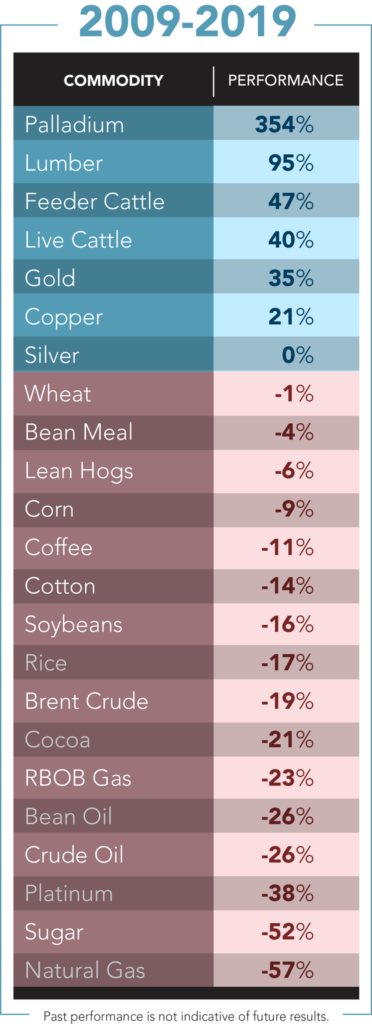

With just days left in the decade, we’re going to look back on commodities. Talk about a lost decade: 2010 through 2019 was, like, lost in the jungle lost, with just a quarter of the 23 markets we track above the zero line for the decade. Yikes.

The notable outlier to a bunch of red was palladium, which more than tripled over the decade. One of the main uses of palladium, it turns out, is in emissions scrubbing catalytic converters in car engines. Say what you will on climate change, but seems like more than a few investors have found a way to play the increase in regulations aimed at carbon emissions, with palladium now at close to a $400 premium to gold.

Elsewhere, the world’s addition to beef (and resultant launch of competing products such as Beyond Meat Inc (NASDAQ:BYND) can be seen in Cattle prices rising, while Gold was somewhat surprisingly positive (albeit only at and average of 3%/yr) given the huge rise in equity prices over the decade.

On the flip side, we can see the effect of fracking on the energy complex, as massive new amounts of supply have come online in the past decade, particularly here in the U.S.; while us keto/low carb folks might not be surprised to see sugar prices having been cut in half over the past 10 years.

All in all, it was a rather blah decade for commodities, with none of the huge outliers (save palladium) that long-term trend followers need to make careers on (crude, for example, had risen nearly 700% between 1998 and 2008). Let’s see what the 2020s bring:

Data note: This data was compiled between 12/31/2009 and 12/5/2019 using the XY1 contract specification on Bloomberg, which is a back-adjusted contract that simulates the continuous performance of each futures market’s front month contract, rolled on the option expiration date of that contract, and does take into account commissions or fill prices an investor would realize if they were to roll the contract in such a fashion month after month. These values are for illustrative purposes only and do not represent trading in any actual accounts.