- Higher US rates and strong dollar catalyst for losses

- Argentine peso and Russian ruble face heaviest rout

- Turkish lira follows closely behind

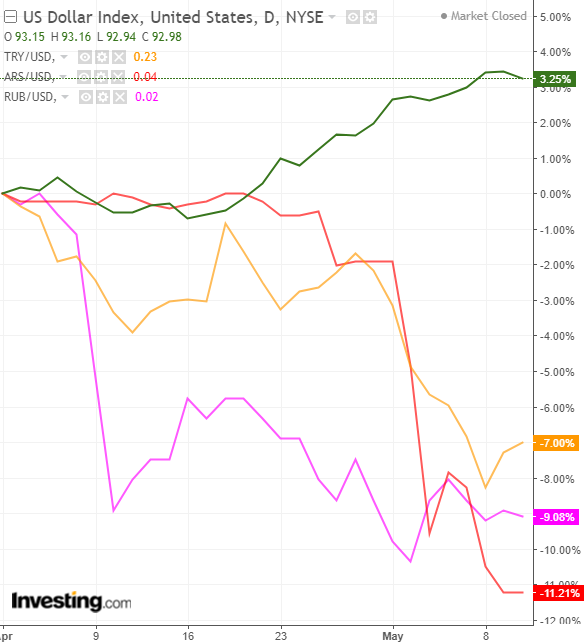

Emerging market currencies have fallen sharply against the US dollar so far in the second quarter, leaving the asset class on track for a brutal run this quarter, according to the head of currencies strategy at ING. ”Broad dollar strength has delivered a brutal second quarter for EM so far,” said Chris Turner, currencies strategy head at ING in a note this week.

The Argentine peso has experienced the worst selloff to date, tumbling 11.29% against the US dollar so far this quarter. Russia’s ruble has dropped 10.6% against the US dollar.

The Turkish lira has shed 7.75%, the Mexican peso has declined 7.17%. Chile’s peso is off 5.88%, the Polish zloty has fallen 4.85%, the South African rand has lost 5.68% and the Brazilian real is around 7.9% lower.

The ruble has been pressured lower by a new round of US sanctions imposed in April targeting some of Russia’s biggest tycoons, in response to alleged Russian meddling in the 2016 US presidential election.

Argentina’s central bank raised interest rates for the third time in eight days last Friday in a bid to stem spiraling inflation and prop up the peso. Since then the country has been forced to seek assistance from the International Monetary Fund.

Meanwhile, the Turkish lira has also been hit by accelerating inflation and investor skepticism over central bank policy. “While we can blame all these moves on local (largely political) stories, it has been higher US rates and the strong dollar which has been the catalyst for losses,” said Turner.

The US Dollar Index hit its highest levels of the year this week, while US 10-year yields rose above the key 3% level for the first time in four years late last month. That has placed pressure on emerging markets by pushing currencies lower and bond yields higher.

Dollar strength, rising US yields “a paradigm shift”

A surging dollar is likely to hit foreign investment into emerging markets this year, the Institute of International Finance said on Wednesday, calling the dollar's rise and higher US yields "a paradigm shift" for investors.

"Prospects for non-resident capital inflows to emerging markets this year have deteriorated...Rising US bond yields and a stronger dollar have prompted a 'sudden stop' in portfolio flows since mid-April," the IIF said in a report.

The Federal Reserve has raised interest rates six times since 2015 and has projected two more rate hikes this year, but some investors expect three more. Emerging market economies with high current-account deficits, a heavy dollar debt load and runaway inflation remain vulnerable to rising global interest rates.

Fed Chairman Jay Powell said earlier this week that emerging market economies should be able to manage as advanced economies move toward tighter monetary policy. He said that many have bolstered their defenses after previous crises, but he did point out that some investors and institutions may not be well positioned for a rise in interest rates, even one that markets broadly anticipate.