Yesterday was a day where either the glass was half-full or half-empty - depending on your point of view.

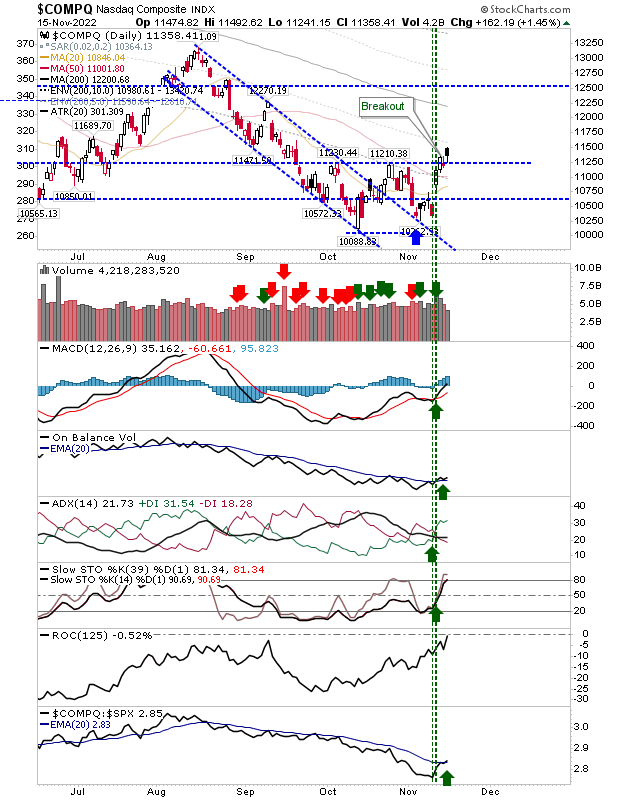

Starting with the Nasdaq, a potential bearish 'harami cross' - usually the most reliable of reversal signals - was negated by a bearish 'black' candlestick; so while one bearish marker was negated, it was negated with another bearish candlestick. Supporting technicals are bullish, and relative performance to the S&P has generated a new 'buy' trigger. So, despite the bearish day-to-day action, the longer term picture is turning more bullish. And, the price breakout is still holding. I would be looking for some selling today, but if the breakout can hold it will be good news for the broader indices.

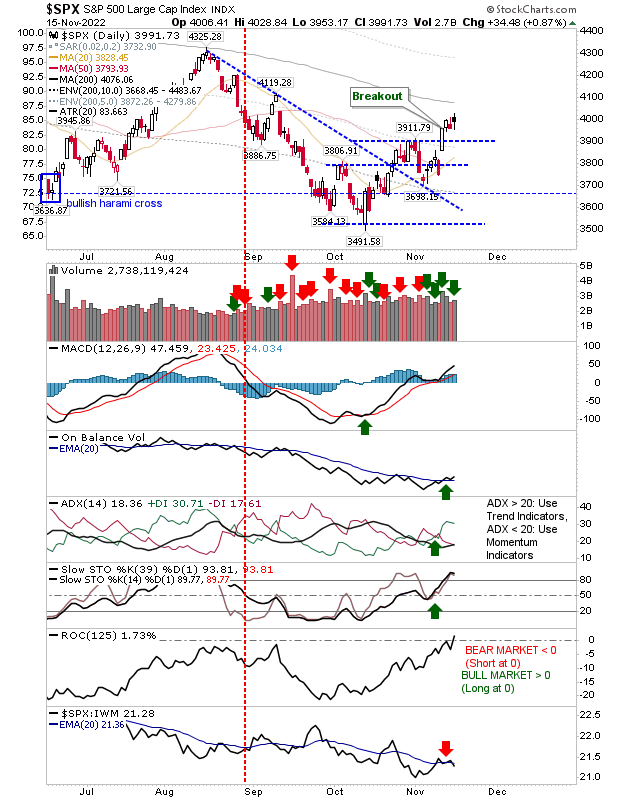

The S&P 500 also closed with a bearish 'black' candlestick, but unlike the Nasdaq, it has seen a bearish tick towards underperformance relative to peer indices. Just to confuse matters, because a 'black' candelstick has a higher close, yesterday's volume registered as accumulation. Other technicals (aside from relative performance) are bullish.

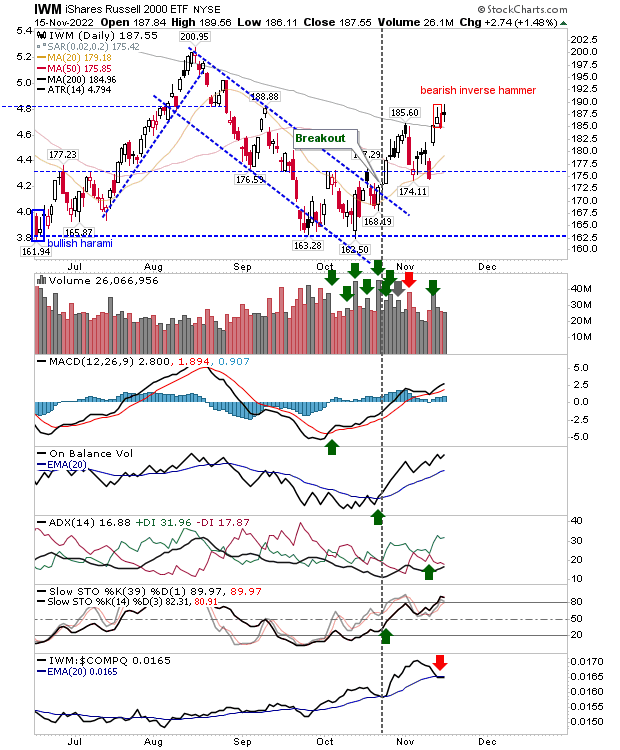

The Russell 2000 had a more neutral day, with yesterday's candlestick registering as a "spinning top", rather than something more bearish. However, the candlestick remains contained by the bearish 'inverse hammer'. Technical damage is limited, with all key indicators showing bullish action.

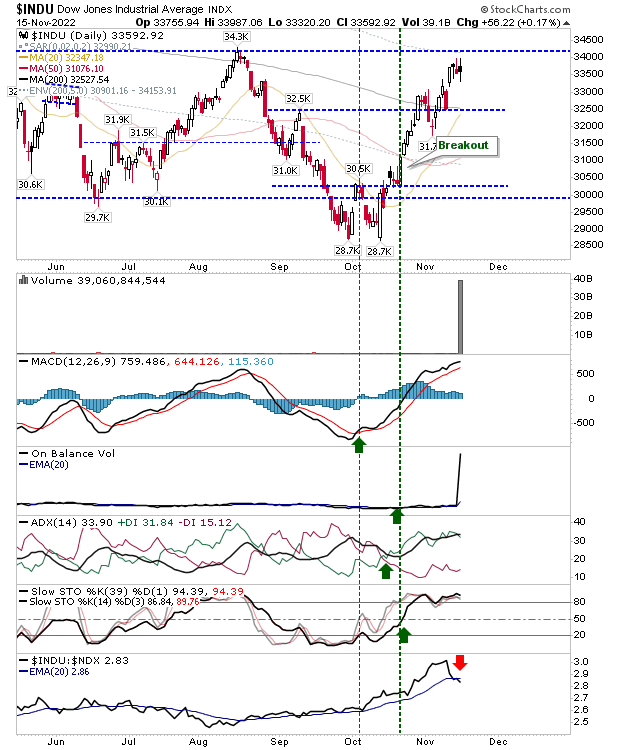

While it's not an index I follow too much, the Dow Jones Industrial Average also finished with a neutral 'spinning top', as having surpassed its 200-day MA it's now very close to breaking through its August high.

So, while yesterday was not the most bullish day for the indices, it did manage to retain recent gains. If it can hold on to these gains over the coming week it help feed the advance into the retest of the August swing high. Investors who have bough in recent weeks should be feeling good. Traders will be having a tougher time of it.