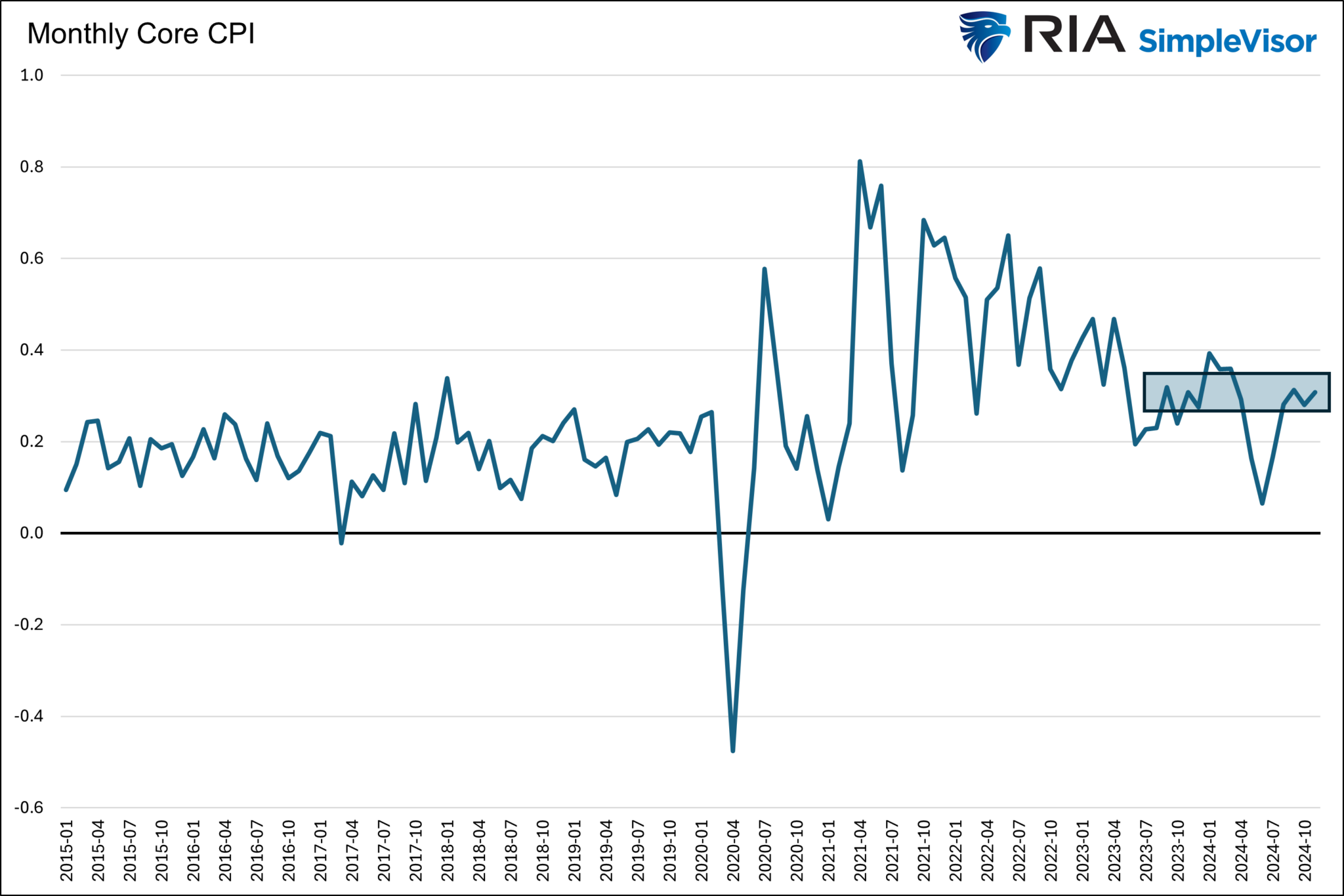

Wednesday's CPI report was seemingly the last hurdle for the Fed to cut interest rates. With the CPI index matching Wall Street forecasts, the Fed Funds futures market now implies a 97% chance the Fed will cut rates next Wednesday. The data was OK but elicits fears that the downward price progress has stalled.

The CPI rate was 0.3%, a tenth higher than last month. The year-over-year rate rose from 2.6% to 2.7%. Core CPI was +0.3% monthly and +3.3% annually. The graph below shows that the Core CPI (excluding food and energy) has run at .3% monthly for most of the last year after falling precipitously over the prior two years.

While the trend appears to be stalling, some data leads us to believe it is only a matter of time before it declines. For one, CPI services, accounting for about two-thirds of economic growth, continue to decline. Before the pandemic, CPI core services averaged +0.3% monthly. The current reading is also +0.3%, and unlike CPI, it continues to trend lower.

Moreover, as we have written several times, CPI less shelter prices only run at 1.6% annually. The mixed data allows inflation bulls and bears to make their cases. Time will tell which side proves correct.

What To Watch Today

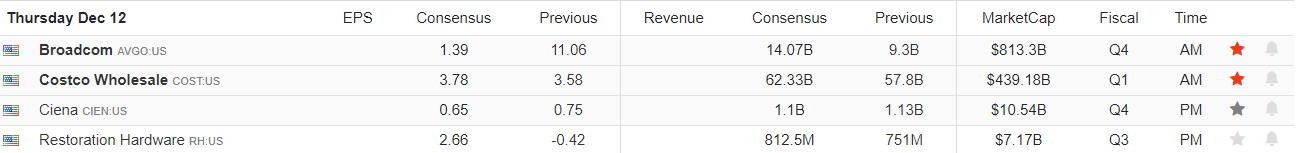

Earnings

Economy

Market Trading Update

Yesterday, we stated that sloppy trading in the market was expected as portfolio rebalancing continues. While the market rallied somewhat yesterday, we are still rebalancing and distributions through the end of the week. Interestingly, I reviewed our commentary from November 8th, discussing Trump’s election and its potential impact on small and mid-capitalization companies. To wit:

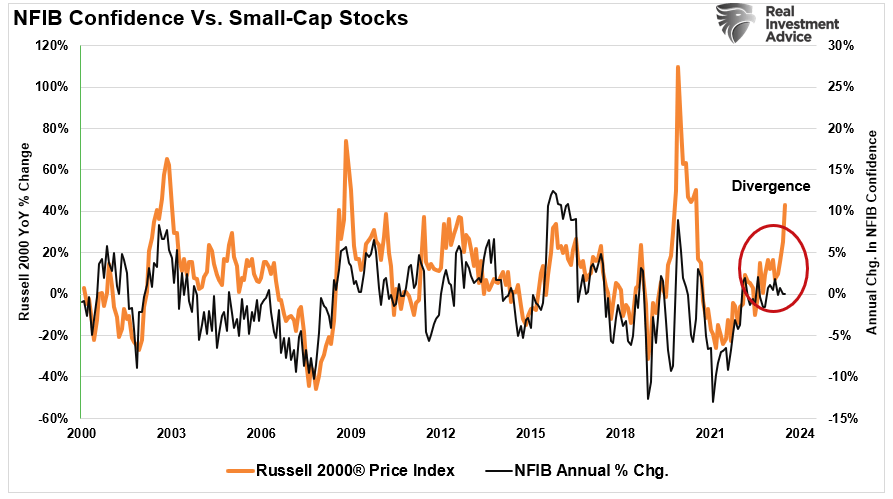

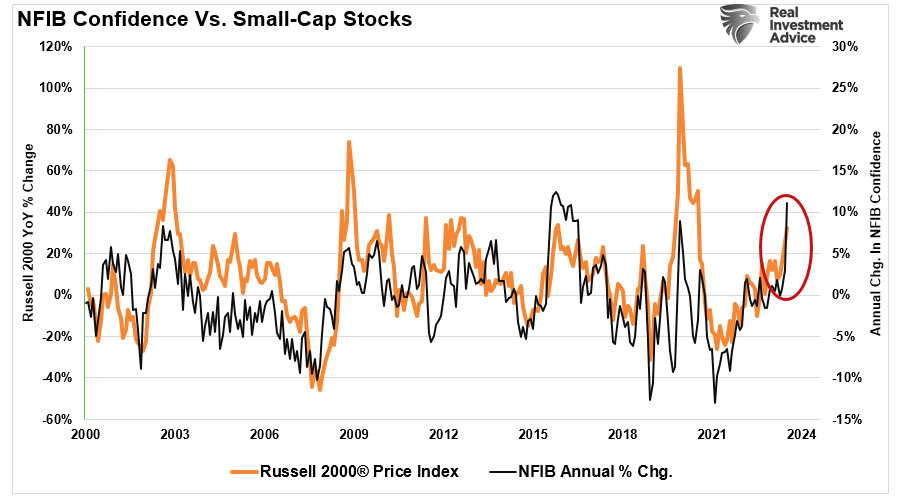

“Notably, the massive surge in small/mid-cap stocks was the most compelling. The chart below shows a very high correlation between small/mid-cap stocks’ annual rate of change and the NFIB small business confidence index. Since business owners tend to lean conservative, favoring policies that promote economic growth, reduced regulations, and tax cuts, Trump’s election supports business owners.

We suspect that the next iteration of the NFIB index will be a catchup move fueled by an explosion of business owners’ confidence. This should lead to increases in CapEx spending, employment, and wage growth.“

The bolded sentence is the most important. This week, the National Federation of Independent (LON:IOG) Business released the first survey following the election, and the surge in confidence was enormous. Investors had pegged the election’s outcome correctly, and the chase into small and capitalization stocks was justified.

Going forward, the question is whether the surge in optimism will translate into more substantial earnings growth for those companies, which has been a problem over the last few years.

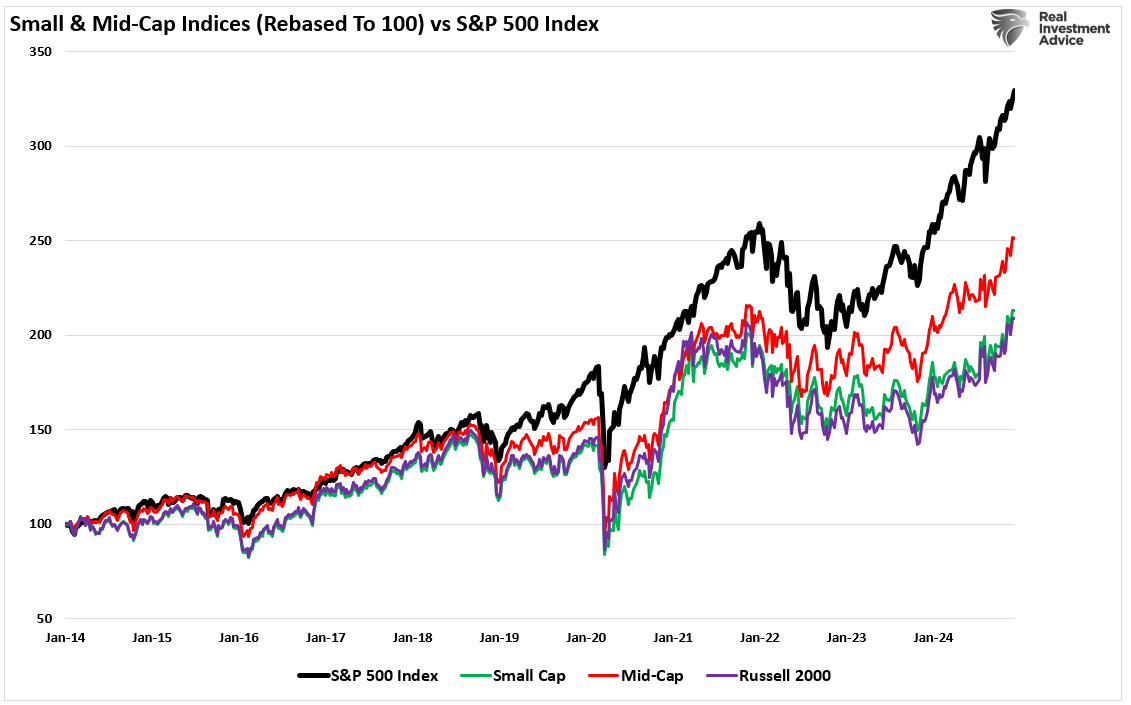

While we currently have a position in the iShares Russell 2000 ETF (NYSE:IWM), we remain somewhat concerned about the risk in small/mid companies from actual earnings growth, profitability, and debt issues. Furthermore, the performance of IWM has been disappointing relative to large-cap stocks, which has been a function of earnings growth.

There is no expectation that this will change over the next few years as the economy transitions to more technological development and increased productivity.

IWM could perform heading into 2025 but may become more challenged later. We will trade it accordingly.

Paulsen’s Walmart Recession Alert

Famed investor James Paulsen has warned his Substack subscribers of a Walmart (NYSE:WMT) Recession Alert. We have noted several times how well Walmart shares are doing, but its valuations are getting extreme for a relatively low-growth entity. For instance, in Walmart Shares: Great Fundamentals But At A Frothy Price, we wrote:

As its latest earnings report reminded us, Walmart is doing very well financially. Furthermore, its share price has surged, reflecting the company’s health. While the price of Walmart shares should increase with its fundamentals, we must ask if the stock performance is commensurate with earnings. This is where technical analysis can look beyond fundamental analysis and play an important risk management role for shareholders.

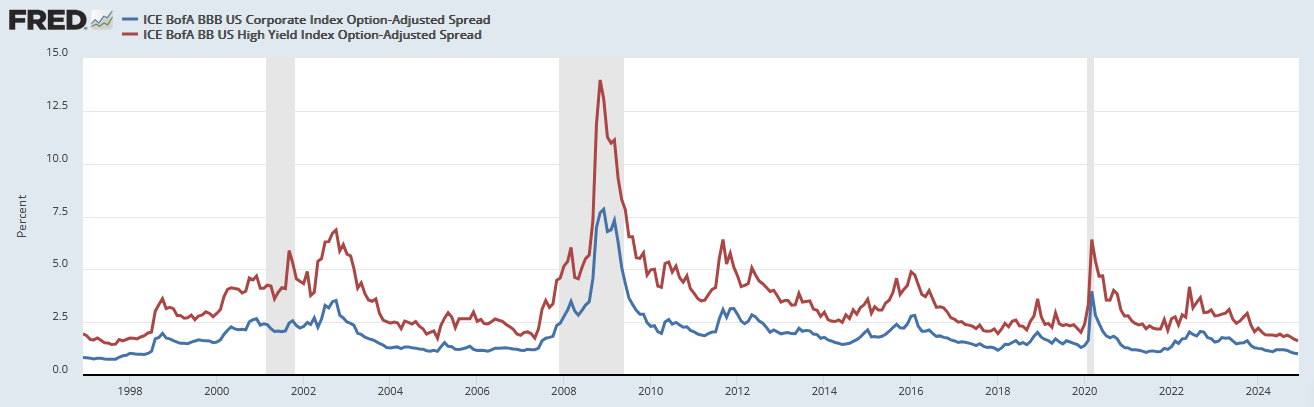

Paulsen finds it odd that Walmart is doing so well while luxury retailer’s shares are primarily flat for the year. He states that investors are favoring a defensive retailer (Walmart) that should do relatively better than luxury retailers in a recession. Moreover, he thinks it strange that corporate bond yield premiums to Treasuries (credit spreads) are at their tightest levels in years. If investors are worried about a recession, credit spreads on investment grade and junk debt should widen. As shown below, investment grade (BBB) and junk (BB) corporate bond spreads are at their tightest levels in almost thirty years.

MicroStrategy And Its Convertible Debt Scheme

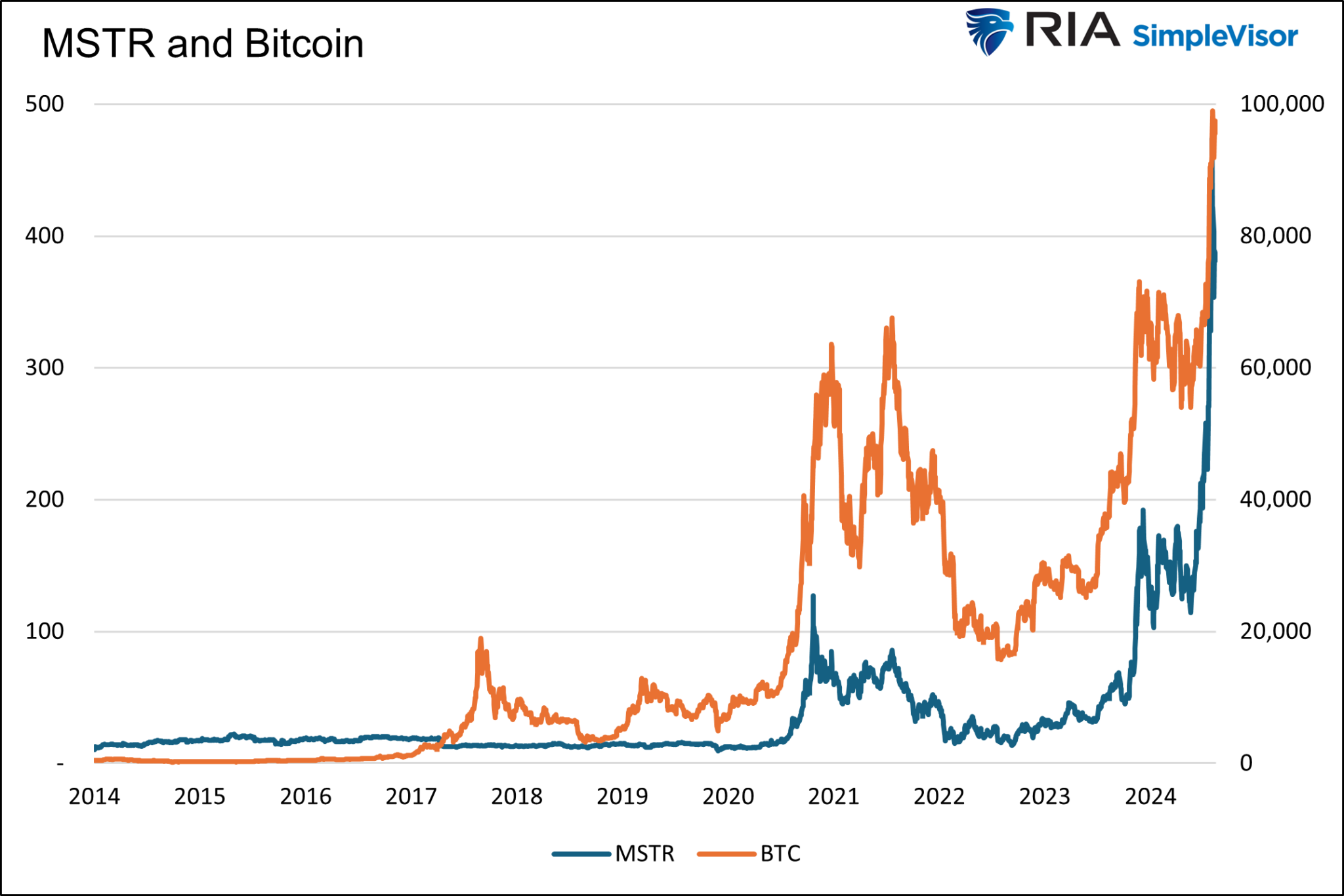

We think MicroStrategy Incorporated (NASDAQ:MSTR) is preying on investors. They are pumping up optimism on Bitcoin to drive higher volatility in their stock. Doing so allows them to raise funds and add to their Bitcoin holdings. Its convertible funding strategy is legal, but the risks to its shareholders and bondholders are much more significant than many of its investors appreciate.

The problem with such a leveraged scheme is that the company is putting all its eggs into Bitcoin. A sharp decline in Bitcoin will likely accompany the collapse of MicroStrategy!

READ MORE…

Tweet of the Day