Global economies are showing signs of slowdown with sluggish GDP growth and rise in unemployment with manufacturing sectors facing challenges, indicating a contraction in the activity across sectors. The current regional conflicts also add uncertainty and play a role in slowing down overall economic activity.

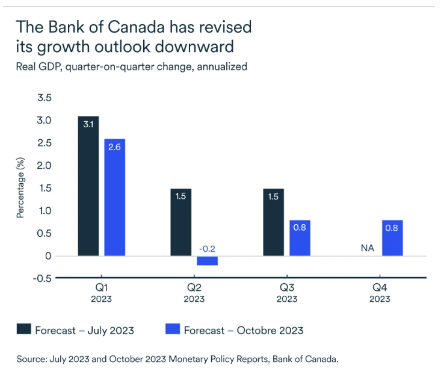

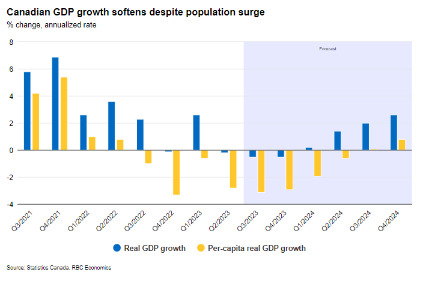

In Canada, the impact of slowing global economy, and the impact of higher interest rates results in the Canada’s GDP declining at an annualized rate of 0.2% in the second quarter of 2023 and growth was most likely flat in July, and signs of flat or negative growth in Q3 2023, a signal to the central bank that interest rates are high enough for now and having an impact.

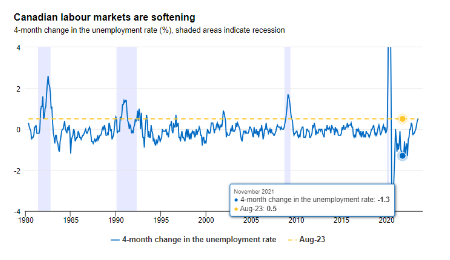

We are witnessing a rise in unemployment - the climb in unemployment results more from a deceleration in hiring (compared to a surge in population and labor supply growth) rather than an acceleration in terminations. The Economy is seeing fewer job openings, a signal for slower productivity and labor demand.

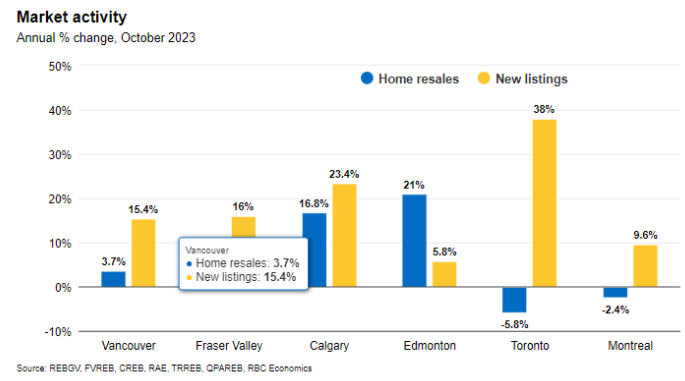

The persistent series of interest rate hikes over the past 18 months have lasting effects on consumers, causing an increase in household debt payments and indications suggest a slowdown in business investment. The housing markets, which experienced a rapid resurgence in the spring during a temporary pause in interest rate increases by the BoC, have once again cooled.

The Canadian Dollar is also losing its ground. As one of the Fed officials, expressed his preference for the Fed to overtighten rather than risk under tightening concerning interest rates, it is highly likely that Canadian currency will remain under pressure.

Adam Button, chief currency analyst at ForexLive said that "The Canadian dollar is selling off because the debate will quickly shift to when rate cuts are coming. It's not out of the question that we are already in a recession in Canada."

Immigration – As an Economic Driver

Citizenship Immigration Canada is adamant of continuing its immigration numbers. Announced by the Minister, in the next three years, Canada will invite over 1.4 million new immigrants.

Canada has been facing a major labor challenge due to its aging population. Not only do we see changing consumer spending patterns and increasing healthcare costs, another impact of the aging population is on labor availability. Perhaps immigration is the only way to quickly address this challenge.

However, immigrants (in most cases) do not have the skill sets Canadian employers are looking for. As a result immigrants do not find satisfying jobs and often struggle in making two ends meet.

Recently, it has been observed that a number of immigrants are leaving Canada after obtaining citizenship.

Source: Statistics Canada, RBC (TSX:RY) Economics

Question here is: Can immigrants serve as economic drivers?

Housing Market Updates

According to a survey findings reported by Canadian Mortgage Trends, housing market players are expecting first interest rate cut by April 2024, with an overall cut of 1% by Q1 2025, with a projected drop to 3.00% by Q3, 2025

Having said that, in the short-run, the cost of owning a house or renting it has gone up significantly.

Ontario has also put a stop to “Blind Bidding”. That change is expected to make transactions more transparent. “Home Buyer’s Bill of Rights” will take effect in 2024 and is aimed at keeping housing deals at a more logical level.

We need to see the interest rate movement. Next spring and interest rates will determine the direction for the Canadian housing market. Currently, the insights from local real estate boards in October paint a picture of dwindling transaction activities. Which is clearly the impact of subdued demand and ever increasing ownership costs. We are seeing fewer sellers in the major markets like Toronto, Vancouver, and the Fraser Valley.

The Bank of Canada continues to emphasize the sole policy mandate of achieving a 2% inflation target. Despite persistent inflation pressures in Canada and a softening in GDP growth and labor markets, it's anticipated that the BoC will maintain a steady interest rate stance throughout 2024.

BoC Governing Council remains split on whether interest rates should rise further. Some members are of the view that rates need to go higher to control inflation. Other members felt that rates are high enough and should be enough to reduce inflation further over the period of time.

As we indicated in our earlier newsletters and post, there are other factors which are driving the inflation including the shortage of housing and increase in population and with the current level of rates, it is important to allow time for other factors to bring inflation down..

In contrast, the U.S. experiences resilient economic growth but sees a notable easing of inflation pressures in recent months. This dynamic is expected to result in both the BoC and the Fed maintaining current interest rates into 2024. However, there are higher near-term risks, and both central banks might not swiftly pivot to interest rate cut.

Are we going to see a rate reduction in the later part of 2024?