1: IntroductionEldorado Gold (TSX:ELD) (NYSE:EGO) is part of my selected group of gold mining companies. However, due to its size and associated risk level, I cannot categorize it alongside Newmont Corporation (NYSE:NEM), Barrick Gold (GOLD), Kinross Gold (TSX:K) (KGC), Pan American Silver (TSX:PAAS), and Agnico Eagle Mines (NYSE:TSX:AEM), which I have recently discussed on this website. I owned and traded EGO regularly until recently, when I decided to sell my entire position between $18 and $19 (lucky move), which was my final target. Since then, I have purchased a small position in EGO at $15.75 and am waiting for lower prices to accumulate more shares, matching my overall gain.

The company released its third-quarter 2024 results on October 31, 2024. This article updates my Gurufocus article from January 25, 2024, in which I analyzed the preliminary gold production for the fourth quarter of 2023.

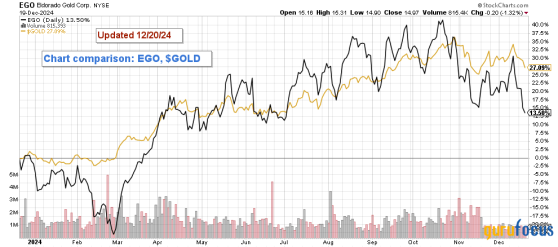

After the release of the third quarter, EGO experienced a bearish reversal. Consequently, the stock declined significantly and is now underperforming gold bullion, as shown in the chart below:

The current downturn is not solely related to EGO; it affects the entire mining industry. This decline has been exacerbated by the tax-selling season and the recent decision made by the Federal Reserve.

While some investors may view this situation as a concerning sign for 2025, others see it as a potential buying opportunity. In this article, I will discuss the potential risks associated with the company and explain why we must exercise caution and avoid investing more than we can afford to lose.

The stock market is highly volatile and requires careful attention to prevent costly mistakes. Daily news coverage is insufficient to identify the potential downfalls hidden in the fundamentals; it takes a discerning eye to spot these issues. You are responsible for avoiding these issues because they will cause you the most harm. Many analysts may be biased because of their employer's influence or simply unaware of the inherent risks associated with the company's assets. They might be hesitant to challenge the status quo. This creates a dilemma.

How often does unexpected news arise, leading to sudden stock declines that catch everyone "off guard," even though the underlying issues were present and easily identifiable? You get my point.

2: Eldorado (SO:ELDO11B) Gold: A Gold Mining Company with a History of ChallengesAs previously mentioned, Eldorado Gold is primarily a gold mining company. However, its revenue is not solely derived from gold. In the third quarter of 2024, gold accounted for 91.75% of the company's total revenue. In addition to gold, Eldorado Gold also produces silver, lead, and zinc as by-products.

The Olympias mine in Greece is the most productive for these metal by-products, yielding 18,833 ounces of gold and 362,581 ounces of silver, and additionally lead, and zinc.

The Olympias mine is part of the Kassandra mines in Greece which is comprised of Olympias, Skouries, and Stratoni.

One important element is that the company will begin producing copper when the Skouries mine is completed next year. Here is the chart showing the revenue generated per metal for 3Q24:

As I mentioned in a previous article, the quality of a company's mines determines its ultimate success. Quality is a broad term that encompasses ore grade, the ease of producing the metal, the costs of extraction, and other factors. However, the location (jurisdiction) of the mine is equally crucial.

Despite significant setbacks, Eldorado Gold has managed to survive and thrive after nearly going bankrupt a few years ago due to heavy investments in Greece. At one point, EGO invested approximately $1 billion without seeing significant results. It was a Danaid's barrel. The company's Certej project in Romania also turned into a fiasco and was recently sold for peanuts.

Eldorado Gold has been operating in Greece since 2008 when it acquired the Perama Hill Gold Project from Thracian Gold Mining by purchasing Canadian Frontier Pacific Mining Corporation.

The company struggled against a government that opposed the Skouries mine and blocked the project for years, resulting in significant financial losses. This culminated in a decision to halt investment in the Skouries project on November 8, 2017, after the precedent socialist government illegally derailed the project by refusing to deliver basic technical permits.

To add insult to injury, the company issued a production warning for its Turkish Kisladag mine in the same year, stating that it would not meet production guidance due to recovery issues at the leach pad.

However, in early 2021, Eldorado Gold got the Skouries project back on track after a new government was elected in Greece. Furthermore, the Kisladag mine production issues were finally resolved as if they never happened in the first place.

The Skouries project is expected to be 86% complete by the end of 2024. The first production of gold and copper is anticipated to occur in 3Q25, with commercial production slated to begin at the end of 2025.

The project is fully funded, supported by a financing facility of 680 million at an interest rate of approximately 6%. In 2025, production will be between 50,000 and 60,000 ounces of gold and 15 to 20 million pounds of copper, a fraction of the expected annual production. After that, yearly production is expected to reach 320,000 gold equivalent ounces.

3: Eldorado Gold Reserves: A solid long-term prospect.

Gold and silver reserves are substantial, totaling 11.9 million ounces of gold and 36.7 million ounces of silver. The company also indicated a P3 reserve of 740,000 tons of copper, 378,000 tons of lead, and 474,000 tons of zinc.

4: Gold production in 3Q24 is back to normal.The company owns and operates four producing mines: Kisladag and Efemcukuru in Turkiye, Lamaque in Canada, and Olympias in Greece. In the third quarter, EGO produced 125,195 gold ounces and sold 123,828 ounces.

As we can see in the graph below, it was a big jump quarter over quarter.

On the less positive side, Eldorado Gold has lowered its production guidance to 505K-530K oz, down from 505K-555K oz.

When comparing the production per mine for 3Q23 and 3Q24, Kisladag and Olympias performed strongly, while Lamaque and Efemcukuru maintained steady output.

However, it's important to note that the costs at the Olympias mine are significantly high, with an All-In-Sustaining Cost (AISC) of $1,688 per Gold Equivalent Ounce (GEO).

Note: Total (EPA:TTEF) cash costs at 3Q24 increased to $953 per ounce due to rising royalties and labor costs, particularly at Olympias.

The all-in-sustaining costs (AISC) for gold have steadily risen, currently at $1,335 per ounce. This figure represents the industry's lower end of the average range 2024. AISC has been on an upward trajectory since 3Q23. While this increase is not severe, it does raise concerns about the company's ability to reverse this trend.

5: A brief review of the 3Q24 financial results: Capital expenditures are increasing as the completion of the Skouries mine approaches.Eldorado Gold announced its third-quarter results for 2024. It reported diluted earnings of $0.46 per share, a significant improvement from the loss of $0.04 in the same quarter last year. This growth was primarily driven by a rise in gold prices, which reached $2,492 per Troy ounce in 3Q24.

The company reported record revenues of $331.43 million, reflecting a 35% increase from the previous year. Additionally, adjusted earnings totaled $71.0 million, exceeding expectations.

The company reported a free cash flow of $11.49 million in the third quarter, a significant increase from the loss of $6.60 million in the same quarter last year. Cash flow from operations amounted to $180.82 million, and capital expenditures totaled $169.34 million.

Eldorado Gold will continue to encounter challenges with free cash flow until the Skouries mine is completed. Costs are rising, and the mine is not yet in production. However, a significant increase in production is expected to begin in late 2025 or 2026. Consequently, despite the anticipated rapid growth in total cash flow, I do not expect EGO to pay dividends soon. EGO stop paying dividends in 2017.

The financial situation regarding Skouries is quite complex. By the end of the third quarter, Eldorado Gold reported having $677.76 million in cash, cash equivalents, and marketable securities, up from $476.75 million in the previous quarter. Total liquidity are $885 million, including $208 million in credit facility.

At the same time, the company's long-term debt, including current debt, was approximately $861.88 million, a significant increase from $598.16 million in the previous quarter. The high price of gold has significantly benefited the company, which has a net debt of only a few million.

6: Technical Analysis: A descending channel.

Eldorado Gold forms a descending channel pattern, with resistance at $17.05 and support at $15. This pattern is characteristic of a retracing situation prevalent throughout the mining industry since the Fed cut interest rates, cooling down the gold rally.

The relative strength index (RSI) is currently at 40, indicating a weakening bullish trend that may lead to further declines. Although the descending channel is generally viewed as a bearish pattern, it can sometimes result in a bullish breakout after the pattern ends, functioning as a continuation pattern.

With a support level of around $15, now may be a good time to consider adding to your position starting at $15.25. Recently, a significant amount of selling has supported this strategy.

Additionally, selling a portion of your shares might be wise once the stock price rises above $16.60 to $17.35. Selling part of your position using the LIFO (Last In, First Out) method is essential, particularly if the stock shows a false bullish breakout followed immediately by a quick retracement.

If the price of gold falls from its all-time highs, EGO could drop to $14.25 or even lower. For more details, please refer to the chart above. Additionally, selling may increase even if gold remains above $2,500 per ounce, as investors might see limited upside potential for the stock and choose to sell due to the lack of dividends.

It is essential to take partial short-term profits using the LIFO method. Consider selling about half of your position for short-term trading while keeping a modest core long-term investment.

Warning: The technical analysis chart should be updated regularly.

This content was originally published on Gurufocus.com