Eaton (NYSE:ETN) Corporation (ETN, Financial) is one of the few companies well-positioned to capitalize on some of the most exciting long-term prospects, such as electrification and energy transition. However, placing your bet on the stock can be a risky move right now.

Sure, Eaton posted good results in the third quarter of 2024 and has an excellent backlog so it will be on guard for even more demand. But the stock saw a great price increase, trading at a premium to its peers. This steep upswing means that even if the company posts solid results in the next few quarters, it might not be enough to push the stock much higher, as much of that potential growth seems already priced in.

Additionally, economic uncertainties and the poor performance of its eMobility segment cannot be overlooked either. Therefore, investors should monitor the stock closely and approach it with caution. Let's talk about why in detail.

Company overview

Eaton is a power management company that was founded in 1911 and provides its customers with efficient energy solutions in the electrical, hydraulic, and mechanical power fields. Being a sustainability company, Eaton applies innovative technologies to improve energy management and minimize the adverse effects on the environment. The company runs operations in more than 175 countries and its focus is to ensure safe and sustainable offerings to fit into the evolving market needs.Strong Q3 amidst mixed segment results

Eaton's impressive Q3 2024 results proved that the company's financials are robust despite macroeconomic challenges.Total (EPA:TTEF) revenues reached $6.35 billion, 8% higher organic growth than Q3 2023's $5.88 billion. This growth is a result of growing demand in its core segments of operations. On the bottom line, adjusted EPS increased 15% YOY to $2.84, and segment operating margin set a new high of 24.3%, an improvement of 70 basis points from the prior year. Particularly remarkable was Eaton's capacity to expand its revenues and, at the same time, optimize its costs.

Moving into its segments, Electrical Americas was a star performer with 14% organic growth and an operating margin of an outstanding 30.1%, up 240 bps. The aerospace segment also delivered an excellent quarter of 9% sales growth and record margins of 24.4%.

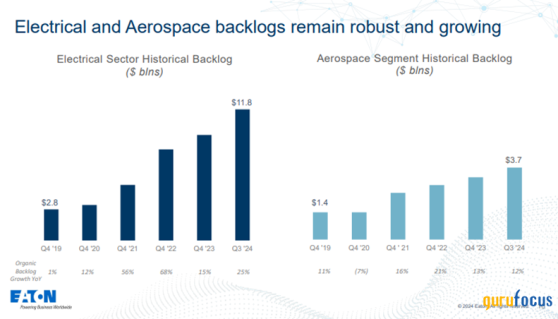

The image below shows that Eaton has managed to record significant backlog growth in these two segments. Electrical backlog increased to $11.8 billion in Q3 2024, up by 25% YOY. Likewise, the Aerospace backlog stood at $3.7 billion while sustaining the demand with 12% growth, reflecting Eaton's continuous operational momentum in core segments. All in all, Eaton remains a model of strategic execution and operational excellence here.

Source: Eaton's 3Q 2024 Analyst Presentation

That said, the Vehicle segment has been down 7% due to challenges in the traditional market for ICE (NYSE:ICE) vehicles. Margins, however, rose by 200 basis points to 19.4%, proving that Eaton still can generate profit even in a declining market. The eMobility segment is also affected. Sales increased by only 2% while operating losses increased to $7 million. Such results, given the high growth prospects of this sector, indicate underinvestment or strategic ineptitude.

Source: Eaton's 3Q 2024 Analyst Presentation

Despite that, the management has shown optimism by raising its 2024 guidance. Total organic revenue is estimated to improve by about 8% to 9%, with the adjusted EPS expected to range between $10.75 and $10.81. Moreover, Eaton has sufficient liquidity to execute $2.5 billion in share buybacks and generate $3.4 to $3.6 billion in free cash flow. Although, better results are expected, addressing the shortcomings in the strategic segments will be imperative for Eaton to capitalize on the transition in energy and infrastructure.

Eaton's premium valuation and peer comparison raises concerns

Eaton's valuation metrics can't be ignored as the stock is highly overvalued in terms of its growth expectations.Its forward P/E Non-GAAP of 33.23 times is 57.96% above the sector median of 21.04 times, suggesting really great market expectations. The same can be said for its forward price/sales ratio of 5.66 times which is over a hefty 264.7% higher than the industry median of 1.55 times, and its EV/EBITDA (FWD) ratio of 25.7 times, which is almost twice the sector median of 12.29 times.

Source: Author Generated Based on Historical Data

Now, when we compare Eaton's valuation to its sector competitors, its already obvious premium gets even clearer. While the selected stocks for this comparison; Emerson (NYSE:EMR) Electric Co. (EMR, Financial) and AMETEK, Inc. (AME, Financial) are also overvalued, Eaton is still the priciest among the three.

Emerson's forward P/E Non-GAAP of 21.84 times and AMETEK's forward P/E of 27.79 times are much lower than Eaton's ratio of 33.23 times. Plus, Eaton's forward P/S ratio sits well above Emerson's 4.08 times and closely matches AMETEK's 6.25 times. As a result, investors are paying a high price for Eaton's revenue today with limited possibility for multiple expansions unless the company delivers extremely strong results.

Another indication of Eaton's higher valuation; it's forward EV/EBITDA, is well above Emerson's 16.99 times and even AMETEK's 21.01 times. This premium is likely due to Eaton's outstanding operating position but that raises the question of whether or not the stock itself offers adequate value when comparing it to peers, especially Emerson, which is better value with more stable growth prospects.

Source: Author Generated Based on Historical Data

Eaton can be considered a good long-term investment because of its premium pricing, however, relative to its peers, it seems like it has a limited short-term upside.

Eaton's stock nears peak

Analyzing the price line of Eaton shows a fairly consistent increase in stock price over the last year, showing how strong it is even during times of volatility. Eaton has experienced a robust increase of 45.74%, with more rise in the latter months as investors regain confidence in the stock's future. Recently, it's relatively close to its yearly high as it remains just about 8% below the 52-week high of $379.9, suggesting that the price is near its top.With Eaton at today's valuation and expected growth rate, the stock should be worth between $355 and $385 within the next three to six months. The lower end shows the potential for some price correction, while the higher end is based on the optimistic growth if Eaton can outstrip market expectations. Therefore, as it continues to deliver on the performance front, investors should be a little more careful as the risk-reward balance could be a little skewed going forward. At the current prices, it may be difficult for the stock to jump to its next levels without the new growth drivers.

Risks to the thesis

These potential risks that surround the stock are hard to ignore.First, there is risk in Eaton's elevated valuation. It is currently trading at a really high forward P/E ratio, that reflects highly expected growth. It provides Eaton with a narrow room for any error. Should this growth fail or stay below such lofty projections, then the stock could be corrected sharply. The company could be on the receiving end of a big downside if performance fails to meet market expectations.

Second, the eMobility segment is also a cause for concern because of its underperformance. The shift towards electric vehicles is an attractive growth story. However, as seen by the relatively slow sales growth and persistent increase in losses, Eaton's inability to take advantage of this fact could damage the overall growth of the company. This trend is a great risk of eradicating the company's image of being an electric powerhouse.

Last but not least, Eaton's high valuation multiples in comparison to its peers makes one question its ability to justify such premiums. If the company agitates, there are other competitors that can have similar organic growth at cheaper prices. Also, Eaton will not be in a position to sustain investor confidence in the event that the company faces operational challenges or market hardships.

Takeaway

Eaton has performed very well in its Electrical Americas and Aerospace segments, which bodes well for it to take advantage of electrification and ongoing energy transition. But its strong price increase over the past year is worrisome because of its valuation. Much of Eaton's future growth is already priced in and with a P/E ratio of 33.23, there's little room for it to go higher. Hope still exists when looking at Eaton's solid backlog and healthy finances, but the troubles in the eMobility segment remain a big concern. If this segment doesn't perform, it may affect the company's long-term potential. The result may be that even if the company can deliver decent results in the coming quarters, it will not be sufficient to generate meaningful further growth.Hence, investors should sit tight and wait for a better-suited opportunity that aligns better with the stock's actual worth rather than chasing the stock at such a premium.

This content was originally published on Gurufocus.com