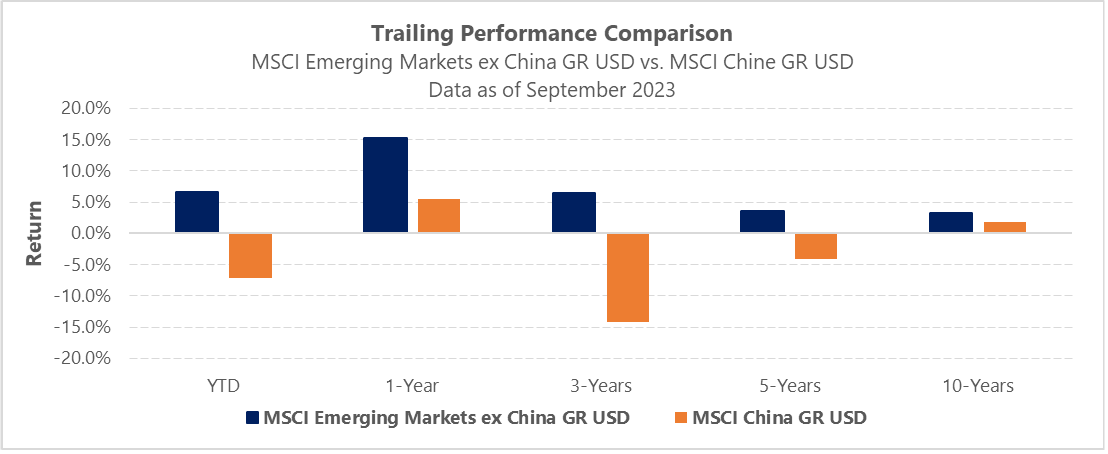

While the Chinese economy is the largest among the emerging economies, after decades of exponential growth, recent data has indicated signs of a significant economic slowdown, as evidenced by sluggish consumer spending, rising youth unemployment, and increasing local debt. As China’s economic woes unfold, the progress of other emerging market economies has come to the forefront, demonstrating to many interested investors that there are burgeoning opportunities within emerging markets, beyond China.

Emerging Markets, outside of China

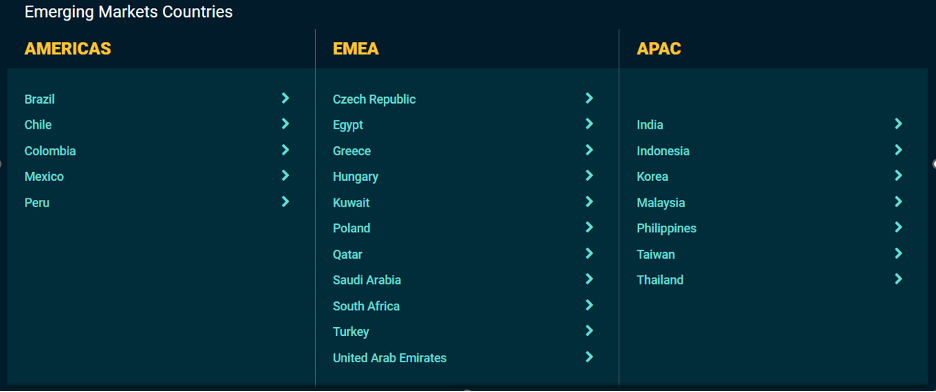

While discussions pertaining to the emerging markets asset class may lead individuals to focus on China, because of its outsized influence. In truth, the countries that encapsulate this grouping are representative of global economies that have access to diverse natural resources and companies that provide distinct products and services utilized by a global economy. In looking at the MSCI Emerging Market Index, the list of emerging market countries spans three geographic regions; with nations that have established economic competitive advantages.

Emerging Markets Growing Influence

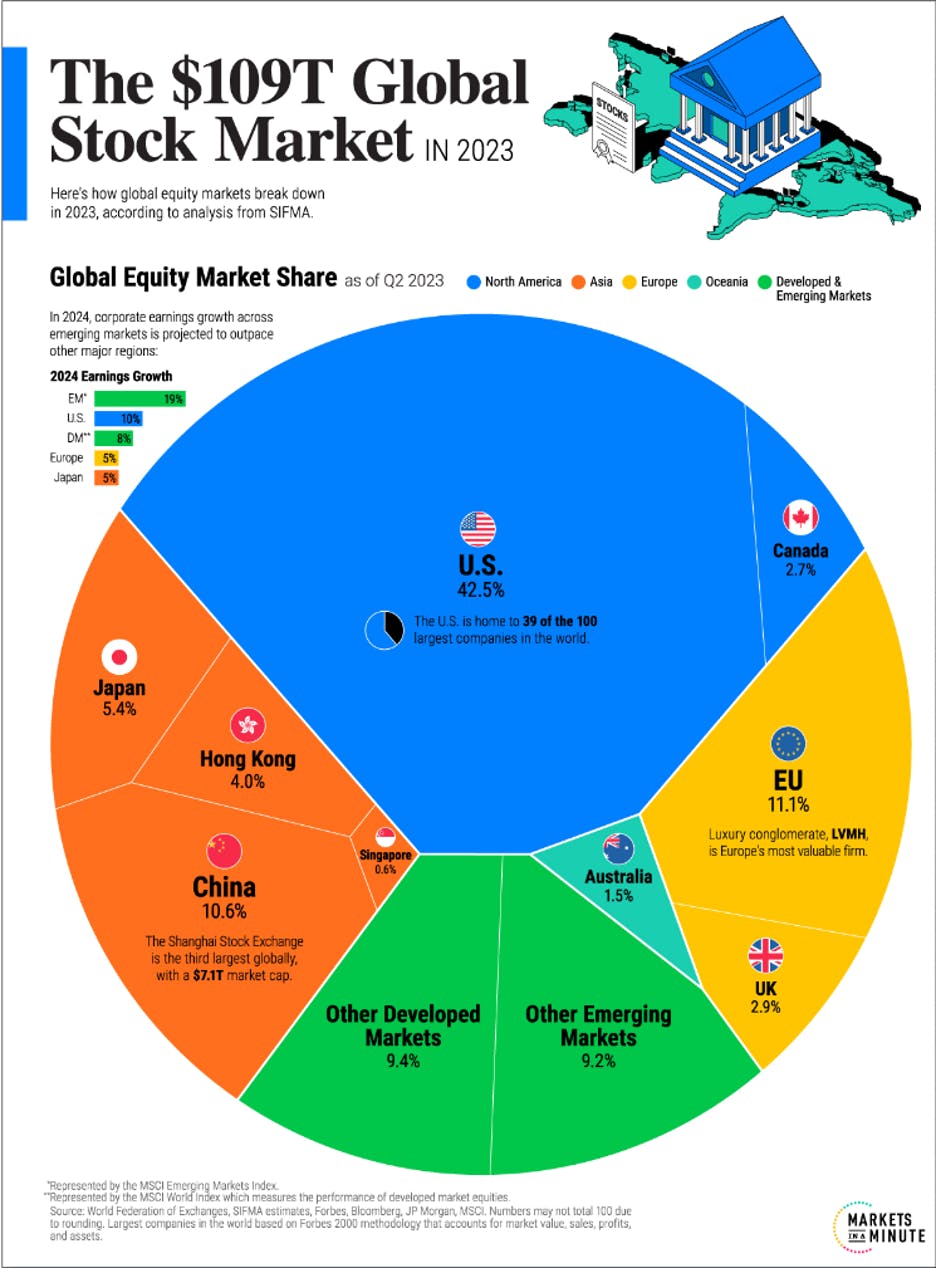

Recent research from Goldman Sachs (NYSE:GS) detailed the growing influence and importance of the emerging market asset class, as the stock market capitalization of emerging markets is projected to overtake the US by 2030. As noted in the article, emerging markets share of the global equity market will rise from around 27% currently to 35% in 2030, 47% in 2050, and 55% in 2075. India is expected to have the largest global market cap share increase — from a little under 3% in 2022 to 8% in 2050, and 12% in 2075 — reflecting a favorable demographic outlook and rapid growth in GDP per capita. China’s share will rise from 10% to 15% by 2050 but, amid a demographic-led slowdown in potential growth, it’s expected to then decline to around 13% by 2075. The U.S.’s share of global equity market capitalization is projected to fall from 42% in 2022, to 35% in 2030, to 27% in 2050, and 22% in 2075.

The catalyst driving this forecast is income convergence between emerging and developed economies. As incomes converge, that implies the share of global GDP accounted for by emerging markets will continue to rise over time: Their incomes will converge gradually towards developed economy levels, and the distribution of global income will shift towards this growing group of middle-income economies. With the right policies and institutions, today’s EMs are expected to make up seven of the world’s top ten economies in 2075; with the world’s three largest economies projected to be China, India, and the U.S.

AGF Emerging Markets ex China Fund

As a prominent, multi-dimensional asset manager, AGF Investments Inc. (AGF Investments) provides investors with diverse investment solutions to help them actualize their long-term goals. For emerging market focused investors, the AGF Emerging Markets ex China Fund (Ticker: AEMX) is an actively managed solution that invests in growth-oriented companies located in, or with significant business interests in, emerging market countries excluding China.

The manager will use a bottom-up investment approach aimed at identifying companies with significant business interests in emerging market countries outside of China trading at a significant discount to their expected earnings potential. By using this approach, the manager is intentionally creating a solution capable of generating long-term earnings growth, by holding companies with strong competitive positioning within their respective markets and excellent management teams.

Simply put, while the solution may focus primarily on businesses outside of China – the disciplined investment approach utilized by the manager allows for quality companies to be reflected within its underlying holdings. For investors looking to diversify their core equity holdings and benefit from the unique exposures and opportunities that emerging markets provide, this solution is certainly worthy of consideration.

This content was originally published by our partners at the Canadian ETF Marketplace.