USD/CAD is almost unchanged in the Tuesday session, as all eyes are on the US presidential election. Currently, the pair is trading at 1.3370. On the release front, we’ll get a look at the strength of the Canadian construction sector, with the release of Housing Starts and Building Permits. The markets are predicting weak numbers from both indicators. Housing Starts are expected to fall to 195 thousand, while Building Permits are expected to decline 5.6%. The US continues to publish employment data, with the release of JOLTS Jobs Openings. The estimate stands at 5.67 million.

After months of a bitter and bruising election campaign, US voters in their millions will flock to the polls and choose either Hillary Clinton or Donald Trump as their new president. Although polls continue to point to a tight race, Clinton appears to have the upper hand as she has an easier path to garnering the 270 electoral votes needed to claim victory. The most recent polls indicate that voters favor Clinton over Donald Trump by a margin of three to five percent. On the weekend, the Clinton campaign received a boost as the FBI announced that it had no reason to change its conclusion that Clinton should not face criminal charges in her use of private emails while she was secretary of state. There are different market scenarios depending on the actual outcome of the election, with the worst case scenario being a too-close-to-call result. If either candidate fails to deliver a decisive victory, the leadership vacuum and uncertainty surrounding the result could trigger higher volatility in the markets. However, if Clinton wins a clear victory, the US dollar could respond with broad gains. The election could also have a significant effect on monetary rate policy. Currently, the odds of a rate hike in December stands at 71.5 percent.However, if the election results trigger market volatility, the Federal Reserve could hold off from raising interest rates at its next policy meeting in December.

USD/CAD Fundamentals

- 6:00 US NFIB Small Business Index. Estimate 94.6

- 8:25 Canadian Housing Starts. Estimate 195K

- 8:30 Canadian Building Permits. Estimate -5.6%

- 10:00 US JOLTS Jobs Openings. Estimate 5.67M

- 11:20 BOC Deputy Governor Lawrence Schembri Speaks

- All Day – US Presidential Election

- All Day – Congressional Elections

*All release times are EDT

*Key events are in bold

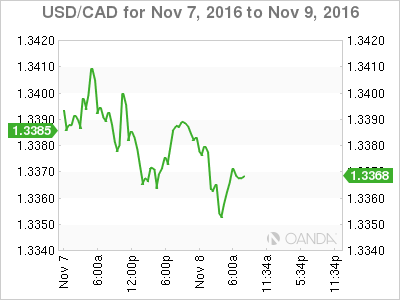

USD/CAD for Tuesday, November 8, 2016

USD/CAD November 8 at 6:55 GMT

Open: 1.3372 High: 1.3391 Low: 1.3351 Close: 1.3371

USD/CAD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.3120 | 1.3253 | 1.3371 | 1.3457 | 1.3551 | 1.3648 |

- USD/CAD has shown limited movement in the Asian and European sessions

- 1.3371 remains fluid. Currently, it is a weak support line

- There is resistance at 1.3457

Further levels in both directions:

- Below: 1.3371, 1.3253, 1.3120 and 1.3028

- Above: 1.3457, 1.3551 and 1.3648

- Current range: 1.3371 to 1.3457

OANDA’s Open Positions Ratio

USD/CAD ratio is unchanged in the Tuesday session. Currently, short positions command a strong majority (71%), indicative of trader bias towards USD/CAD breaking out and moving to lower ground.