- Copper hits another higher low

- Goldman Sachs analysts turn sour on battery metals

- Timing is everything: Copper bounces after Goldman’s latest forecast

- Bull markets rarely move in straight lines

- Levels to watch in copper market

Copper is the leader of the base metals that trade on the CME’s COMEX division and the London Metals Exchange. The red metal’s nickname 'Doctor Copper' is due to its ability to diagnose the overall health and well-being of the global economy. Copper’s price tends to fall when the global economy contracts and rise when it expands. Copper has a Ph.D. in economics.

Over the past decades, China has been the world’s leading copper consumer, while at the same time being its top producer.

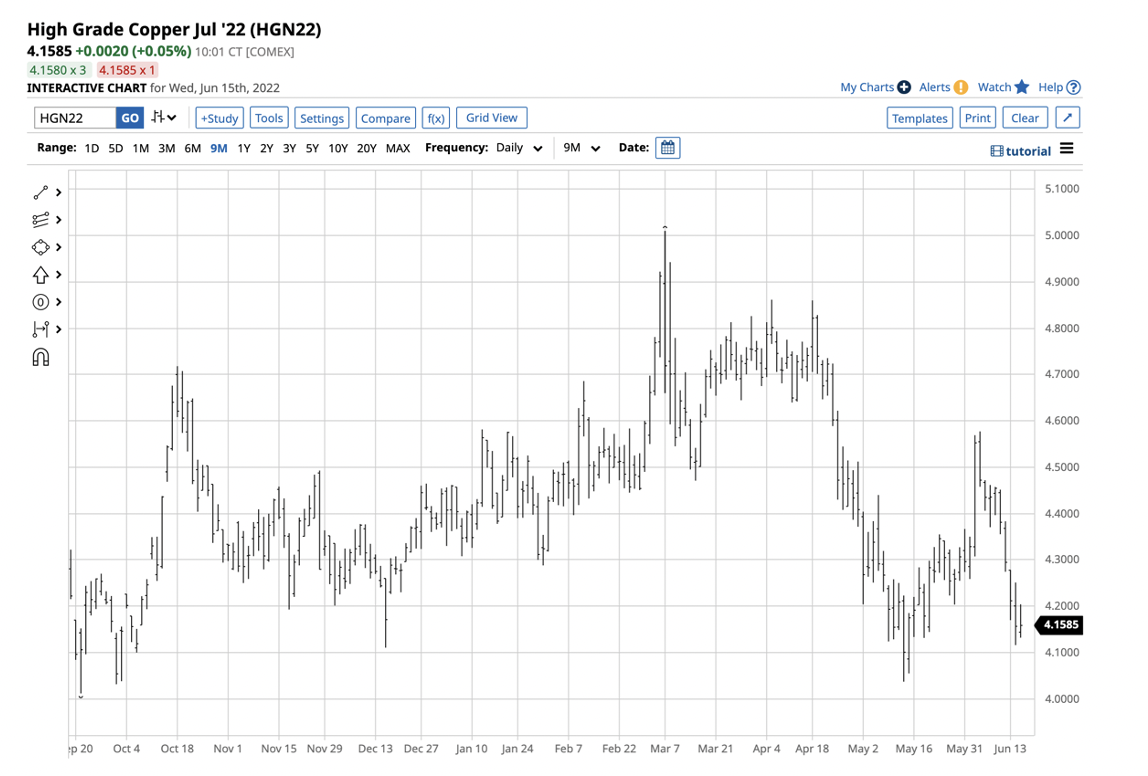

Copper rose to a new all-time high in early March 2022 when the price reached $5.01 per pound, surpassing the previous record peak at $4.8985 recorded in May 2021. The price of copper then fell after reaching the new milestone, but the price action was close to technical perfection as it stopped declining at another higher low.

Since March 2020, when copper fell to $2.0595 per pound, buying dips and corrections has been the optimal approach to the red base metal. The recent price action validates the long-term bullish trend, which remains intact in June 2022.

Copper Reaches Another Higher Low

The prospects for rising interest rates and a stronger dollar weighed on the copper market after the early May 2022 high at just over the $5 per pound level.

Source: Barchart

The chart highlights nearby COMEX copper future’s decline to $4.0560 per pound in early May, a drop of nearly $1 from the high. Meanwhile, copper stopped short of challenging a technical support level at the $3.98, August 2021 low. Copper’s price declined 18.8% after reaching $4.8985 in May 2021 and 18.7% from the March 2022 high at the early May 2022 low.

The higher low kept the bull market trend intact since the March 2020 low. However, the price was back near the $4.15 level on June 15, not far above the recent low.

Goldman Sachs Analysts Turn Sour On Battery Metals

In 2021, Goldman Sachs called copper “the new oil” because of its requirements for EVs, wind turbines, and other green energy initiatives. Goldman’s analysts forecast the price will rise to $15,000 per ton by 2025. The most recent high on LME three-month forwards was below the $11,000 level. At $15,000 per ton, COMEX copper futures will rise to over $6.80 per pound.

Meanwhile, Wall Street’s top investment bank recently issued a bearish warning on battery metals, writing the bull markets in lithium, nickel, and cobalt have peaked. The report did not mention copper, but the red metal is another critical component in green technologies.

Timing Is Everything: Copper Bounces After Goldman’s Latest Forecast

Goldman’s latest report came out on June 1, after copper futures reached their latest higher low.

Source: Barchart

The chart shows the July futures contract’s decline to $4.0370 on May 12. Since then, the leading base metal recovered, reaching a high of $4.5770 on June 3, when it ran out of upside steam.

Bull Markets Rarely Move In Straight Lines

Bull markets can rise to illogical, unreasonable, and irrational levels, and corrections can be sudden and brutal.

Since reaching a low of $2.0595 per pound in March 2020, copper’s technical price action has been almost picture-perfect. The metal has experienced ups and downs, but the corrections have held the critical support levels while making a series of new all-time highs. In mid-June 2022, copper continues to digest its latest new peak and is consolidating above the $4 level and above the August 2021 low.

If Goldman Sachs is correct, we should expect a continuation of the pattern of higher lows and higher all-time peaks. Buying dips in the copper market could be the optimal approach for investors and traders looking to participate in the volatile copper market.

Levels To Watch In Copper Market

The present U.S. administration doubled down on its energy policy, which is bullish for the copper market. President Joe Biden recently said that high oil prices would foster an accelerated shift away from dependence on fossil fuels to alternative and renewable energy. Goldman Sachs pointed out that copper is the critical metal for decarbonization. With many companies taking net-zero carbon emission pledges, the demand for copper will continue to grow. Moreover, it takes eight to 10 years to bring new production on stream, which will create supply deficits.

Source: LME/Kitco

The five-year chart of London Metal Exchange stockpiles highlights the pattern of lower highs and lower lows that support supply shortages over the coming months and years.

Source: Barchart

The chart shows the current technical support levels at $4.0560 and $3.98 per pound on the nearby COMEX futures contract. Technical resistance stands at the March 2022 high of $5.01.

Copper’s bull market remains intact in mid-June 2022. The most direct investment in the copper market is via the LME forwards or the COMEX futures. The United States Copper Index Fund (NYSE:CPER) and iPath® Series B Bloomberg Copper Subindex Total Return ETN (NYSE:JJC) products track copper’s price. Copper mining companies tend to provide leveraged exposure to the metal as they often outperform the price action on a percentage basis during rallies and underperform during price corrections. Freeport-McMoran Copper & Gold (NYSE:FCX) and Southern Copper Corporation (NYSE:SCCO) are leading copper products that have risen significantly from the March 2020 lows.

While the odds favor higher highs in copper’s price, the road to the upside will likely be far from a straight line. I view the $3.98 level as a significant downside support.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »