View crude oil fundamentals at face value reveals a product that has overwhelming supply and solid demand. Crude oil stocks are currently at 80-year highs, and are is no sign that they are poised to decline. Rig counts have been declining which has historically been a telltale sign that prices are poised to rally, but production has not been decreasing. The catalyst that will allow prices to move higher are declining production and imports, but a stronger dollar will likely bring headwinds.

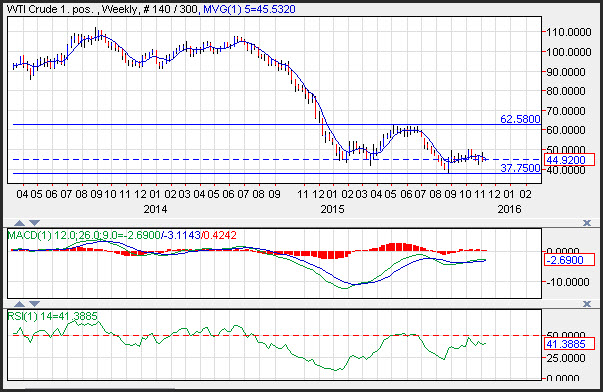

Crude oil prices have been trading in a $25 per barrel range for all of 2015, and this range will likely persist for the foreseeable future. Traders are aware that stocks are well above the most recent highs and that the trajectory of petroleum stock declines are subdued. Despite this knowledge prices seem to be support above $40, which could be a function of 10% year over year demand for distillates.

November is maintenance season, where refiners prepare for the winter season and change over production after cranking out large sums of summer grade gasoline. During this period, refiners reduce their draw on crude oil and pull stocks from gasoline and diesel made during the summer. This allows crude oil stocks to build until winter demand kicks in.

Production in the latest month actually increased according to the most recent estimate by the Energy Information administration. According to the EIA, U.S. production increased by 48K per day in the week ending October 30. This comes despite a decline in the Baker Hughes (N:BHI) drilling index which saw a decline of 6-oil rigs in the latest week which was the 10th straight week of rig count declines. The number of oil rigs are now at the lowest point since mid-2010. If production is increasing, there are at least some producers who believe that $44 dollar crude oil is profitable.

With rigs declining and demand increasing one might believe that prices could have a chance to dent the large surplus of crude oil stocks. Unfortunately, a dollar headwinds could keep prices capped. Since crude oil prices are quoted in U.S. dollars, a rise in the greenback makes crude oil more expensive in other currencies. This increase in expense needs to be countered by a decline in prices for demand to remain constant. Friday’s stronger than expected jobs report boosted the greenback and higher yields are likely to continue to help the dollar remain in favor. A stronger dollar could continue to cap crude oil prices allowing a $62-$37 range to hold for another year.