After analyzing the current geo-political scenario in perspective of the further directional moves by the commodities prices which are likely to remain on the bearish path as the traders are expecting a stimulus from China this year.

Undoubtedly, any stimulus does not generate fresh demand while the geo-political situation shows heightened uncertainty surrounding an economic halt for the commodity prices due to policy changes by the central banks under the influence of their political heads.

Having a look at the current movements of the prices of different commodities I find that these price halts look ready to deepen further after January 20 when President-elect Donald Trump will join.

Undoubtedly, his preferences will influence his policies to deal with interest rates and tariffs on import fronts to make the US currency stronger, which could generate jolting moves in precious metals and energy prices shortly.

If the markets find his action too hard to generate fresh demand due to higher interest rates, not only the commodity markets could remain volatile but the global stock markets could see an economic upheaval in the days ahead as Donald Trump has avoided inviting the heads of some developing countries which are the potential economic hub for the US.

On the other hand, higher inflation around the world could keep the global central banks to remain too strict to keep the interest rates on the higher side which could generate more economic uncertainty for fetching fresh investments.

I find that the traders must remain extremely vigilant during the first six months of this year while concise their final opinion to invest as these economic jolts could lead to a recession-like situation if the current geo-political problems are not resolved properly.

Let’s have a look at the price movements of the precious metal and energy prices since the last rate cut by the Federal Reserve.

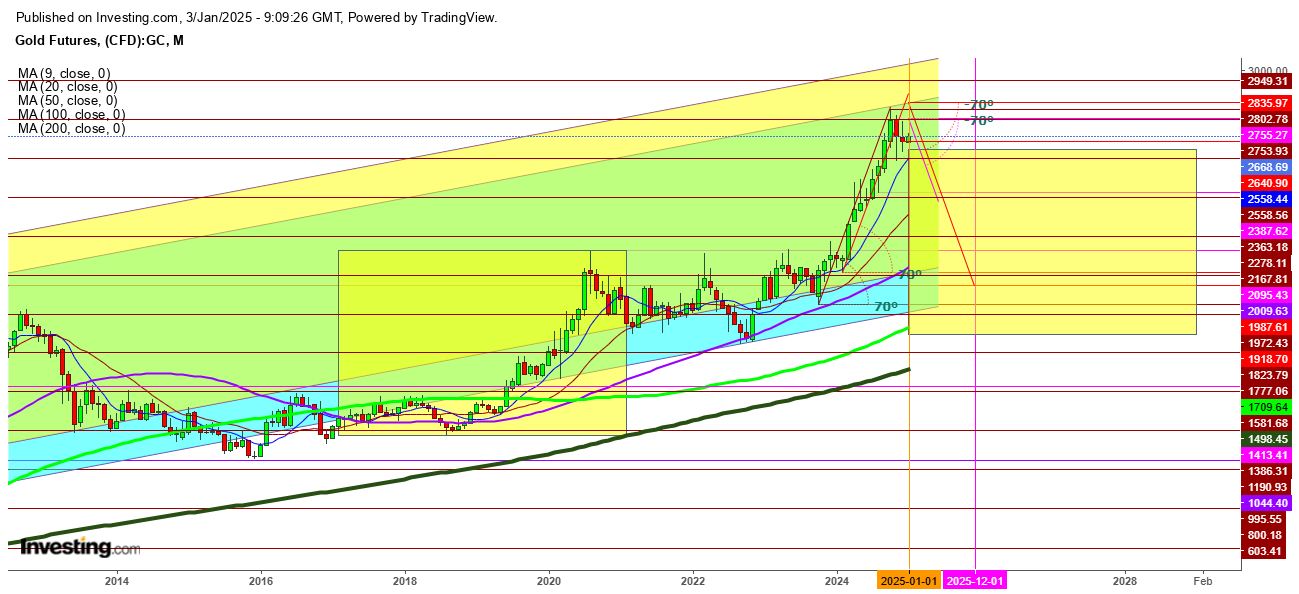

Precious Metal Prices

On analyzing the movements of the goldand silver futures during the last few weeks I find that both could remain under bearish pressure after testing a peak at $2828 on Oct. 30, 2024, due to heightened global uncertainty amid hopes for more rate cuts by the Fed during the year 2025.

Secondly, silver futures are showing consistent exhaustion since they hit a high at $35.194 on Oct. 30, 2024, despite growing demand. This shows a bearish pressure could continue amid expectations for the final views of Donald Trump on interest rate cuts in the near future.

On the other hand, broader crypto markets were battered by a wave of selling during the last week of 2024 as the traders locked in a stellar run of profits through the year. However, some caution also crept into the markets, particularly amid the expectation that US interest rates will fall at a slower pace in 2025.

Undoubtedly, the prospect of friendlier regulations under Trump kept crypto markets relatively upbeat, and Bitcoin also staged a recovery from its year-end lows.

On the other hand, fresh investments could turn more attractive in cryptocurrencies in comparison to precious metals which used to be the darling of the markets till 2024 as the way of a safe haven.

Now, the friendlier regulations under Trump could lead to the turn of the flow of money from precious metals to cryptocurrencies.

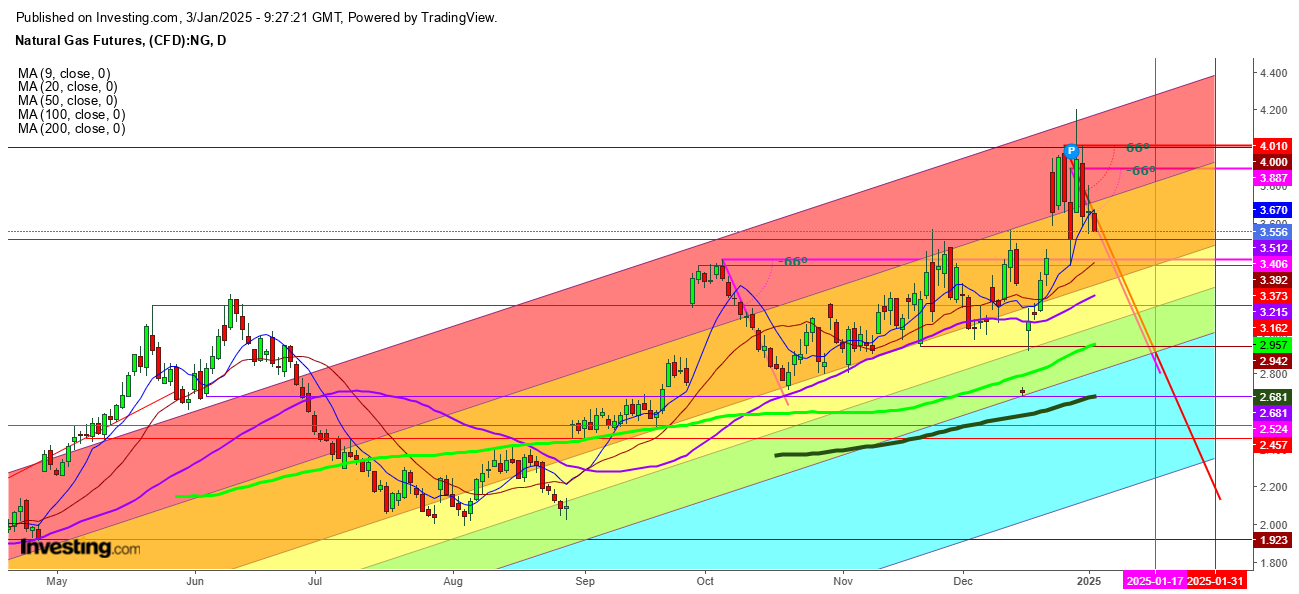

Energy Prices

On analyzing the price movements of the natural gas and the WTI Crude oil futures, I find that the WTI Crude Oil futures are continuously on a sliding path after testing a peak at $132.62 during the first week of Mar. 2022. Now, this could remain under bearish pressure due to the formation of a super bearish crossover with a downward crossing by the 50 DMA and 100 DMA below the 200 DMA in the weekly chart confirming a selling spree to continue as the WTI Crude oil futures are trading below the 50 DMA, and just hold above the 9 DMA.

Secondly, natural gas futures are under bearish pressure after testing a peak at $4.207 on Dec. 30, 2024. Despite growing volatility overall trend could remain bearish as any upward move will attract big bears as the fossil fuel could be on the priority list of Donald Trump once again like it was during his last tenure from 2017 to 2021.

Conclusion: I find that the surging fear of a severe economic situation revolves around President-elect Donald Trump. If they are not tackled sophisticatedly by the Trump administration shortly, fear of economic recession could prevail.

Disclaimer: This analysis is based on observations and does not constitute investment advice. Readers are encouraged to make investment decisions on commodities or cryptocurrencies at their discretion.