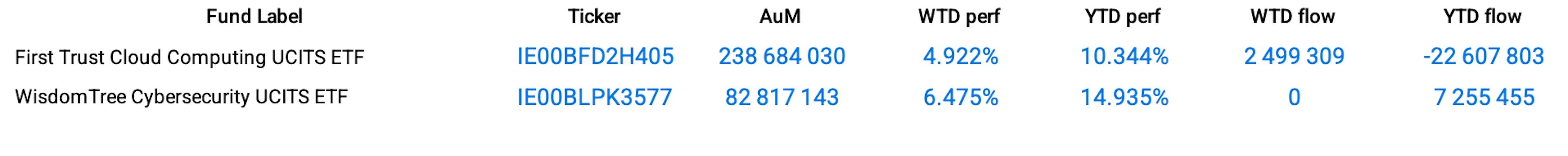

The cloud computing sector has been experiencing strong demand in recent years, as remote work and cloud-based services developed accordingly. Cloud computing providers offer businesses the flexibility to store data and access software on the cloud, reducing the need for on-site hardware and infrastructure. The First Trust Cloud Computing UCITS ETF, which tracks this theme, was up 4.92% over the week.

Cybersecurity has become an increasingly critical area for businesses to invest in as the threat of cyberattacks continues to grow exponentially. Cybersecurity companies provide protection against data breaches, cyber-espionage, and other types of cybercrime. The sector has benefited from increased spending on cybersecurity measures as businesses seek to secure their data and networks. As an example of an ETF focusing on the theme, the WisdomTree Cybersecurity UCITS ETF saw a gain of 6.48% over the week.

Group Data

Funds Specific Data