- Markets are bracing for a key CPI report today.

- This data comes amid growing recession fears after weak labor market data.

- A lower-than-expected print could drive a stock rally, but a higher-than-expected number may stoke recession fears.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

In recent weeks, the market narrative has shifted. Concerns over a potential recession have overtaken inflation fears, as the labor market shows signs of weakening.

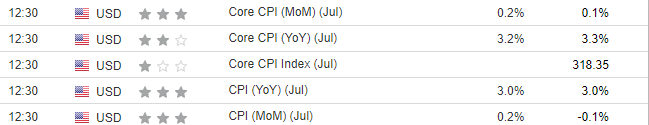

After a lower-than-expected PPI release yesterday, today's inflation data is expected to show a modest 0.1% month-on-month increase in both CPI and Core CPI.

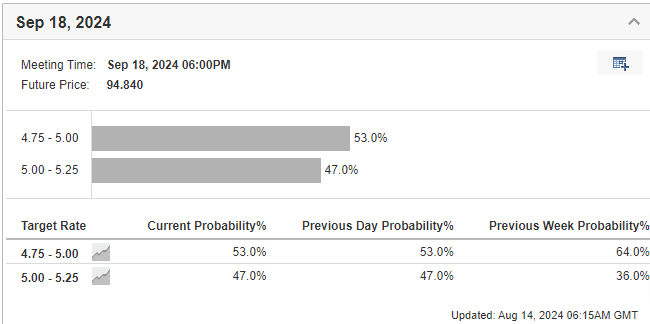

Yesterday's lower-than-expected PPI figure may signal a similar trend in today's CPI data. Given the recent trends, the market is pricing in a 50-point reduction in September.

However, I believe the Fed, still focused on taming inflation, may choose a more balanced approach, opting for a 25 bp rate cut on September 18.

How Could CPI Data Move Markets?

CPI data could drive markets in several ways:

If inflation comes in lower than expected:

- Equities might rally.

- Bond yields could fall.

- Small-cap stocks may outperform large-cap stocks.

- The dollar could weaken against the euro.

Conversely, higher-than-expected inflation would likely have the opposite effect.

The CPI report will be closely watched, but it's important to remember that the market's focus is increasingly shifting toward recession concerns.

While inflation remains a key issue, the potential for a recession adds another layer of complexity. Higher-than-expected inflation could limit the Fed's ability to ease monetary policy, which would weigh on the economy.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month.

Try InvestingPro today and take your investing game to the next level.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.