For a brief period at the end of March 2022, it appeared as if Ethereum (ETH), the cryptocurrency with the second-highest overall market capitalization, was poised to make a real challenge to Bitcoin’s dominance. Ethereum’s price quickly accelerated as the date neared for “the Merge” - a promised shift to a proof-of-stake consensus model that would reduce energy consumption, making ETH more sustainable and climate-friendly. Bitcoin (BTC), on the other hand, remained relatively flat during this period and well off its all-time high.

The run was short-lived, however. In the final days of March, Bitcoin surged while Ethereum stalled. Then came course corrections for both. On April 11, a tweet indicated Ethereum was postponing the Merge for at least several months. By the beginning of May, both cryptocurrencies had fallen 21% from their early April prices.

What happened to cause this sudden change and bring Ethereum back in line with Bitcoin? And what are Ethereum’s prospects moving forward?

Understanding the Merge

Despite its overall popularity and position as Bitcoin’s primary challenger over the years, Ethereum has not been without its problems. Even Ethereum’s most ardent supporters complained about the high transaction speeds and lengthy confirmation times.

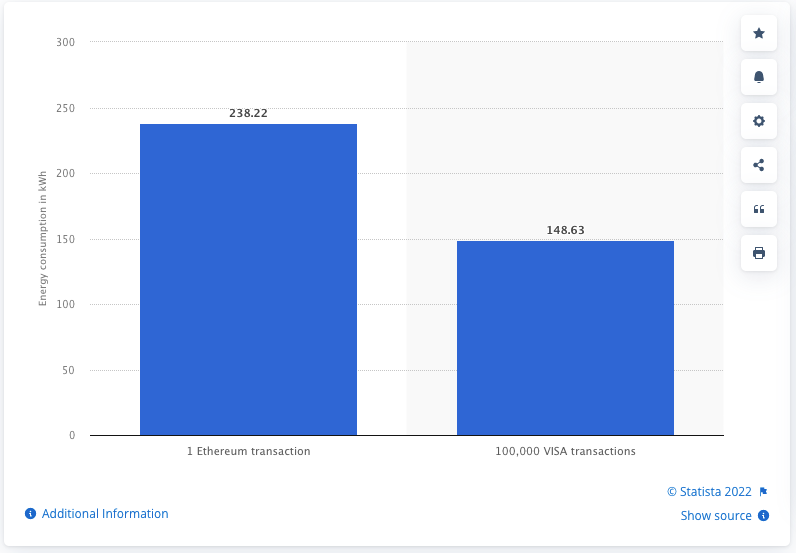

In addition, like its big brother Bitcoin, Ethereum’s proof-of-work (PoW) mining model consumed massive amounts of energy, raising the ire of climate change activists and governments worldwide. As of early 2022, estimates suggested that a single ETH transaction consumed 50% more energy than 100,000 visa transactions:

While the Merge, or Ethereum 2.0 as it is also known, will not reduce transaction fees, it does have the potential to drastically improve the three S’s: scalability, security, and sustainability. And by drastically, we mean an energy consumption 99+% below current levels.

To accomplish these changes, the Merge transitions ETH from its current proof-of-work model, which requires large numbers of mining rigs competing to complete complex mathematical calculations, to a simpler and more energy-efficient proof-of-stake (PoS) model. In the proof-of-stake consensus model, actual coins take the place of competing for computational power.

While anyone with the right equipment can mine BTC or other proof-of-work cryptocurrencies, only those who stake a sufficient amount of ETH can potentially become transaction “validators.” And apparently, this shift was in the minds of Ethereum’s founder from the currency’s early stages.

What exactly is being merged?

The various names and descriptions for the Ethereum upgrade may confuse those who are not devoted followers of cryptocurrency news. If Ethereum 2.0 is just changing how the currency validates transactions, why is it called the Merge?

To get the process of shifting to PoS underway, in Dec. 2020, Ethereum launched a separate blockchain called the Beacon Chain. Beacon uses PoS, while the Ethereum mainnet remains PoW. The Merge is the combination of these two blockchains. Rather than replacing the Ethereum mainnet, Beacon will act as a separate layer working with the mainnet to make PoS a reality.

Is the Merge the same as Layer 2?

While the Merge is also called Ethereum 2.0, it is not a Level 2 solution. L2 scaling solutions arose due to the high transaction fees on Level 1 Ethereum blockchains. As opposed to L1 solutions like Terra, Solana, and Binance Smart Chain, which are actual blockchains, L2 solutions like Polygon and Polkadot are protocols built on top of L1 blockchains to increase overall throughput and lower gas fees.

While the Merge has many of the same goals and effects as L2 solutions (with the critical exception of reduced transaction fees), it uses a different approach than L2 solutions. L2 solutions don’t affect the underlying consensus mechanism but instead use a variety of approaches to optimize performance.

It will be interesting to see how improvements resulting from the Merge (when it finally happens) affect Ethereum’s position relative to L2 solutions.

Will the Merge help ETH outperform BTC?

It may seem that this is a simple question with an equally simple answer. If ETH is faster, more scalable, more secure, and more climate-friendly than BTC, then it should increase in value compared to BTC. ETH already has far more transaction volume than BTC, even with high fees, and every improvement will lead to gains against BTC.

Unfortunately, most things are rarely as simple as they seem, and the Ethereum 2.0 vs. BTC debate is no exception. Indeed, crypto enthusiasts are far from consensus on the effects of the shift in the ETH consensus model.

One challenge is that delays in the Merge could actually cause Ethereum significant problems due to a feature known as the “difficulty bomb.” Mining difficulty in PoW consensus models like BTC and ETH tends to increase over time. In 2016, ETH developers introduced the difficulty bomb to ensure the transition to PoS. The bomb will increase mining difficulty exponentially to the point where the blockchain will become unresponsive. And if this happens before the Merge, ETH and its owners could find themselves stuck.

Another issue that may prevent the Merge from catapulting ETH ahead of BTC is that it still does not address one of the biggest complaints about the Ethereum blockchain, namely incredibly high transaction fees. When fees are in the tens or hundreds of dollars for a transaction, many users are priced out of using ETH, especially as an everyday payment currency or an option for customers to pay their outstanding balances to businesses. And without large-scale adoption, ETH will not be able to get around BTC’s popularity.

There are also other concerns about the effects of the Merge. Some critics suggest that it will open ETH up to 51% attacks, where hackers take control of the blockchain and are able to double-spend coins. Others fear that transitioning to PoS will lead away from the goal of decentralization. And all of these concerns may affect ETH’s ability to compete.

Is the delay of the Merge responsible for ETH’s recent price decline?

BTC and ETH have followed a very similar steep downward price trend since the end of March. And this trend has little to do with the Merge. Instead, issues such as ongoing concerns with inflation, rate increases by the Fed to control inflation, and supply chain owes exacerbated by the war in the Ukraine have had a major impact on both the cryptocurrency markets and the stock markets worldwide.

Although it is hard to ascribe all of ETH’s recent decline to issues with the Merge, there is no doubt that the announced delays have hurt ETH’s price. Without the upgrade, L2 solutions will likely outperform ETH, continue to eat into its market share, and lead to price declines.

Where will ETH end the year?

Even with delays, barring major obstacles, the Merge will happen this year. And if the promised performance benefits prove true, expect to see price improvement for ETH and another period of outperformance compared to BTC. And if the world economies and supply chains begin to stabilize, expect ETH to benefit from a market-wide lift in crypto prices. In the best scenario, ETH will gain some competitive ground against BTC. But it is too far behind BTC’s market cap to expect that it can pull ahead this year, even under the best circumstances.