Treasury Secretary Mnuchin’s strong dollar comments saw the greenback rally across most asset classes.

PRECIOUS METALS

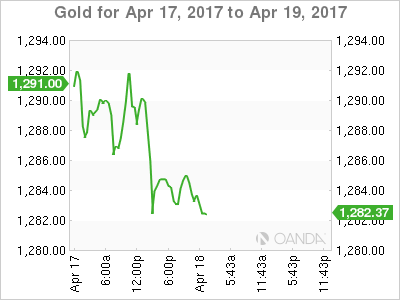

Gold fell from its high above $1295 to 1280 overnight, but gold has made a sprightly start in Asian trading, up five dollars to the 1285 level in the early part of the session, before drifting back to $1283.

This reinforces the view that gold is trading as a function of safe haven demand, with ongoing geopolitical tensions meaning that dips will be eagerly sought by investors and traders alike. This coming weekend’s French Presidential first round elections are looking increasingly murky, and this will most likely fan those haven fires.

Gold has initial support at $1280 with major support at the $1255/60 region, the break-out and the 200-day moving average. Above, gold has resistance at $1296, $1300 and $1308. In all likelihood though, it will be news headlines and opinion polls that drive gold’s short-term direction.

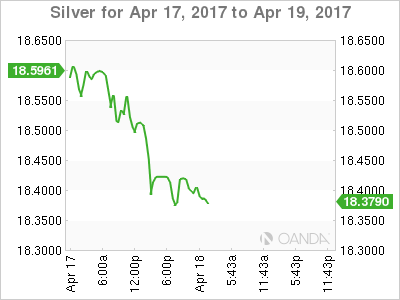

Silver suffered much the same fate as gold overnight and for exactly the same reasons. Silver fell from $18.6600 to close at $18.4100 for the New York session. Of greater conern, silver has traced an outside reversal day on the daily charts which are a bearish formation in this case. However one could qualify this, since the move has occurred in a low liquidity holiday market. One suspects that silver will trade on the news as well and not technicals.

Silver has support at $18.3500 initially with possibly some weak long liquidation if it breaks. Behind this, we have support at $18.2500 and then the 200-day moving average at $18.0500.

Resistance lies intra-day at $18.4500 and then yesterday’s high at $18.6550.

OIL

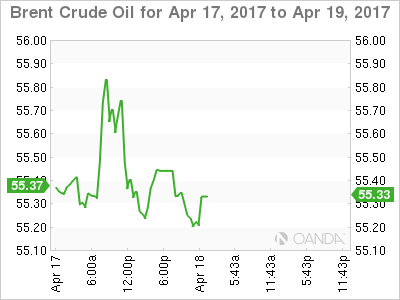

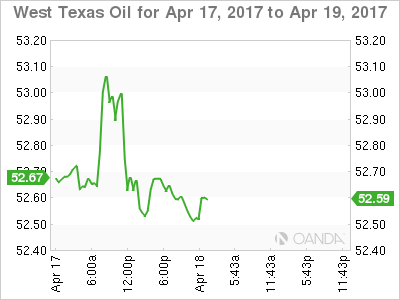

Both Brent Crude and WTI fell by approximately one percent overnight to leave both hovering just above short-term support in early Asian trading. In a holiday-thinned market, Treasury Secretary Mnuchin’s comments were the start of the rot. As the USD rallied across the board, this prompted short-term profit taking in crude as well.

Traders will be eyeing the $55.00 and $52.50 levels for Brent and WTI spot nervously this morning, with a break of either possibly prompting another wave of selling to flush out weak longs. As liquidity is still below average following the Easter break, short term moves could be exacerbated.

The above levels aside, Brent spot has support at $54.00, its 100-day moving average, with resistance at $56.00 and then $56.50.

WTI spot has support at $51.40, its 100-day moving average, with resistance at the $53.60 region.

Summary

Despite the comments by Mnuchin causing dollar strength, its effect may be temporary given the event risk around the world at the moment. After pausing for breath, precious metals may find support along with oil as the street trades off news headlines this week.