E.l.f. Beauty (NYSE:ELF) has been a standout in the beauty sector, leveraging its disruptive marketing, strong brand affinity with Gen Z, and impressive financial execution to deliver consistent growth. The company has gained traction with its ability to deliver cruelty-free, clean, vegan, and premium-quality products at accessible prices, a combination that differentiates it in the beauty industry. In just five years, e.l.f. Skin has become a top 10 skincare brand in a category dominated by legacy brands built over decades. For context, the average age of the other top 10 skincare brands is 63 years old. Moreover, according to Civic Science, E.l.f. is the most purchased brand among Gen Z, Millennials, and Gen Alpha.

In my previous analysis, I highlighted the company's ability to expand market share, maintain industry-leading margins, and capitalize on digital engagement strategies. However, following its latest earnings release, the stock has faced headwinds, losing more than 40%, raising concerns about whether its growth story is losing momentum.

In this article, I will break down E.l.f.'s latest financial results, guidance updates, and key topics affecting the company to assess whether this pullback presents a buying opportunity or signals deeper challenges ahead.

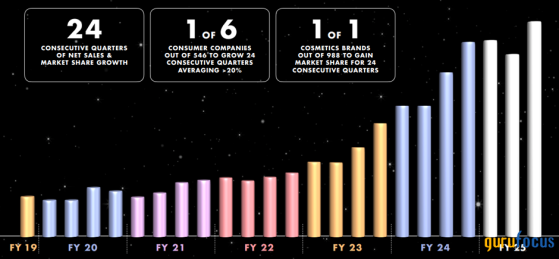

Financial PerformanceE.l.f. Beauty delivered another quarter of strong revenue growth, reporting net sales of $355 million, a 31% year-over-year (YoY) increase on top of an 85% growth in Q3 last year. This marks the 24th consecutive quarter of net sales growth and market share gains, reflecting the company's ability to sustain momentum even in a challenging environment.

Source: E.l.f. Investor Presentation

The company expanded its gross margin to 71.3%, a 50 bps improvement compared to the prior year. Gross margin benefits were primarily driven by favorable foreign exchange impacts on goods purchased from China, cost savings, and inventory adjustments. This was partially offset by mix related to Naturium's wholesale expansion and higher transportation costs.

Source: Gurufocus

SG&A expenses accounted for 61% of sales in Q3, with marketing and digital investments steady at 27% of net sales, consistent with the prior year. Q3 adjusted EBITDA came in at $69 million, up 16% YoY, while adjusted net income was $43 million or $0.74 per diluted share, matching last year's performance despite rising costs.

Free cash flow (FCF) turned negative for the first time since Q3 2023, largely due to increased operating activities and higher working capital requirements. Net income for the nine months fell below the previous year, impacted by a doubling of stock-based compensation (SBC) and shifts in working capital.

Working capital fluctuations, including product costs, compensation, rent, distribution, and marketing, were influenced by retailer restocking schedules, space expansions within existing retailers, and seasonal demand shifts. Despite SBC doubling from the prior year, it still accounts for just 6% of revenue, and dilution remains controlled, with the stock count increasing only by less than 1%. The company has a $500 million share repurchase program available to further mitigate dilution concerns.

Source: E.l.f. Q3 2025 10-Q

In my view, the company's cash position was under pressure, declining from $108 million to $74 million. This decline was driven by increased inventory for retailer expansion, higher accounts receivable, and reduced accounts payable, as well as previously highlighted working capital movements. Additionally, long-term debt has been reduced, further increasing the use of cash.

Source: E.l.f. Q3 2025 10-Q

Revenue Growth & Market Share GainsE.l.f. continued its impressive streak of market share gains, bolstering its dominance in the U.S. cosmetics market while accelerating international expansion. Domestic sales grew 25%, while international sales surged 66% YoY, reflecting the brand's growing global presence.

During the earnings call, management highlighted that in color cosmetics, E.l.f. continues to outperform the category. In Q3, E.l.f. Cosmetics grew 16% in tracked channels compared to a category decline of 5%, increasing E.l.f.'s market share by 220 bps. Nationally, E.l.f. is the number one brand on a unit basis with approximately 14% share and the number two mass brand on a dollar basis with approximately 12% share, more than doubling its market share from three years ago.

E.l.f. has been able to gain market share due to its value proposition, powered by an asset-light supply chain delivering a superior combination of quality, cost, and speed. Its powerhouse innovation, delivering premium products at accessible price points, disruptive marketing strategies, and efficient retail execution have promoted its global success.

Management's OutlookE.l.f. Beauty revised its full-year revenue outlook downward, expecting a net sales midpoint of $1,305 million, representing 27% YoY growth. Adjusted EPS guidance was also revised downward, citing higher costs and macroeconomic uncertainties.

The guidance cut was primarily attributed to a decline in January, which management believes reflects consumers stocking up during a highly promotional December and a decrease in beauty-related social media engagement. Consumer focus shifted toward broader concerns, including speculation around a potential TikTok shutdown, a platform that remains a critical driver of brand awareness for E.l.f. Similarly, the LA wildfires led to fewer beauty-related posts.

Despite the January slowdown, E.l.f. still managed to gain 90 bps of market share. I view these headwinds as temporary, with the 77% YoY revenue growth in FY 2024 creating even thougher comps. However, a stickier challenge lies in the initial performance of a couple of new product launches for Spring 2025, which have started off slower than expected.

Tariffs also present a potential risk, given that 80% of E.l.f.'s manufacturing is in China. However, management noted that tariffs haven't impacted fiscal year results. CFO Mandy Fields stated, "We believe we have a successful playbook from 2019 when tariffs moved to 25%. This included supplier concessions, cost savings, and select price increases. We also benefited from favorable FX movements. With increased supplier diversification outside China and a growing international sales base, we have multiple levers to mitigate the impacts of new tariffs."

ValuationThe beauty sector is facing headwinds, and E.l.f. is no exception. However, in my opinion, E.l.f. remains the standout performer. No other beauty company in its peers is expected to achieve double-digit revenue growth over the next two years.

I compared E.l.f. to larger beauty brands, particularly L'Oreal (LRLCY), which has the highest growth rate among its peers outside of E.l.f. itself. While L'Oreal's projected revenue growth is approximately 6% over the next few years, E.l.f. is expected to grow by over 20%. Despite this, E.l.f.'s forward price-to-sales (P/S) ratio of 2.8x and forward price-to-earnings (P/E) ratio of 20.5x are lower than L'Oreal's.

Source: Author

E.l.f. is not optimized for FCF as it is currently investing heavily in future growth. Since an FCF model is not appropriate, I used a multiples-based approach, valuing E.l.f. at approximately $128 per share, representing an 80% potential upside. I reduced my price target since my last article due to softer guidance and some temporary headwinds. However, I still see an opportunity in E.l.f. as I believe the market overreacted to its earnings.

Source: Author

Conclusion: Buy the Dip?E.l.f. Beauty continues to execute well, maintaining double-digit revenue growth, expanding its global footprint, and increasing gross margins, highlighting the brand's strength in disrupting the sector and gaining market share. However, the company's heavy reliance on TikTok introduces an element of uncertainty, particularly with ongoing discussions about the platform's future. Furthermore, despite efforts to diversify its supply chain, 80% of E.l.f.'s manufacturing remains in China, and while management asserts that tariffs won't impact FY 2025, the market may be factoring in potential long-term risks. Nevertheless, E.l.f. has navigated challenging tariff environments before, and I believe it is well-positioned to do so again without significant impact.

Source: Gurufocus

Management's history of under-promising and over-delivering suggests that the company may be setting conservative expectations now, only to exceed them later. For long-term investors who believe these headwinds are temporary, this pullback could present an opportunity to buy into a high-growth disruptor at a more reasonable valuation.

This content was originally published on Gurufocus.com