The company’s name is derived from its origins as part of Eastman Kodak. It was spun-out from Kodak back in 1994. Kodak had a need for chemicals for developing photographs when chemicals were scarce during WWI.

In the hundred-plus years since, the chemical division has expanded way beyond its initial niche and today is a major supplier of specialty chemicals and materials, with a market cap approaching $12 billion and over $9 billion in sales in 2023. That was not a banner year for growth as revenue declined from the $10-billion-plus of the two previous years. But the company was profitable due to gross margin improvement, a decline in R&D expenses, and the sale of its Texas City operations that closed last December.

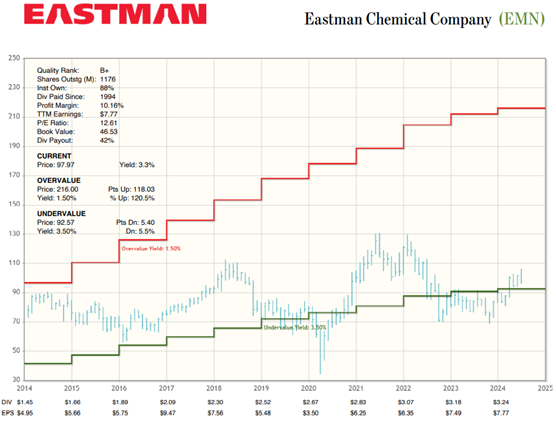

Free cash flow at close to $950 million should be sufficient to cover the $376 million dividend, $150 million in share repurchases, retire some debt, and increase cash on hand to $55 million. EMN is a mature business, and as such, needs to generate new revenues for continued growth.

One path is to invest into greater recycling capacity for plastics that have historically been difficult to recycle. EMN has built a molecular recycling capacity in Tennessee that recently began generating revenue, and intends to build two more of these plants, one in France and another in Texas, where the company has an existing plant.

The Texas plant is attempting to secure up to $375 million through the Department of Energy from Inflation Reduction Act infrastructure funds. The goal is to recycle plastics from automobiles that are just as good as newly sourced plastics using EMN’s carbon renewal technology (CRT). It can recycle almost any plastic into materials used in the production of new plastic resins. These resins can be molded into new automotive parts that meet a number of requirements established by Ford, GM, and others.

The ROIC, FCFY, and PVR are 5%, 4%, and 2.9 respectively. The Economic Book Value is $33.72 per share.

Recommended Action: Buy EMN.