After a short-lived "crypto winter" during 2022 that saw numerous exchanges (Celsius, Voyager, FTX, BlockFi) collapse in dramatic fashion, Bitcoin is now back with a vengeance. Year-to-date (YTD), as of May 2nd the price of Bitcoin in U.S. dollars is up nearly 72%.

The same can't be said for ETF investors, who as a result of the SEC's continued prohibition on spot Bitcoin ETFs have been forced to rely on Bitcoin futures ETFs or close-ended funds. For example, the popular ProShares Bitcoin Strategy ETF (BITO) is only up around 57% YTD. On the other hand, the Grayscale Bitcoin Trust (GBTC) is up over 94% YTD, despite still technically trading at a massive discount to net asset value (NAV) of around 39%.

Still, ETF investors looking for crypto exposure have some developments on the horizon to look forward to. On April 6th, 2023, ProShares filed a prospectus for a 2x leveraged Bitcoin ETF, the ProShares Ultra Bitcoin Strategy ETF. Let's take a look at this upcoming ETF.

Why leverage Bitcoin?

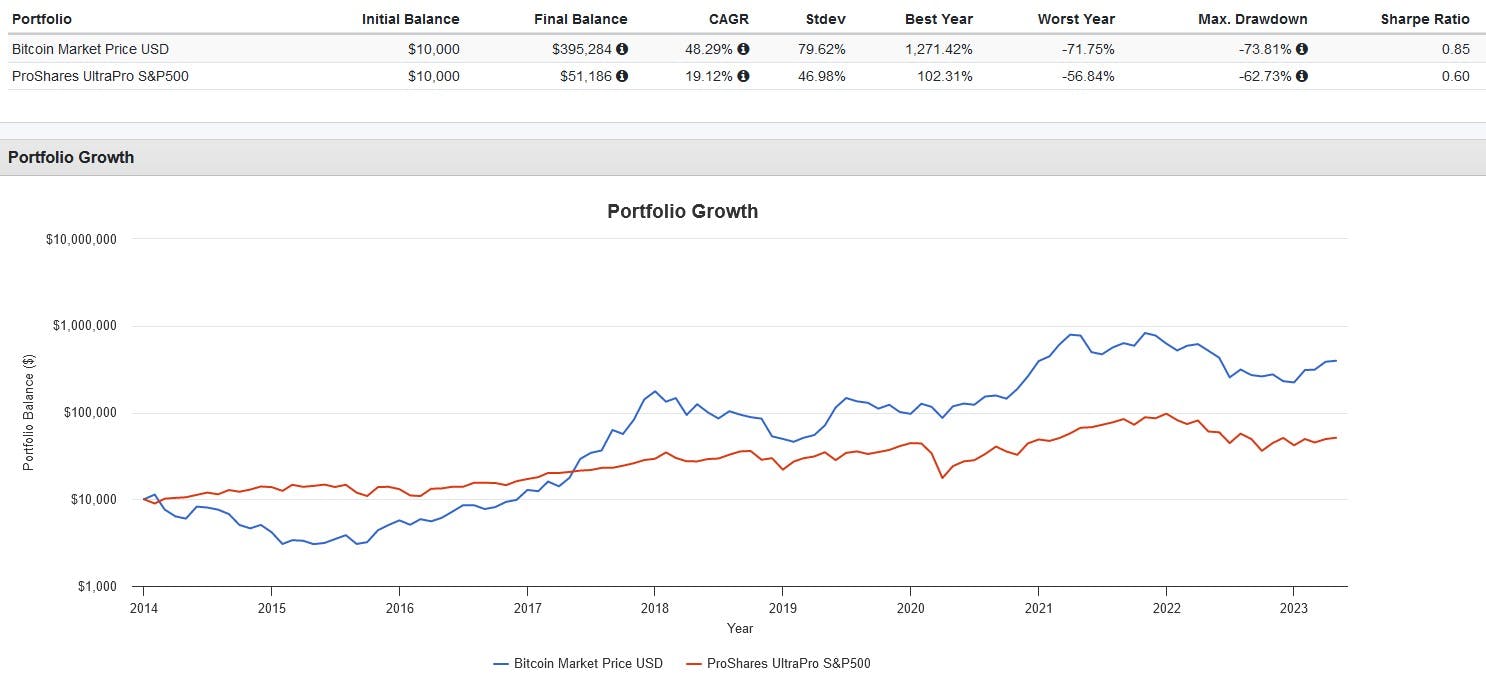

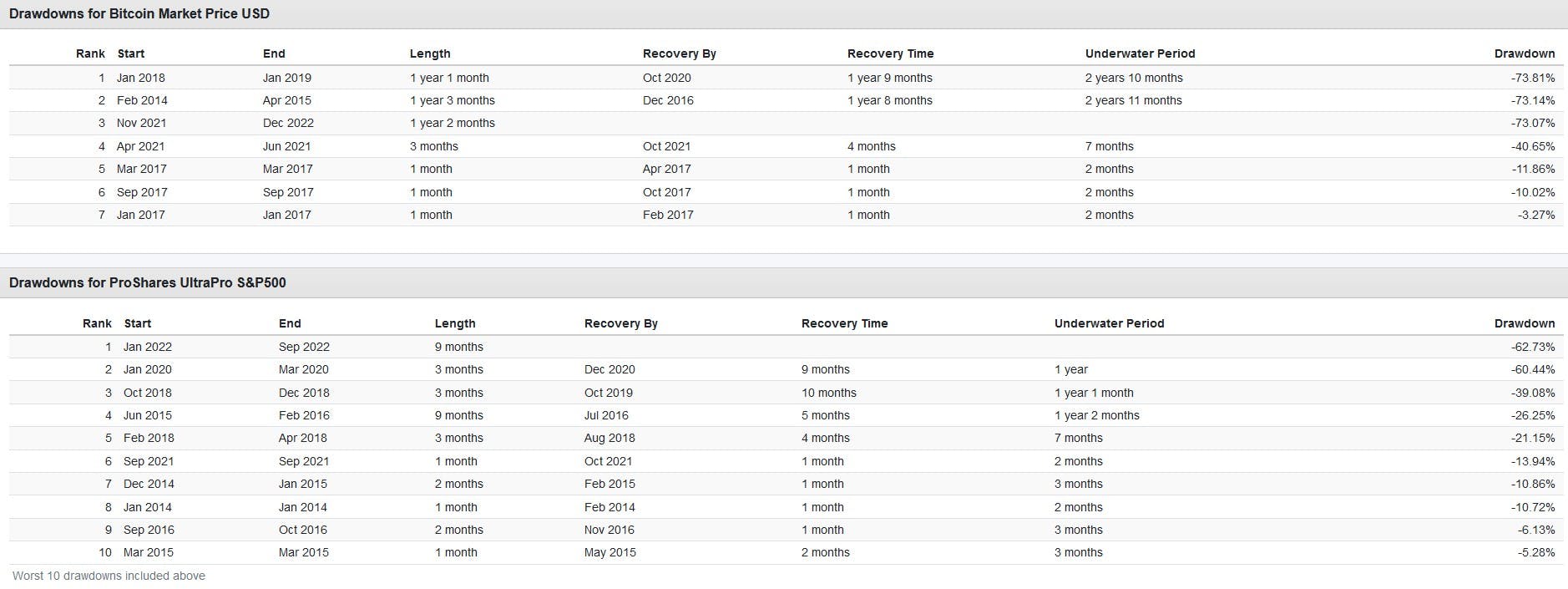

Bitcoin is highly volatile, capable of large intra-day swings in both directions. Case in point, from January 2014 to the present Bitcoin has actually been more volatile than a 3x leveraged ETF in the form of the popular ProShares UltraPro S&P 500 (UPRO).

It has also endured numerous prolonged and deep drawdowns. As noted earlier, the Bitcoin community calls these "Crypto Winters". The deepest one was from January 2018 to October 2020, where an investor would have been underwater for 2 years and 10 months, suffering a 73.81% drawdown.

A 2x leveraged ETF like the upcoming ProShares ETF is therefore intended to be a short-term holding for day traders and swing traders. Buying and holding such an ETF for longer periods would be insanely risky, especially given that the 2x leverage target is only accurate for a single day.

ProShares sums this risk up succinctly:

"The return of the Fund for periods longer than a single day will be the result of its return for each day compounded over the period. The Fund’s returns for periods longer than a single day will very likely differ in amount, and possibly even direction, from the Fund’s stated multiple (2x) times the return of the Index for the same period. For periods longer than a single day, the Fund will lose money if the Index’s performance is flat, and it is possible that the Fund will lose money even if the level of the Index falls. Longer holding periods, higher Index volatility, and greater leveraged exposure each exacerbate the impact of compounding on an investor’s returns."

There's also the problem of a complete fund wipeout. Unlike the S&P 500 index, Bitcoin does not have circuit breakers built in to halt trading if large intra-day drops occurred. If the price of the Bitcoin futures tracked by the ETF falls by 50% in a day, the ETF and investors in it could be badly hurt.

Again, ProShares sums this risk up succinctly:

"The use of such leverage increases the risk of a total loss of an investor’s investment. For example, because the Fund includes a multiplier of two times (2x) the Index, a single day movement in the Index approaching -80% at any point in the day could result in the total loss of an investor’s investment if that movement is contrary to the investment objective of the Fund, even if the Index subsequently moves in an opposite direction, eliminating all or a portion of the earlier movement."

How the ETF works

The ProShares Ultra Bitcoin Strategy ETF will target a daily 2x return benchmarked to the return of the S&P CME Bitcoin Futures Index (SPBTCFUE). It is important to note that like its unleveraged counterpart BITO, this new ETF does not invest directly in Bitcoin. As of right now, spot Bitcoin ETFs do not exist in the U.S., and there is an ongoing legal battle with the SEC over it.

Let's look at the S&P CME Bitcoin Futures Index. This index measures the performance of the front-month bitcoin futures contract trading on the Chicago Mercantile Exchange, rolled monthly. The futures provide the leveraged exposure needed by the ETF. As with all futures-based ETFs, contango and backwardation are possible risks/benefits to be aware of.

As collateral for the futures, the ETF will hold a portfolio of money market instruments, which can consist of U.S. Treasury Bills, repurchase agreements, and reverse repurchase agreements.

The other risk to be aware of is a divergence between the Bitcoin futures price as measured by the index and the Bitcoin spot price. The ETF is expected to invest in both front-month and back-month futures, with the former having the shortest time to maturity and the latter having a longer time to maturity.

As a result, there is a possibility that the price of the futures, especially the back-month ones may not correlate closely to the spot price of Bitcoin.

All in all, the upcoming ProShares Ultra Bitcoin Strategy ETF is a fairly advanced trading tool making use of two exotic assets in tandem: derivatives (futures contracts) and cryptocurrency (Bitcoin). Coupled with the use of 2x daily resetting leverage, the ETF may not be suitable for lower-risk or beginner investors.

This content was originally published by our partners at ETF Central.