- Reports Q2 2021 results on Wednesday, Aug. 11, after the market close

- Revenue Expectation: $3 Billion

- EPS Expectation: $0.95

Judging by the stock market reaction, investors don’t see much excitement surrounding the release of eBay's (NASDAQ:EBAY) quarterly earnings tomorrow after the close.

Shares of the internet retail platform have fallen about 11% since the market leader, Amazon (NASDAQ:AMZN), reported disappointing results at the end of last month, and provided a weaker-than-expected outlook for the third quarter.

This should not be much of a surprise. After all, Amazon has been able to dominate the e-commerce space during the pandemic as people stuck in their homes splurged via online shopping channels.

Brian Olsavsky, Amazon’s finance chief, told analysts on the earnings call on July 29 that more vacations and social gatherings are on the horizon, and there will “be things that probably people shied away from last year and that’s all good.”

The California-based eBay suggested in April that spending on the site could recede as more people get vaccinated, businesses reopen and stimulus checks dry up. Slowing e-commerce sales also highlight another challenge for the smaller e-commerce players like eBay: How many people will hang on to these platforms once the pandemic rush is over?

Business Consolidation

JMP analysts, who have the equivalent of a hold rating on the stock, wrote in a report that the various deals should help eBay focus on retaining customers and attracting sellers. eBay has been consolidating its business for the past two years by selling assets and raising cash.

It sold StubHub, a secondary market for sports, music and live-entertainment tickets, for more than $4 billion in 2019. It also agreed to sell its classifieds business last year in a deal that would bring in $2.5 billion in cash. In June, eBay said it was selling the majority of its South Korean operations for about $3 billion.

In a statement the company said:

“We believe these transactions create incremental strategic optionality for eBay as it invests and builds out newer experiences around its core marketplace while maintaining its capital return strategy.”

eBay Chief Executive Officer Jamie Iannone, who took the helm last year, is focusing on advertising and payments to generate more revenue and counter the potential slowdown in the company’s core online marketplace.

Gross merchandise volume, the value of all goods sold on the site, rose 29% in the first quarter to $27.5 billion, but growth in the second quarter is expected to slow to about 5% from 6.6% a year earlier, according to StreetAccount.

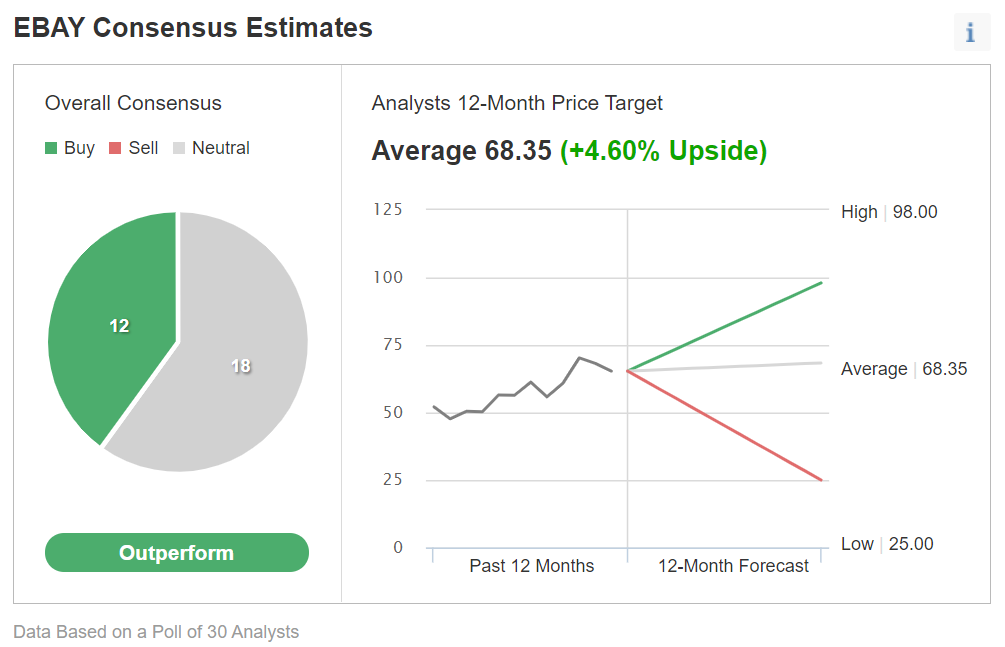

Analysts, on the other hand, don’t see much upside in eBay stock after a 30% jump this year.

Chart: Investing.com

Of 30 analysts polled by Investing.com, 18 have a neutral rating, while 12 have a buy call on the stock. Shares closed on Monday at $65.35.

Bottom Line

eBay’s core e-commerce business may show slowing growth after a year of blistering sales as the economy reopens and people divert their spending on travel and eating out.