While the topic of ESG may elicit polarizing opinions among people these days, there is sufficient academic and empirical proof to support the notion that integrating environmental, social, and governance considerations into the portfolio investment process can lead to better performance. The AGF Systematic Global ESG Factors ETF is reflective of this belief, as the solution integrates ESG data in a quantitative multi-factor model to evaluate equity securities of global issuers.

This article will highlight the investment thesis behind the AGF Systematic Global ESG Factors ETF, showcase the efficacy of the ETF’s investment approach and feature the solution’s current ESG profile.

A look at the investment thesis

The AGF Systematic Global ESG Factors ETF employs an ESG integration approach using a quantitative multi-factor model to evaluate equity securities of global issuers. The investable universe is comprised of all securities in the MSCI All Country World Net Index. However, subject to exclusions are companies that derive a significant portion of their revenue from the extraction of fossil fuels, tobacco product manufacturing or distribution, or military defense contracting; and companies involved in severe ESG controversies.

The quantitative model then evaluates and ranks eligible securities based on environmental, social and governance factors. Growth, value, quality and risk factors are also analyzed and may be used as control variables. Although the ETF’s investments are selected based on the output of a quantitative model, the portfolio incorporates constraints/controls (in relation to country, industry, group, sector, style and individual security concentrations) that are designed to foster portfolio diversification, liquidity and risk mitigation.

A look at performance

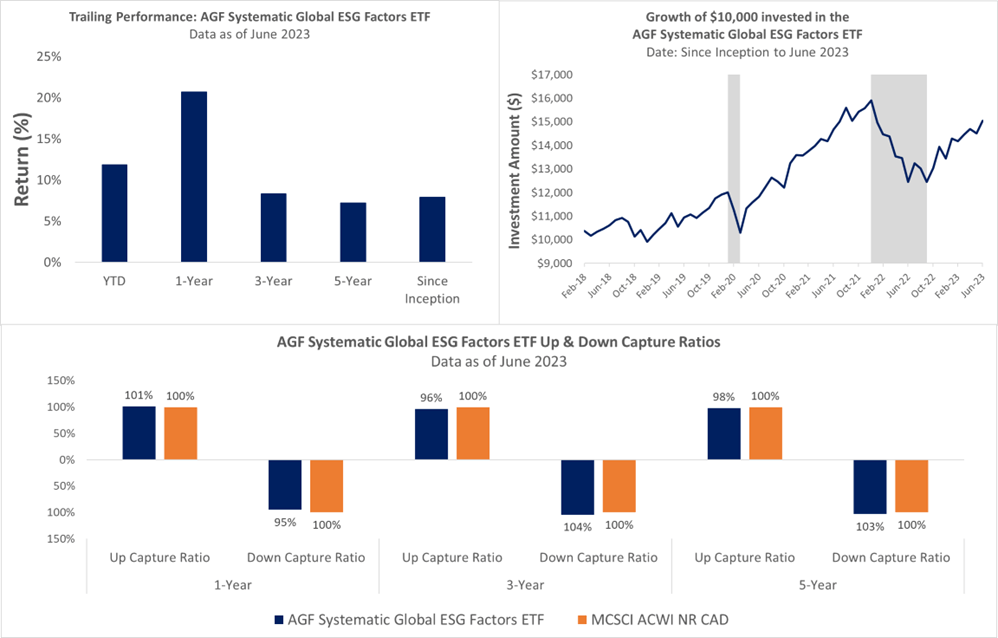

Though the performance of the fund since its inception has been strong, the recent upswing in the equities asset class has resulted in a strong year-to-date and 1-year trailing performance for the mandate, as of June 2023. In examining the historical performance of the solution, while seminal events, such as COVID and the 2022 market drawdown did adversely impact performance – the losses that the fund experienced were mostly in line with that of the market.

Thus far in 2023, the mandate has reflected the strong resurgence that has occurred not only in US equity markets, but in differing regions across the globe, as the fund is globally focused in its investment philosophy.

A look at the ESG Profile

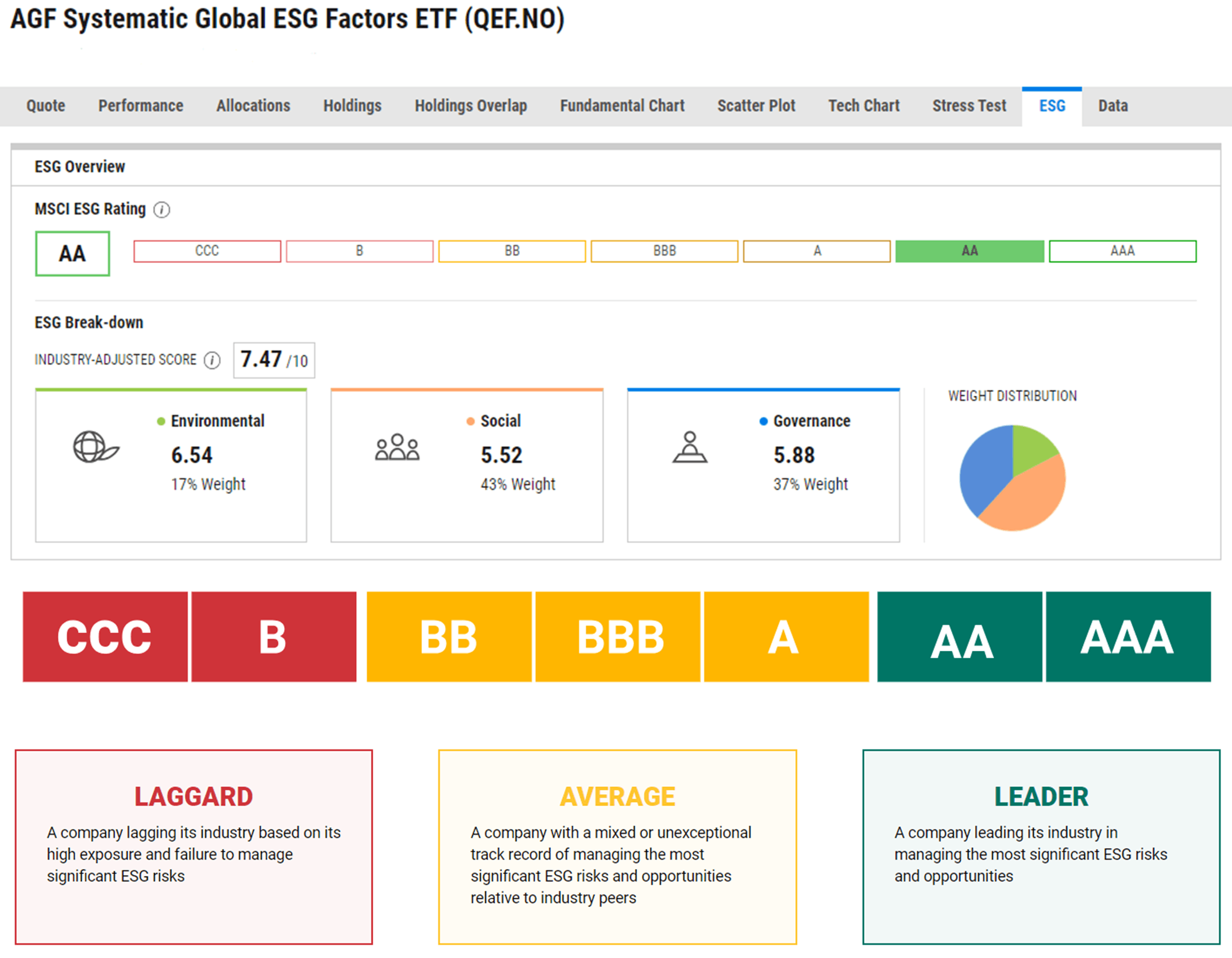

ESG data sourced from MSCI rates the AGF Systematic Global ESG Factors ETF highly, with a leadership classification.

As observed from the imagery, the MSCI rating is based on a weighted average of three quantifiable categories. The fund’s Environmental rating of 6.54 is reflective of the fund’s fossil fuel-free mandate, which requires any company that derives a significant portion of its revenue from the extraction of fossil fuels to be excluded. By implementing this singular action, the ETF’s contributions to carbon emissions are minimized from the onset.

The fund’s Social rating of 5.52 reflects the solution’s avoidance of varying product liability and stakeholder opposition issues that are top of mind in responsible investing. For instance, the fund has no exposure to companies involved with controversial weapons, such as cluster munitions, landmines, and biological/chemical weaponry to name a few. Furthermore, the fund does not have an industry tie to the manufacture or retail of civilian firearms and has no exposure to companies in violation of international norms around human rights.

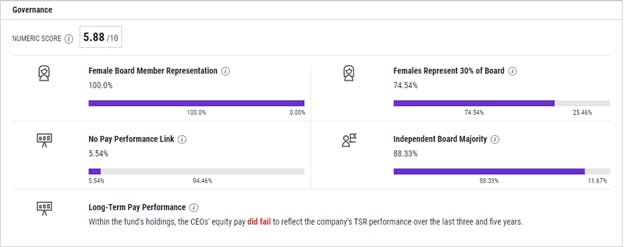

Finally, the fund’s Governance rating of 5.88 is indicative of matters pertaining to corporate governance and corporate behavior. On the matter of female board member representation, the fund ranks high, with approximately 75% of the solution’s market value being exposed to companies where at least 30% of the board of directors are women. Additionally, independent board majority and no link between executive pay and company performance are areas ranked highly.

For investors interested in a fund that blends strong quantitative capabilities, with the qualitative elements of ESG, the AGF Systematic Global ESG Factors ETF is truly a solution worthy of consideration.

This content was originally published by our partners at the Canadian ETF Marketplace.