Recently the markets have been awash with talk about crude oil seemingly having discovered a bottom to the recent decline. However, the supply fundamentals remain unchanged, and despite the talk of re-leveraging, there is only one way for crude prices to head and that’s down.

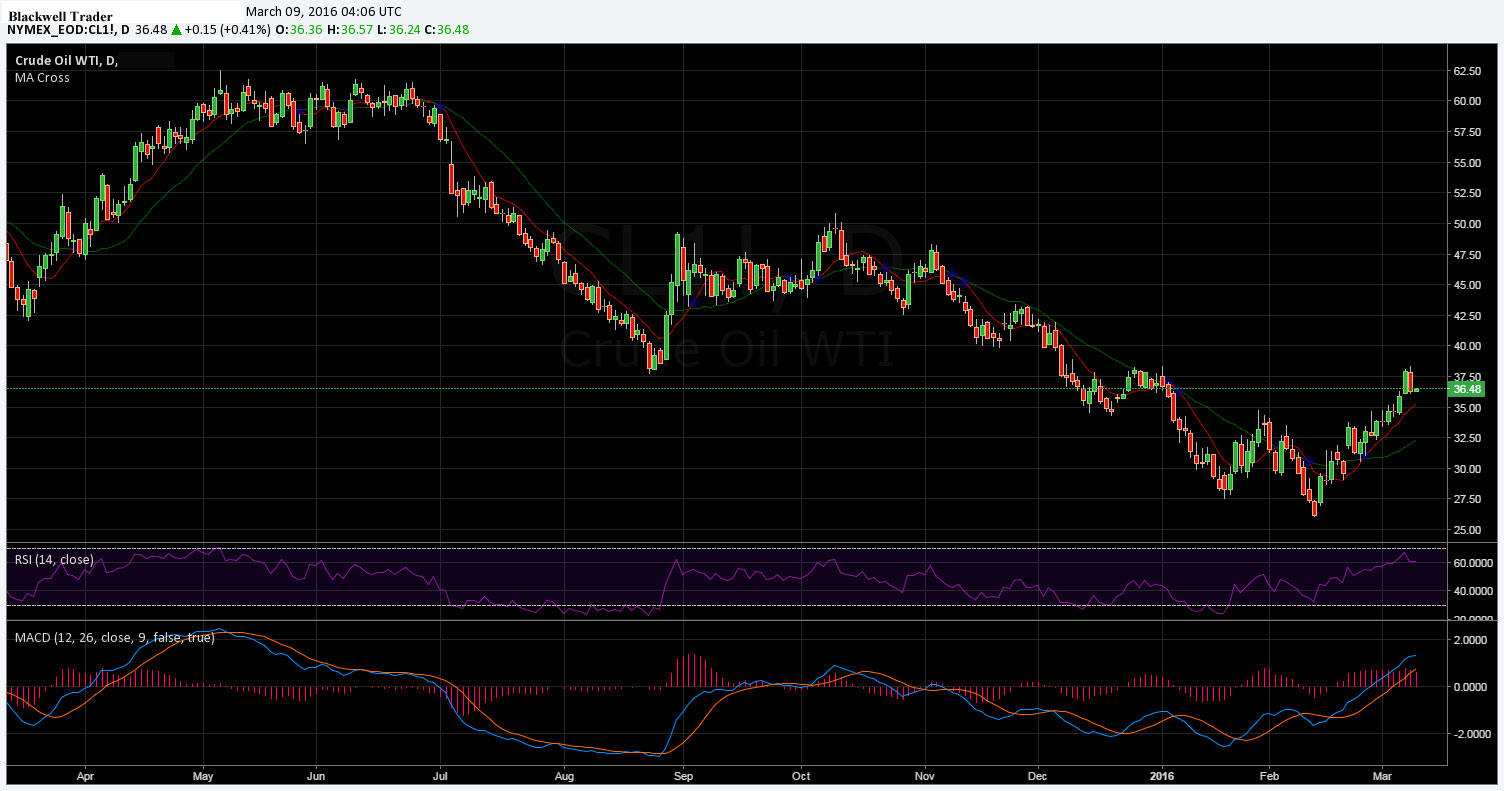

The past few weeks have seen the price of crude oil (WTI) surging amid talks of production capacity constraints and re-leveraging leading to inflation for commodity prices. Subsequently, prices have reacted strongly to the rhetoric and the past few sessions have seen prices rally to a high of $38.37 a barrel.

Much of the upward price pressure in crude oil markets has been driven by the initial phase in rebalancing, with a range of oil supply curtailments evident in both the US Shale Industry and amongst OPEC producers. However, the realignment process has largely lost out to the increasingly robust eurozone manufacturing data, as well as a significant level of credit growth evident in China’s January figures. Subsequently, there is a view that much of the world is now starting to re-leverage which is likely to flow on to growth and ultimately demand for the black gold.

However, these short term market corrections do nothing to help the plight of the needed supply rebalancing. The crude oil supply glut is still a significant problem within the industry and the only way to clear that imbalance is for lower prices and some significant hard ship. Although the current world economic dynamics may lend itself to taking a short term bullish view on crude, ultimately any rise is not sustainable.

Subsequently, we expect crude oil to continue its rebalancing efforts throughout the majority of 2016, regardless of any short term price moves. It is estimated that the market will not reach a new, stable equilibrium, until Q1, 2017. At that point it is likely that some significant upward pressure on prices will occur. Historically, it is clear that a sustainable rally can only be created through by a physical deficit in the crude markets. And until the rebalancing is complete, that is an unlikely prospect.

The state of the Chinese economy is also a concern for future oil prices in the broader economic sense. There is continuing deterioration within Chinese Manufacturing, subsequently supported by much of the easing measures undertaken by the PBOC. In addition, China also has some significant credit constraints which likely predisposes it to consider fiscal policy over any form of monetary stimulus. Subsequently, the uncertainty component of any ongoing shocks to the Chinese economy is a real risk to both crude and metals demand.

Ultimately, especially given the level of uncertainty in China, re-leveraging and reflation will not support crude oil prices in the long run. Genuine price rallies can only be sustained by a physical deficit and that means a continuing of the rebalancing process. Subsequently, expect the pain to remain until we genuinely see supply shiftingthereby moving price towards new and stable equilibrium.