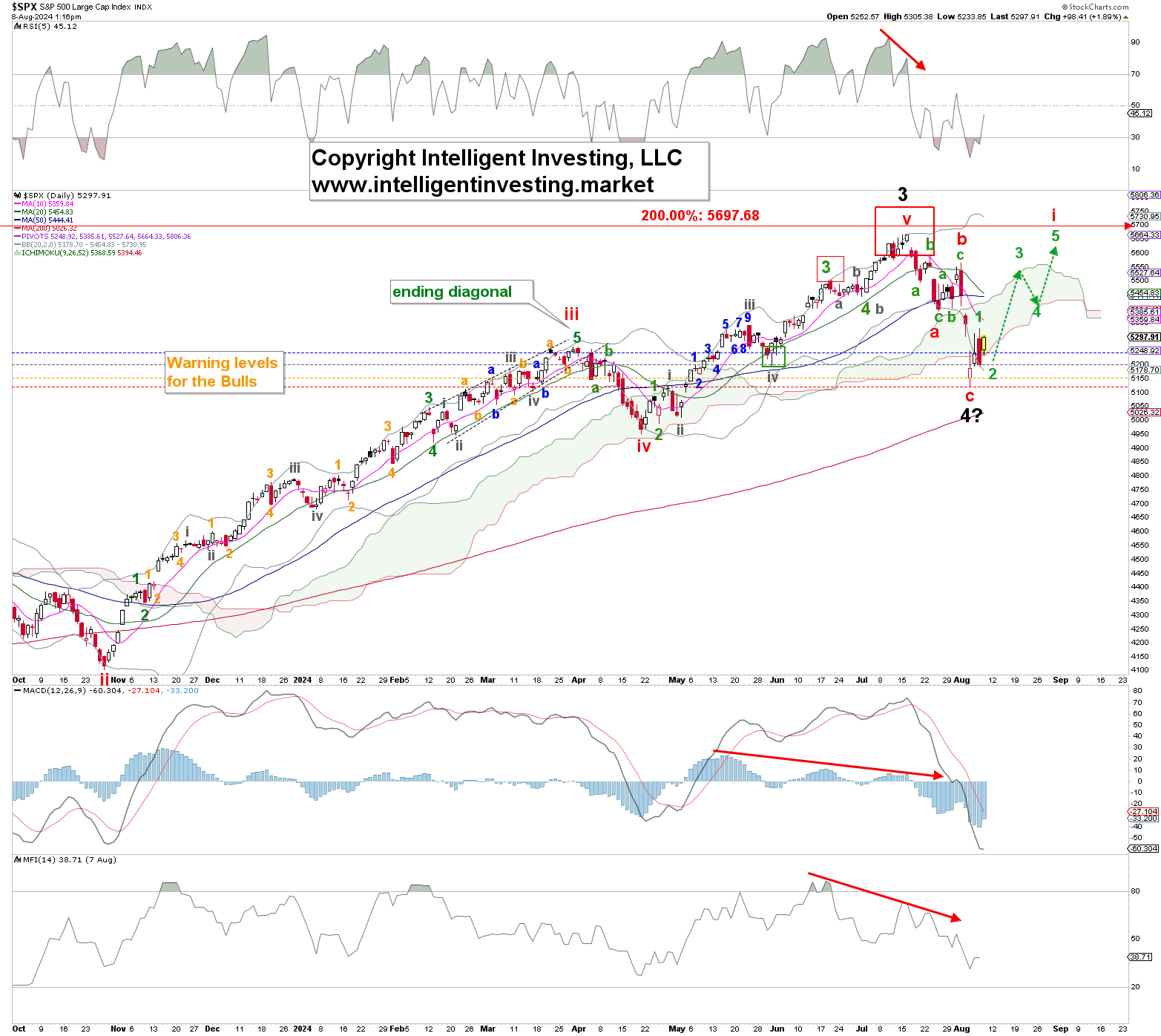

We primarily track theS&P 500 (SPX) using the Elliott Wave Principle (EWP). In our July 2 update, when the SPX was trading at $5480s, we viewed the current rally from the May 31 $5191 low as an impulse 5th wave targeting ideally $5427-53, based on a standard Fibonacci-based impulse pattern, possibly as high as $5550+/25. As such, we warned of trouble ahead, as we concluded,

“… although some charts suggest we should look higher, price is always the final arbiter. However, the Bears have so far been unable to break price below even the 1st raised warning level, and if the index can stay above $5400, and especially $5325, we see no reason to turn Bearish.”

Fast-forward and the index peaked at $5669 on July 16, proving our Bullish stance correct. However, on July 25, it broke below $5400, giving the Bulls their warning, which was correct. Namely, last Friday, August 2nd, the SPX dropped to as low as $5300, which was followed up by Monday’s drop to $5119. Hence, we all had ample warning. But it is not all doom and gloom yet. See Figure 1 below.

The July 16 peak fell 28p (0.5%) short of the ideal 5th wave target, the 200.00% Fibonacci extension of (Red) W-i, measured from red W-ii. That is still pretty accurate. The former, albeit not shown, is the rally from the March 2023 low into the July 2023 high, whereas, as shown, the red W-ii was the October 2023 low. See Figure 1 above.

Thus, assuming that our bigger picture wave count from the October 2022 low is correct, then the index topped for the black W-3 and is now in the black W-4, which may have already bottomed out on Monday. Namely, the recent decline was clearly only three waves lower, with red W-a also comprising three (green) waves. Hence, corrective. Thus, the index may now work on five (green) waves back up to ideally $5650+/-50 for the red W-i of the black W-5. The latter will consist of five red waves (i, ii, iii, iv, and v) and will eventually reach new ATHs.

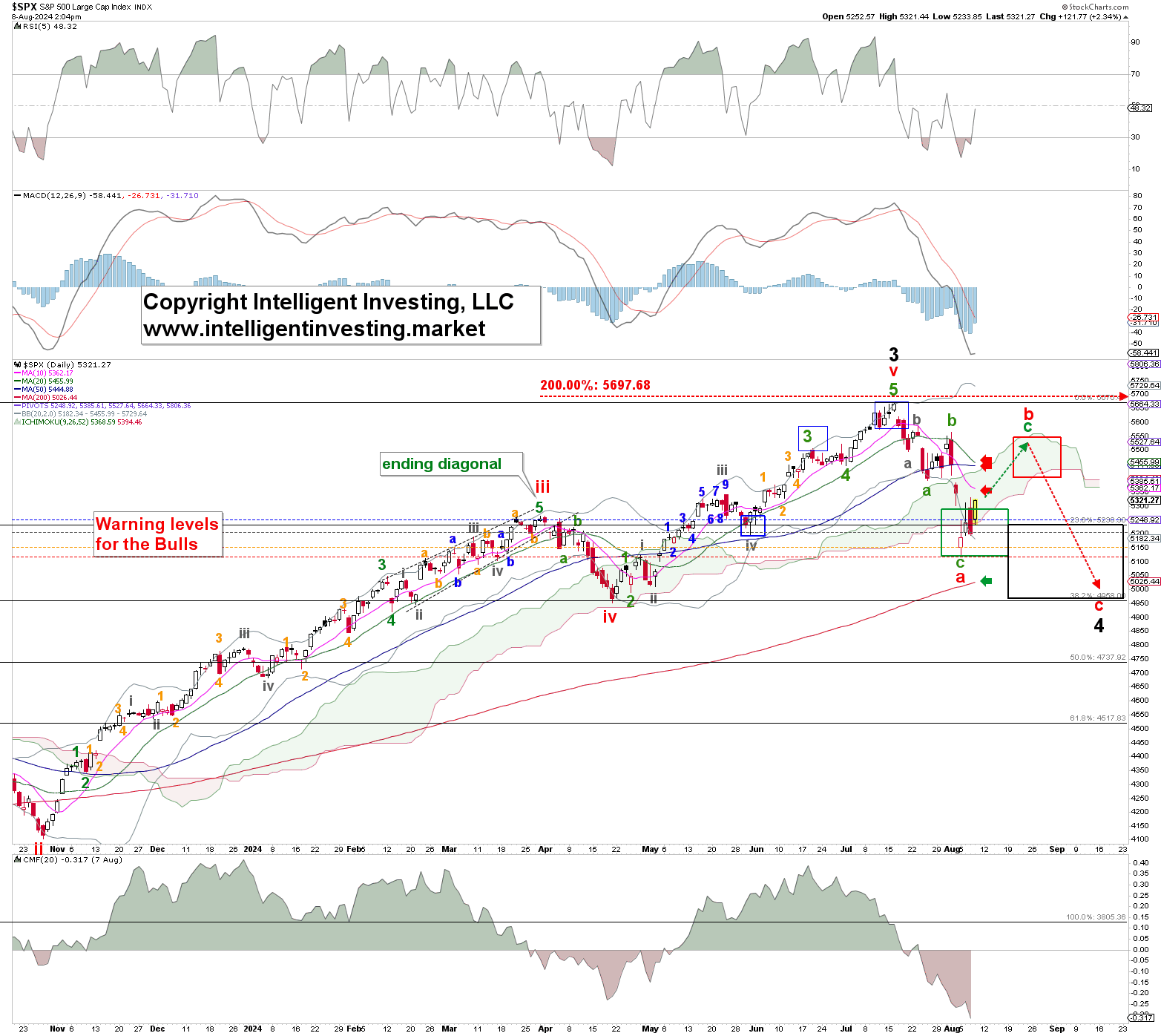

However, after three waves down, we must always expect at least three waves back up, and thus, the black W-4 may not be done just yet. See Figure 2 below.

It could be that the W-4 becomes more protracted, and the current rally from Monday’s low is only a bounce -the red W-b- back to around $5550+/-50 before the red W-c back down to ideally the 38.20% retracement of the W-3 at around $4950+/-25 kicks in.

We must acknowledge that we cannot look around more than two corners at once, so we simply don’t know which of the two EWP options is operable. Regardless, both options are currently pointing higher if the Bulls can keep the index’s price above the colored warning levels, and a major top may not be in just yet.