Editor's Note: this article offers a counterpoint to the opinion piece: Crypto: 3 reasons to be bearish in 2022

No one knows what the future holds exactly, but we can use past trends and experience to forecast what is likely to happen. Here are three reasons why I am bullish about crypto in 2022 and why you should be too!

1 — Bitcoin is Finite & Scarce

Zoom out. Prices will go up and down in any market that has traders and liquidity. Bitcoin went from $30,000 to $63,000 to $29,800 to $67,500 to $35,000 in the past year, according to Messari data. It will keep going up and down in the near term.

A question I am often asked by newcomers is “Where will the price be in one week?” A more important question to me is, where will the price be in five years? What about 10 or 20 years?

There will only be 21 million Bitcoin ever owned. About 3.7 million of those are considered lost, so the actual number is closer to 17.3 million.

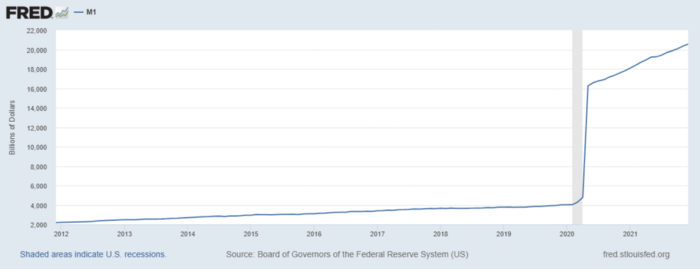

As long as central banks have no statutory restraints on the amount of money they can print, they have an unlimited ability to produce fiat currency. We have already seen the results this can create. The chart below illustrates how much the M1 money supply has changed over the last decade.

Should these fiat currencies continue to depreciate, market observers should expect bitcoin to increase in value over the long-term.

In other words, if bitcoin’s demand and supply remain steady, the devaluation of fiat will continue to drive the digital currency’s price.

2 — Institutional Demand — Are Institutions Buying?

Yes they are.

It’s hard to believe, but it all happened within a single year. In 2021, companies such as Tesla (NASDAQ:TSLA), Square (NYSE:SQ) and MicroStrategy (NASDAQ:MSTR), as well as the nation state of El Salvador, bought bitcoin to hold on their balance sheet. Check out BitcoinTreasuries.net for a more complete list.

In the U.S., two bitcoin Futures Exchange Traded Funds (ETFs) were approved by the U.S. Securities and Exchange Commission.

In Canada, two bitcoin Spot ETFs were approved.

The mayors of New York City and Miami announced that they will receive their paychecks in the world’s most prominent digital currency.

Many NFL players did this. Starting with Russell Okung, this then followed with the likes of Tom Brady, Saquon Barkley and many others.

Institutional demand has resulted in a weekly net positive inflow into bitcoin and cryptocurrencies almost every week in the past year, which CoinShares details here.

There were many other events across the world that are positive for bitcoin’s price action long-term, which could be the subject of an entire blog.

Here are some predictions from the El Salvador President Nayib Bukele:

Will other nations buy bitcoin? Will they be a small country like Tonga, or a Top 10 world economy like Brazil? What will be the result if they do?

3-Regulation, Regulation, Regulation

Wait, what? This is usually not what excites crypto investors.

But actually, regulatory uncertainty is a major barrier to institutional adoption and major inflows into bitcoin and other digital assets. In contrast, regulatory clarity would open up a lot of doors.

The Congressional Blockchain Caucus is growing, and it is one of the very few bipartisan movements in Washington, D.C. They clearly state in their website above that they are seeking to create a “light touch” environment with crypto legislation. This is crucial to pro-Bitcoin and crypto regulation in the U.S., and it’s hard not to be bullish on this.

The Ace in the Hole

This could be considered a fourth reason, but this is really under the heading of regulation.

I will also bring up another cryptocurrency — regardless of whether you are a fan of XRP or not, this is important. The SEC lawsuit with Ripple has been ongoing for quite some time. Should this resolve either way, it would be directly bullish for XRP.

This would mean relisting on major U.S. exchanges. XRP has not seen major price increases during the recent bull market. If exchanges decide to relist the digital token, it could experience significant upside.

Again, either way it goes, this will bring further precedent and regulatory clarity, and it may provide a roadmap to many ERC-20 tokens on Ethereum and BEP-20 tokens on the Binance Smart Chain.

2022 and Beyond

Once again, I reiterate that past performance does not guarantee future results.

Keeping that in mind, the above are some of the positive factors I see that are long-term bullish.

I am also very bullish on:

- Cross-chain projects like Dot

- Larger more stable DeFi staking options like Nexo Finance (NEXO) and Pancake Swap (CAKE).

- Ethereum Layer Two gas-fee solutions like MATIC

- Some high quality blockchain gaming projects like Star Atlas and Pizza NFT.

Could there be further short-term pain? Yes, in fact I am torn, because I believe there is a good chance there will be. But again, I could be wrong.

Great investments go up long-term, and the best time to buy them is when they are less valuable. Let’s see if larger institutions with the ability to move the market agree with me.