Dell Technologies (DELL, Financial) is a global leader powering the era of an intelligent, always on, and connected world. As a Dell user myself, I really can attest to their choice of reliability, and innovation. Dell delivers solutions that are powerful and secure, whether you're in the office or on the move. There's so much more to this company than just the devices we use every day, though.

Additionally, what is impressive to me is Dell's adaptability. They have solutions for startups, as well as for global powerhouses. The company is incredibly good at being able to pivot and evolve with the changing tech landscape. Dell's AI driven solutions, cloud infrastructure, and enterprise systems are always moving forward, always being innovative, always evolving to keep up with businesses and consumers alike. With its modest valuation and upside potential, Dell is poised to remain at the forefront of the technology realm for years to come. Therefore, its a sure bet for growth over the long-term.

Strong performance in Q3 FY25

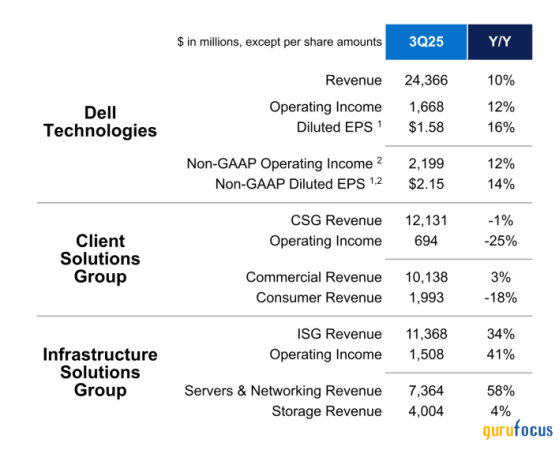

Dell had a superb third quarter of fiscal year 2025. Though there were challenges in some areas, they were balanced by growth in others.Revenue increased by 10% annually to $24.4 billion, fueled by the performance of its Infrastructure Solutions Group (ISG). Despite mixed results in its Client Solutions Group (CSG), profits remained impressive at Dell, with diluted EPS up 16% to $1.58 and non-GAAP EPS up 14% to $2.15. The combination of growth and efficiency makes this the ideal basis for Dell's ability to expand its reach into high demand areas while maintaining operational costs. Let's dive a bit deeper into how each piece contributed to the quarter's results.

Source: Dell 3Q FY25 Performance Review

The ISG segment was the star of the show, experiencing a 34% revenue bump to $11.4 billion. This surge was driven by a stunning 58% growth (reaching $7.4 billion) in servers and networking revenue. We saw Dell leading strongly in AI-driven solutions with record AI server orders of $3.6 billion and pipeline up over 50%. Another $4.0 billion was brought in by storage revenue, which grew 4% YOY. ISG's operating income shot up 41%, to $1.5 billion, which is both a testament to scale and operational efficiency. Dell's reportable segment operating income was 68%, and its profitability was critical.

On the contrary, the CSG segment struggled, with revenue declining 1% to $12.1 billion. However, commercial client revenue jumped 3% to $10.1 billion in this segment, continuing the charge from corporate IT customers. Nevertheless, consumer revenue collapsed 18% to $2.0 billion as weakness in end user demand flagged by macroeconomic pressures was likely behind the further falls. A 25% decrease in CSG operating income to $694 million reflects this decline along with a narrowing of the segment's profit margin to 5.7% from 7.5% a year ago.

While Dell's headwinds are temporary, the company's competitive position should remain in good shape. Dell provided Q4 revenue guidance in a range of $24 billion to $25 billion, up 10% year over year, with ISG anticipated to grow in the mid-20 % range. In addition, the company also expects long-term tailwinds from AI server demand, aging traditional server and PC install base, and enterprise refresh cycles.

How Dell is capitalizing on the explosive growth of AI servers

As more and more industries are adopting AI for use across several different applications, the AI server market is gearing up for explosive growth. It's set to skyrocket from $31.87 billion in 2025 to $457.93 billion by 2034, with a CAGR of 34.46%. The rising demand for high-performance computing infrastructure is driving this surge. Tasks like machine learning, deep learning, and real-time analytics can be handled very well by AI servers, so scaling out the solution using AI servers is obviously the way to go. The lead is taken by GPUs, which will see their total CAGR at 7.5%, up to $86.3 billion in 2032.Source: Market Search Future

For instance, FPGAs and ASICs designed for specific AI workloads, are poised to see strong growth at CAGRs of 8.9% and 10.8%, respectively, as the move toward more specialized hardware accelerates. By 2032, it is likely that cloud-based AI servers will dominate the market share at close to 60% and will cement their dominance amongst the deployment models.

In any case, Dell's move into AI servers couldn't have come at a better (or worse) time. Traditional server markets, which used to be Dell's bread and butter, are solid but rising slowly: they're estimated to reach $89 billion in 2025 at a rate of only 3%. This is the exact opposite: a tremendously larger and far higher ASP criterion for this emerging AI server industry. Well above-average server racks completely equipped with the newest and finest Nvidia (NASDAQ:NVDA) GPUs cost $3 to $4 million each.

Dell stands apart from rivals such as Super Micro Computer (SMCI, Financial) thanks to the integration of networking, cooling, and management software into its factory. Dell's liquid-cooled XE9680L server is not just 2.5 times more energy efficient than air cooled, but it can hold up to 72 GPUs in a single rack and is the most densely packed AI server on the market. As customers scale up their AI clusters, these kinds of innovations are critical. The demand for AI infrastructure is increasing rapidly, with some installations requiring as many as 200,000 GPUs to train huge language models.

The most obvious differentiator is that Dell can service a broad spectrum of consumers. Dell is helping organizations that are migrating to AI workloads beyond hyperscale cloud providers. This diverse client base gives Dell the freedom not to specialize too much in any one area and keeps its pockets full of steady money as more businesses find their way to integrating AI into their day-to-day work.

Dell's high-growth trajectory and impressive valuation

Based on earnings and revenues, Dell is on the right path to financial success. From FY25 to FY28, the company's EPS is expected to surge by a staggering 16.35% compound annual growth rate (CAGR) from $7.83 to $12.32. Dell's ability to capitalize on growing markets that are driving its profitability, such as AI and ISG, is reflected in this. The revenue growth also shows a noteworthy scenario of itself as it is looking at $96.25 billion in FY25 and climbing to an amazing $113.7 billion by FY28.Source: Author generated based on historical data

Meanwhile, Dells valuation indicators suggest that it's only just getting started and the market does not fully understand the companys long-term growth potential.

Dell is now selling at a forward P/E ratio of roughly 14 times, which is consistent with its five-year average. However, this is a significant discount from the industry median of about 25, indicating probable mispricing. The tale gets even more appealing when you examine Dell's PEG ratio of 0.37, which shows that its value is falling behind its expected profit growth. Adding to that, its price-to-sales ratio of 0.80 times is 76.6% lower than the sector median of 3.41.

Depending on these metrics and already provided forecasts, Dell is already the market leader in the AI server market which is growing at a 35% compound annual rate. Aimed directly at this market, Dell is poised to capture this $252 billion by fanning on its strengths in capturing market share and adequately delivering on that. If ISG keeps up the good work, Dell might be commanding 18-20x ahead P/E, thus pushing up the market value of Dell to $150- $160, which is 29-43% from current values.

Comparison with peers

Now, in comparison to peers like NetApp (NASDAQ:NTAP, Financial) and Pure Storage (PSTG, Financial), Dell is looking more attractively valued. Forward P/E and PEG ratio of Dell show high undervaluation compared to NTAP's forward P/E of 22.13 times and PEG ratio of 2.09 times, as well as PSTG's forward P/E of a staggering 216.47 times and PEG ratio of 2.21 times. In addition, NTAP's Price-to-Sales ratio of 3.94 times and PSTG's 7.33 times is much higher than Dell's 0.80 times, which indicates that Dell is giving better value for its revenue performance.Source: Author generated based on historical data

While NTAP and PSTG trade at premium valuations, the fact that Dell is a leader in AI servers and ISG growth justifies the company's promising potential.

Dell's market momentum and analysts' price target

Dell's solid performance in the market shows that it has the potential to be a growth story for the long-term. In the past year, the stock has risen 25% and the five-year gain is an unbelievable 301.8%.The analysts are also bullish, with a 12-month average price target of $152.51, which is a 44% upside from current levels. Analysts have a lot of confidence in Dell's prospects as the lowest figure stands at $115 while the highest is $220. This momentum is consistent with the company's strategic direction of high-growth markets like AI servers and ISG that will drive the company's long-term trajectory.

While my target of $150- $160 is below the highest analyst estimate of $220, it considers strong fundamentals, undervaluation to peers, and solid momentum.

Risks to my thesis

Dell is definitely going to have a good future, however, there are some risks to it too.Firstly, the costs of critical components like GPUs, which are also necessary for AI servers, could keep rising, putting pressure on its margins. Because of the increasing demand for AI solutions, the prices of these components might keep growing, and it will be difficult for Dell to keep its margins in the black. In addition, supply chain issues, particularly around high end chips, could result in shipment delays which would be a hit to revenue recognition timing and a strain on Dell's ability to meet market demand.

The competition in the AI server space is also heating up. Companies like HPE, Lenovo and Supermicro are ramping up their own products in areas like liquid cooling and high-density servers. That means Dell has to continue to innovate and invest heavily to remain competitive, which could ultimately limit how much it's able to price things and its market share in the long term.

Last but not least, a risk is Dell's PC business (CSG). Although there's hope for a PC refresh cycle with the Windows 10 end of life in 2025, there isn't much clarity around how big or timely that bump might be. Dell's overall revenue could be weighed down if consumer sales don't bounce back as expected. Thankfully, strong growth in its Infrastructure Solutions Group (ISG) should absorb any potential setbacks in CSG, but it will be critical as to the timing and scale of the recovery.

Your takeaway

With its leadership in AI-driven solutions, robust infrastructure services growth, and sound financial foundation, Dell Technologies has the potential to be a compelling investment. The company is well-positioned for long-term success due to its ability to adjust to market demand, particularly in the rapidly expanding AI server space; its strong pipeline and server technology advancements give it an advantage over competitors; and, despite risks like supply chain issues and component cost inflation, it's a solid execution and strategic growth pivots in the areas of AI and Dell's enterprise solutions that give them a clear path to continue to expand.As analysts are bullish and Dell trades at a discount to its peers, the stock appears to have a compelling risk-reward profile. It is still a cheap tech company with a lot of room to expand given its excellent valuation, strong momentum, high growth estimates, and prospects for long-term expansion. This makes Dell a viable option for investors with significant potential for development, especially as its story continues to develop.

This content was originally published on Gurufocus.com