Split share funds are unique investment corporations that offer investors the dual benefits of equity investing, but in a bifurcated manner. The fund will typically invest in an underlying portfolio of dividend paying companies, however, the dividends paid by these underlying equities and the capital appreciation realized by said equities are divided (i.e., split) into two distinct share classes, Preferred Shares and Class A shares, respectively.

The benefits of each share class

Each share class has a distinct benefit that will appeal to investors, depending on what their specific investment goal is.

For more conservative investors, preferred shares may be of greater interest, as they provide a steady income stream due to their fixed, cumulative quarterly payments and have a priority claim ahead of the Class A shares on the fund’s assets in the event of termination. However, the net asset value of Preferred shares does not benefit from growth in the underlying stocks. Conversely, for more risk-tolerant investors, who may have strong fundamental knowledge of the underlying portfolio, Class A shares may be of greater interest. All of the capital appreciation in the underlying portfolio of stocks accrues to Class A shares. This in turn provides embedded leverage and does not have additional costs associated with utilizing traditional leverage by borrowing at prevailing interest rates. Class A shares also receive a targeted monthly distribution generated from capital gains and excess dividend income after preferred share distributions have been paid.

A focus on income

The income derived from split preferred share solutions can be relatively high and secure due to the underlying basket of equities the solution may contain. If specific firms or a particular industry has historically made higher dividend payments over time, a split preferred share solution comprising said firms can be created. Thus, the actively managed nature and intentional diversification of holdings within the solution will facilitate a high degree of income generation for the solution. Furthermore, income from the preferred shares is normally declared as dividend income, which in Canada, has favorable tax treatment compared to the tax policies applicable to the interest income that is produced by fixed income investments.

Brompton Split Corp. Preferred Share ETF (Ticker: SPLT)

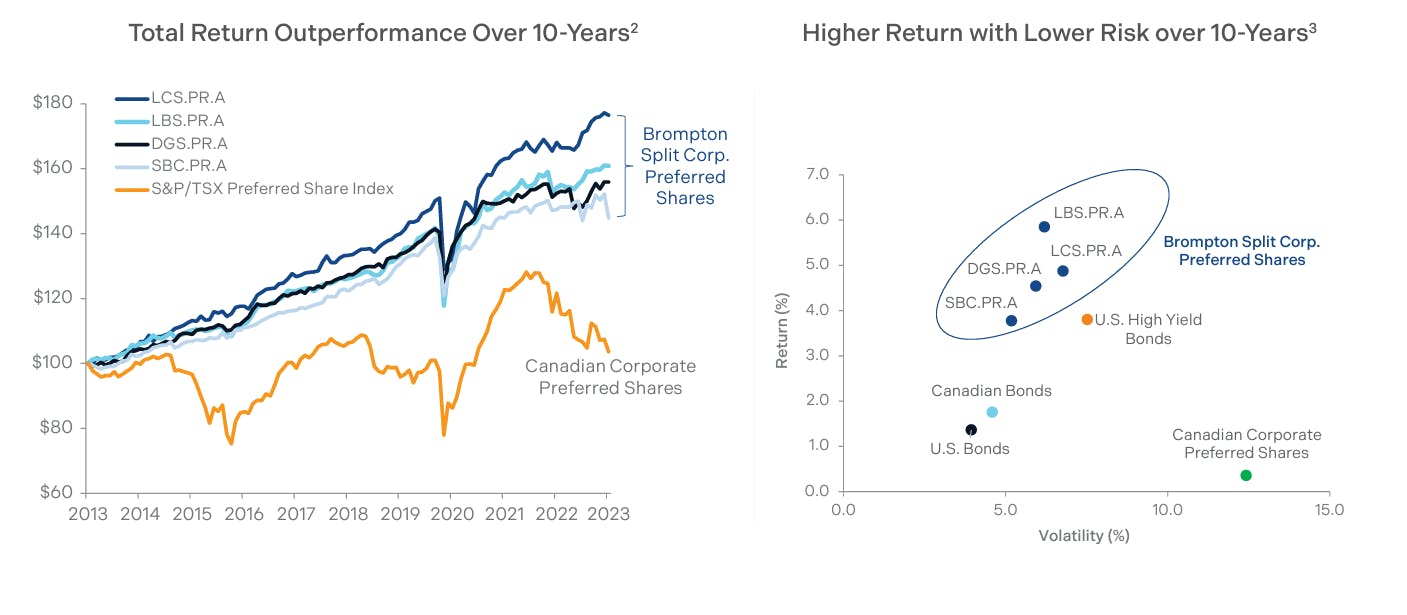

As a prominent and experienced asset manager within the split corp. preferred shares space, Brompton Funds has exhibited their leadership with a diversified offering of split corp. preferred solutions reflecting the Canadian banks, life insurance companies, and North American oil and gas firms (see following image).

*Image taken from Brompton Funds. The data shown is as of May 31, 2023.

In launching the Brompton Split Corp. Preferred Share ETF (Ticker: SPLT), the firm is now providing a solution that facilitates diversified exposure across the Canadian split preferred market. The ETF is designed to provide monthly distributions and the opportunity for capital preservation in an actively managed portfolio of split corp. preferred shares offered by Canadian corporations listed on Canadian exchanges. Simply put, the ETF will be comprised of both Brompton and non-Brompton funds, an indication of the solution’s breadth and depth of diversification.

For investors seeking a solution that is low risk in nature and will provide a consistent source of income through a broad portfolio of holdings, the Brompton Split Corp. Preferred Share ETF is worth considering.

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI