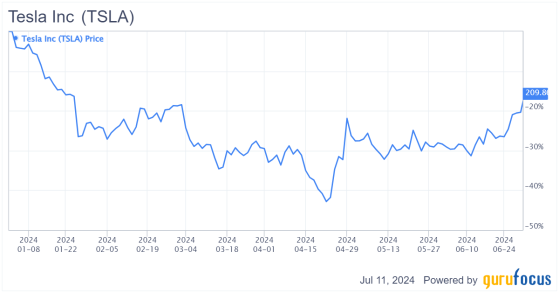

Tesla Inc. (NASDAQ:TSLA) had a challenging start to 2024, with its shares depreciating by 20% year to date at the time of writing. This decline was driven by weak business performance due to a tough macroeconomic environment and increased competition within the electric vehicle market, albeit some of the losses have been regained thus far.

Figure 1: Tesla stock down about 20%YTD

TSLA Data by GuruFocus

However, I believe these negative effects are overblown from the perspective of a long-term investor. Looking ahead, I see two main trends that will lead to long-term value creation for Tesla, which I will discuss both qualitatively and quantitatively.

EV market and Chinese competitionThe first trend concerns its EV business and its position relative to Chinese competition.

In April, the EV market began to show signs of growth following a period of suppressed demand. However, Tesla's shipments decreased during the same period, indicating that competition from Chinese manufacturers has impacted its ability to grow at previous rates. In response to this competition, the company reduced prices, which has not yet led to a proportional increase in top-line performance despite impacting its margins, with the operating margin dropping to 5.50% in the first quarter of 2024 from 11.40% a year ago.

Despite these challenges, I believe Tesla will continue to capture a significant market share in China due to the superior quality of its offerings. While Chinese automakers produce good value products, Tesla's advanced technology, such as full self-driving and other developing autonomous features, provides a competitive edge. Although the timeline for these technological advancements is uncertain, I believe they will eventually enhance Tesla's profitability and solidify its competitive advantage over Chinese manufacturers.

Figure 2: Increasing adoption of Tesla's FSD technologies

Source: Tesla Investor Relations

The Chinese OEM advantage is likely to be less pronounced outside their home market due to tariffs. Moreover, legacy automakers like Ford (NYSE:F), which has scaled back its EV capital expenditure and transition plans due to the current macroeconomic situation and profitability issues, presents another growth opportunity for Tesla, particularly in Western markets.

The energy storage businessThe second, and perhaps most critical, factor in my analysis of Tesla is the long-term growth potential of its energy storage products business, which is not currently reflected in the stock price.

The company produces a range of advanced energy storage solutions designed to promote sustainable energy. Its products include the Powerwall, a home battery system that stores energy from solar panels or the grid, and the Powerpack, a scalable energy storage solution for businesses and industrial applications. For utility-scale projects, Tesla offers the Megapack, a large-scale energy storage system capable of storing vast amounts of energy, stabilizing the grid and supporting extensive renewable energy initiatives.

In the context of its energy storage business, a significant advantage for Tesla is its ability to design and manufacture its own batteries, using the same low-cost lithium iron phosphate batteries as in its EVs, providing valuable manufacturing flexibility over its competition in this business.

Figure 3: Rapidly increasing energy storage deployments

Source: Tesla Investor Relations

The growth trajectory of Tesla's energy storage division aligns with a global shift toward renewable energy. At the end of last year, the company's energy storage deployments reached 14.70 gigawatt hours, with total installations in 2023 more than doubling those of 2022, representing a 125% increase. The division's profit nearly quadrupled, and demand is currently outstripping manufacturing capacity. This heightened demand is altering Tesla's revenue dynamics. Currently, Tesla Energy accounts for only 9.40% of overall revenue, yet the year-over-year growth of its energy revenue has averaged 62% each quarter since the first quarter of 2023, so we may see this segment overtake the primary EV business in the next few years in terms of revenue contribution (given current growth rates continue).

Tesla currently holds around 30% of the global battery energy storage system market, a figure that is expected to grow as the market expands. CEO Elon Musk's vision of capturing 15% of the total energy market solely with Megapacks might seem ambitious, but even achieving a 5% share could translate into significant revenue of $4.20 trillion eventually. Assuming the company's current market share dilutes given the entry of more competitors into this space, if Tesla secures a 15% share (post-dilution; conservative estimate) of a potential $600 billion battery storage market, sales from this business could reach $90 billion, nearly matching Tesla's total revenue from last year. Based on these estimates, the energy generation and storage business could be worth $120 billion to the EV manufacturer. This represents over 20% to 25% of Tesla's current market cap for a segment that is not yet fully priced into its valuation.

Revenue performanceNow I turn to the company's financials and its first-quarter 2024 performance, along with my expectations moving forward, which are aligned with the aforementioned key trends and growth opportunities.

In 2023, Tesla achieved significant growth, with total revenue reaching $96.80 billion, a 19% increase from $81.50 billion in 2022. This growth was primarily driven by the automotive segment, which generated $82.40 billion, representing a 15% year-over-year gain largely due to increased deliveries of the Model 3 and Model Y, with the latter becoming the best-selling vehicle globally in 2023. Additionally, the energy generation and storage segment saw substantial growth, with revenue increasing 54% to $6 billionn, spurred by record deployments of 14.7 GWh of energy storage solutions such as the Megapack.

Figure 4: Operating performance

Source: GuruFocus

Despite the strong performance in 2023, Tesla faced challenges in the first quarter of 2024. The company reported total revenue of $21.30 billion for the first quarter, a 9% decline from $23.30 billion in the prior-year period. This decrease was primarily due to a 13% drop in automotive sales, which fell to $16.50 billion, driven by a 9% decrease in vehicle deliveries and a decline in the average selling price of Tesla vehicles as it matched its Chinese competitors in terms of pricing. Production adjustments, including the ramp-up of the updated Model 3 at the Fremont factory and disruptions at Gigafactory Berlin, contributed to the decrease in deliveries.

On a positive note, Tesla's energy generation and storage segment continued to grow, with revenue increasing 7% year over year to $1.64 billion, driven by record energy storage deployments of 4.10 GWh. This consistent growth highlights the strong market demand for the oompany's energy solutions and underscores the segment's increasing contribution to overall revenue.

Figure 5: Model deliveries and energy deployment

Source: Tesla Investor Relations

Further, Tesla's outlook appears robust, driven by strategic investments and technological advancements. The company plans to ramp up production of the Cybertruck and expand its next-generation vehicle platform. Cybertruck production and deliveries are expected to increase throughout the year, despite initial manufacturing complexities.

In the energy segment, Tesla aims to continue growing its energy storage deployments, leveraging its 40 GWh Megafactory in Lathrop, California to meet increasing demand. The company expects the growth rate of deployments and revenue in the Energy Storage business to outpace that of the Automotive business in 2024, underscoring the strategic importance of this segment.

MarginsIn 2023, Tesla's gross margin was 18.20%, down from 25.6% in 2022. The operating margin also declined significantly, dropping to 9.20% from 16.80% the previous year. This reduction in margins was primarily due to lower average sales prices and increased operational expenses, particularly in research and development for AI and new products.

The first quarter of 2024 continued to reflect these pressures, with the gross margin at 17.40%, down from 19.30% a year ago, and the operating margin at 5.50%, significantly lower than the 11.40% recorded in the prior-year period. These margin compressions were driven by lower vehicle ASPs, increased costs associated with production ramp-ups and higher R&D expenditures. Despite rising competition and further pricing pressure, S&P expects Tesla's Ebitda margin to remain strong over the next two years, around 14%, due to better manufacturing efficiency, higher capacity utilization and ongoing cost reduction efforts.

Figure 6: Margin performance

Source: GuruFocus

Cash flow and capexFrom a cash flow perspective, Tesla performed robustly in 2023, with free cash flow reaching $4.40 billion despite substantial capital expenditures of $8.90 billion, a 24% increase from 2022. These investments were directed toward expanding production capacity, enhancing AI infrastructure and developing new products.

However, in the first quarter of 2024, Tesla reported a negative FCF of $2.50 billion due to continued high capex and increased inventory levels. Tesla benefits from strong liquidity amid these high-capex investments with nearly $27 billion in cash and investments as of the end of the first quarter. This liquidity ensures Tesla can fund its global expansion and navigate uncertain macroeconomic conditions despite expectations of lower free cash flow over the next two years.

Tesla's capital expenditures are expected to exceed $10 billion in 2024 to support production ramp-ups and significant investments related to autonomous driving and next-generation vehicles.

Valuation perspectiveI believe the valuation below accurately captures the upside potential for Tesla's stock, estimating a fair value of around $212 per share on a five-year growth exit, indicating a 7% increase from the price of $198 at the time of writing. This valuation is based on a discount rate of 7.10% and a long-term growth rate of 4%. The model considers the expected recovery in Tesla's automotive segment and the significant growth in its burgeoning energy storage business.

Figure 7: Discounted cash flow model for Tesla (5-year growth exit)

Source: valueinvesting.io

Ebitda is projected to rise from $14.20 billion in the first nine months of 2024 to $55 billion by 2028, driven by increasing automotive revenue and the rapid expansion of the energy storage segment. Free cash flow is anticipated to grow from $8.40 billion to $31.50 billion over the same period, underscoring the strong cash generation capability of Tesla's business, even with substantial capital expenditures. Capex is expected to increase from $6.50 billion to $15.3 billion, yet the company is still projected to generate over $31.50 billion in cash by 2028.

With a robust liquidity position of nearly $27 billion in cash as of the first quarter, Tesla is well-equipped for global expansion and significant capital expenditures, particularly in autonomous driving and next-generation vehicles, which are crucial for creating the competitive edge over Chinese competitors. The energy storage segment is vital for Tesla's future, with growing deployments driving significant revenue growth. Strategic investments and technological advancements, such as full self-driving and autonomous driving, further strengthen Tesla's competitive position and profitability. If the growth exit is extended to 10 years, the fair value could rise to an 80% premium over current market levels, highlighting the long-term growth potential and strategic importance of Tesla's energy storage business.

Wrapping upContrary to current investor sentiment, Tesla appears undervalued and well-positioned for another significant growth phase. The company's strategic focus on advancing its full self-driving technology and autonomous driving capabilities provides a distinct competitive edge in an increasingly crowded EV market, particularly against Chinese competitors. Moreover, the rapid growth of its energy storage business presents substantial revenue opportunities that are yet to be fully appreciated by the market. With robust financial health and strategic investments in key growth areas, Tesla is set to capture long-term value and reaffirm its leadership in the sustainable energy and automotive sectors.

This content was originally published on Gurufocus.com