Most U.S. dividend investors focus their holdings on ETFs that hold large-cap U.S. equities such as the Vanguard High Dividend Yield ETF (VYM). Reasons for this include feelings of familiarity with the holdings, favorable taxation on qualified dividends, and strong performance over the last decade.

However, I think there could be a case for diversifying outside of the U.S. (and to an extent, international developed markets) to also consider emerging market dividend equities. These companies hail from countries in the early stages of economic development but have the potential for significant growth.

Typically, emerging markets encompass geographies like Asia, Latin America, and Africa, which are characterized by younger populations, increasing consumer demand, and rising incomes. As globalization accelerates, the tailwinds for emerging market outperformance might finally be taking shape.

Let's examine the thesis for emerging markets dividend ETF strategies by assessing two of the more specialized ETFs in this niche: the WisdomTree Emerging Markets High Dividend Fund (DEM), and its cousin, the WisdomTree Emerging Markets SmallCap Dividend Fund (DGS).

Diversification benefits

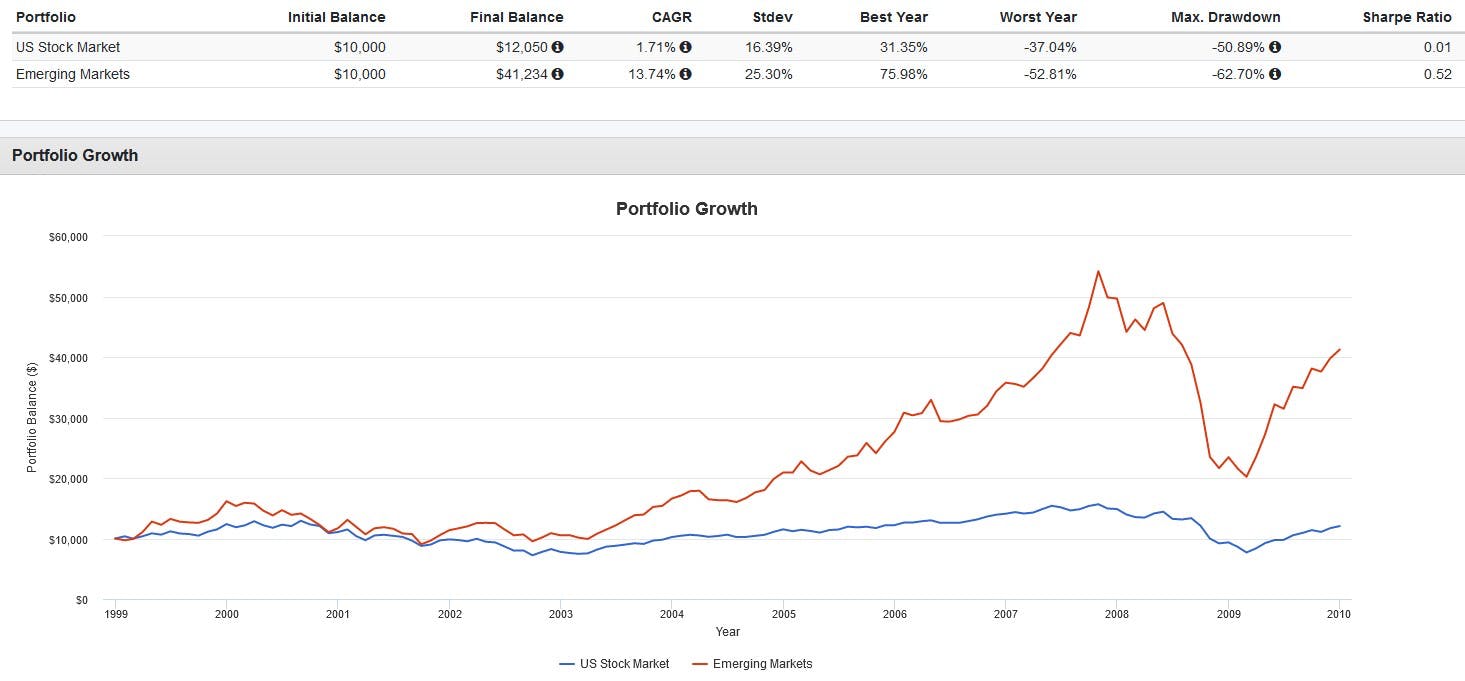

The U.S. market may have outperformed the rest of the world over the last decade, but this wasn't always the case. Older investors may remember the "lost decade" of 1999 – 2009. During this period, U.S. markets returned an annualized 1.71%, while emerging markets returned 13.74%.

During this time, the U.S. market endured not only a three-year bear market after the 2000 Dot-Com Bubble, but also the 2008 Great Financial Crisis and years of stagnant returns in between. It wasn't until 2010 that U.S. markets began their decade-long bull run again.

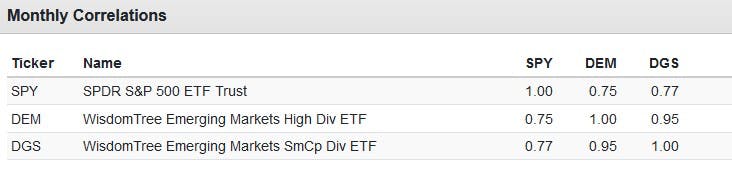

There's also the matter of correlations to consider. Generally, investors should consider adding assets with less-than-perfect correlations with their portfolio that still possess a positive expected return. Dividend-generating emerging market ETFs fit this profile perfectly as seen below.

While U.S. markets pulled ahead strongly in recent years, there is no guarantee that this will continue for the next decade, especially given that U.S. valuations are still much higher than emerging market valuations (more on this below in the next section).

Simultaneously, there is historical evidence that points to extended periods of emerging market outperformance when the U.S. market falters. As Mark Twain once remarked: " “History never repeats itself, but it does often rhyme.” Why bet your entire portfolio on the U.S.?

Factor exposure benefits

The Fama-French value risk premium is a well-documented factor when it comes to explaining a portion of long-term equity returns. To quote Warren Buffett: "A too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments."

WisdomTree themselves note that DEM's backwards-looking yield is currently sitting at 10.60% as of February 21st, around October 2008 Great Financial Crisis levels. Generally, a higher yield corresponds to depressed share prices.T.Row Price notes in a March 2022 whitepaper that a combination of value and dividend‑paying stocks appears favorable for long‑term investors.

Currently, valuations in emerging market dividend ETFs like DEM and DGS are also substantially lower compared to U.S. equities. According to Portfolio Visualizer, the SPDR S&P 500 ETF (SPY (NYSE:SPY)) currently has a price-to-earnings (P/E) ratio of 20.33, compared to just 5.52 for DEM and 7.28 for DGS.

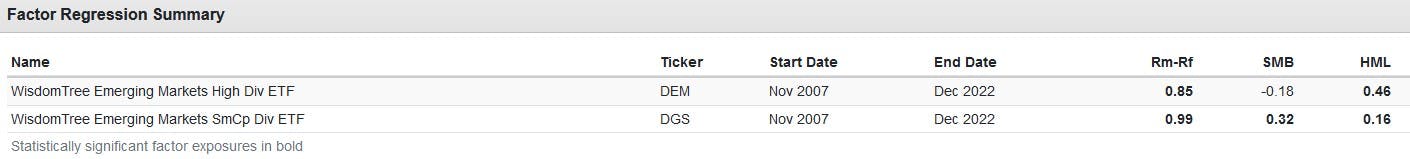

Moreover, by running a factor regression on a monthly return basis over a 36-month roll period, we find that DEM has historically produced statistically significant loadings for value, while DGS has historically produced statistically significant loadings for value and size.

Compared to the overall emerging market blended cap indexes, DEM offers palpable value exposure. Notable, this combination makes DGS a possible candidate for an emerging market small-cap value ETF, an offering currently missing in the U.S. ETF industry.

Investors interested in DEM and DGS can find multiple reasons to be bullish, whether in terms of high dividend yields, low valuations, or potent factor exposures. For those looking for enhanced emerging market exposure beyond the usual market cap-weighted blended-cap index ETFs, these ETFs could be excellent augments or substitutes.

This content was originally published by our partners at ETF Central.