The cryptocurrency industry is facing intensified regulatory scrutiny as the U.S. Securities and Exchange Commission took legal action against leading platforms Coinbase (NASDAQ:COIN) Global and Binance. The SEC has even asked a judge to freeze assets held by Binance.

A complaint, filed in the federal court for the District of Columbia on Monday, said the company has shown “blatant disregard of the federal securities laws.” Binance and Changpeng Zhao, its CEO, would have “enriched themselves by billions of U.S. dollars while placing investors’ assets at significant risk.”

These developments triggered significant market repercussions, with Coinbase's shares plummeting by 17.46% for the week, underscoring the growing regulatory challenges faced by digital asset exchanges. Despite the heightened regulatory crackdown, however, Cathie Wood's Ark Invest demonstrated its confidence in Coinbase by increasing its stake in the company.

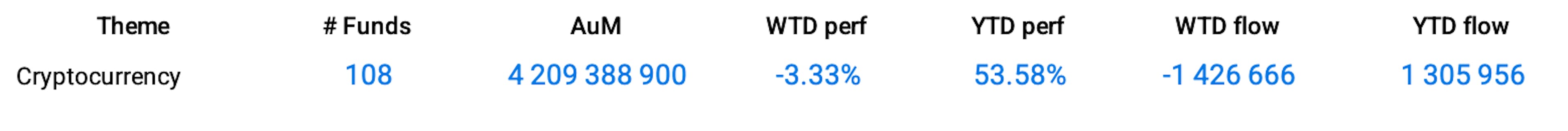

Meanwhile, cryptocurrencies weathered the storm. Bitcoin (BTC) traded between $25,500 and $27,250 all week long, bolting roughly 55% so far this year. The relative resilience of the world's largest cryptocurrency can be partially attributed to the SEC’s classification of BTC as a commodity. In a nutshell, it falls under the supervision of the Commodity Futures Trading Commission (CFTC). Overall, crypto funds lost 3.33% week-over-week but still gained 53.59% year-to-date.