- The anticipation keeps building for a potential rate cut in September.

- As markets begin to price in a 25bp cut, we explore the key question on everyone's minds.

- Can rate cuts ensure a continued bull run?

Markets are forward-looking, reacting more to future expectations rather than just the current conditions.

This is a key idea to keep in mind, especially with the potential Fed rate cut in September being highly anticipated. Many investors are hoping this cut will solve all their problems.

But let’s set the record straight: a rate cut doesn’t automatically mean stock markets will rise.

In fact, in the short term, it can sometimes lead to corrections because the market may have already factored in the rate cut. So, if investors have been expecting this move, it might not have the impact they’re hoping for.

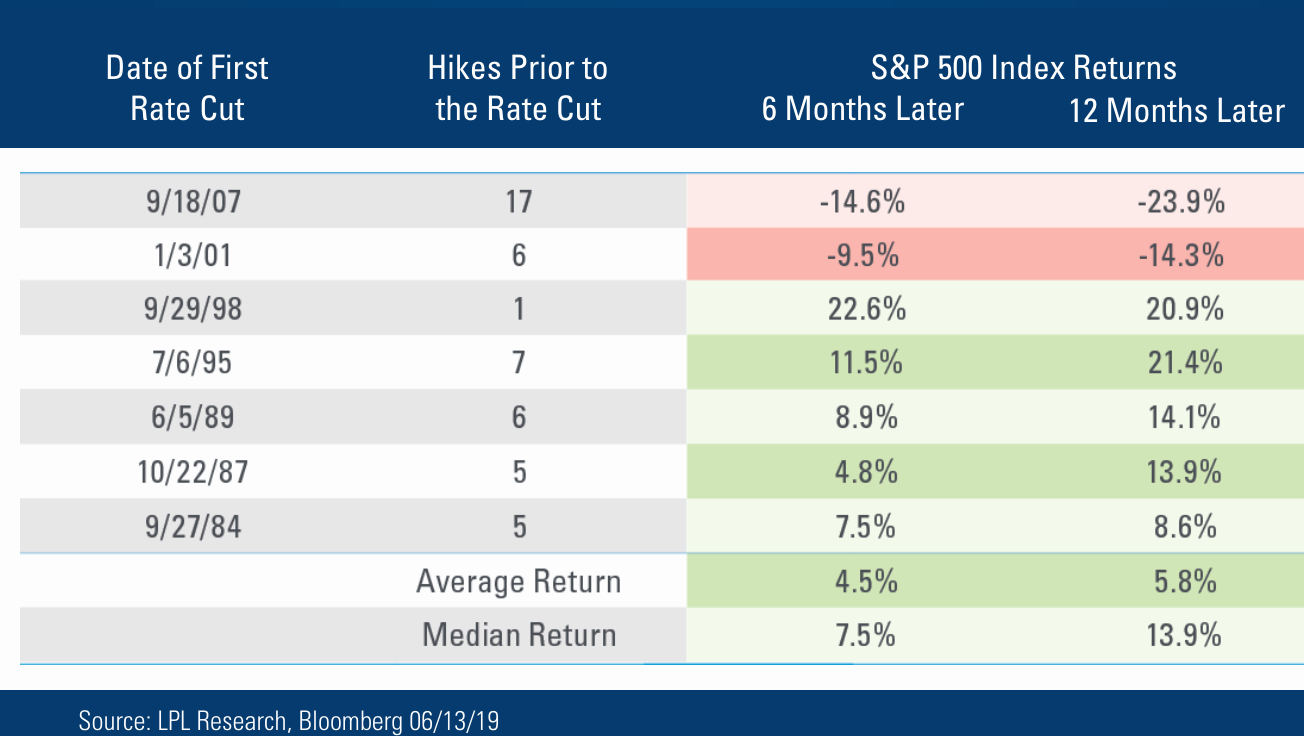

It's crucial to ask, "Why is the Fed cutting rates?" If the cut is part of a strategy to soften monetary policy after tightening it to combat inflation, then it makes sense.

But if the cut is merely a reaction to worsening economic conditions - aimed at avoiding a recession that might still happen - then the situation is quite different.

Markets are always evolving, and investing means accepting a degree of uncertainty. Those who handle this uncertainty better tend to see greater rewards over time, while those who struggle with it may not fare as well.

Do Tech Stocks Really Benefit From a Rate Cut?

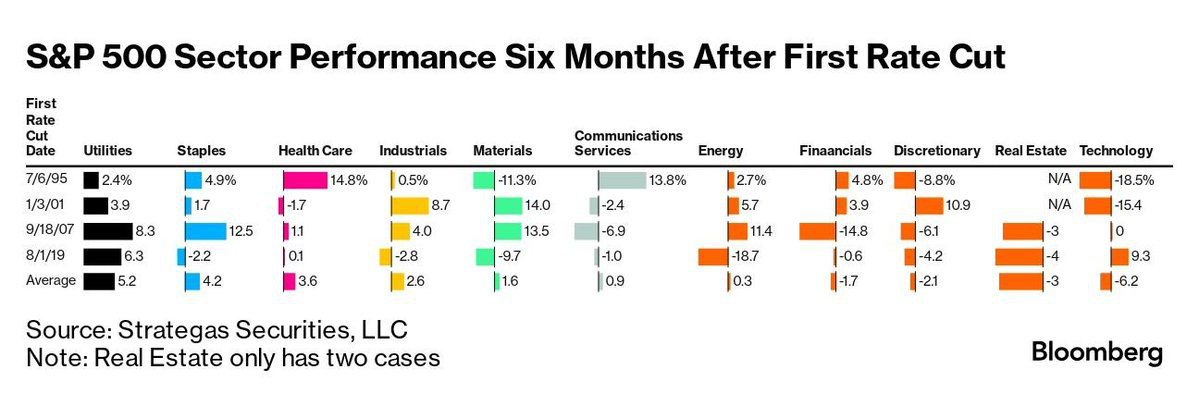

Looking at sector performance, there’s a common but misleading belief that rate cuts automatically boost tech stocks (NYSE:XLK). While a lower discount factor can lead to higher valuations, it doesn’t always mean tech will outperform.

In reality, defensive sectors like utilities (NYSE:XLU), consumer staples (NYSE:XLP), and healthcare (NYSE:XLV) often benefit more from these situations. Bonds follow a similar pattern.

Bottom Line

While it’s tempting to assume that rate cuts will automatically benefit certain sectors, the real impact can be more nuanced. So, when it comes to investing, always be wary of what seems obvious, as markets rarely follow a straightforward path.

***

Do you wish to discover how to leverage 13F filings to track the latest moves of leading hedge funds and take your investment strategy to the next level?

Join us for an exclusive webinar hosted by Jesse Cohen, senior analyst at Investing.com, and learn how you can copy the latest investments of great investors.

Register now and gain the expertise to make smarter, more strategic investment decisions.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.