Energy ETFs experienced a significant upturn in performance as crude oil prices increased for a second consecutive week amidst the Israel-Hamas conflict sparking fears of supply disruption.

Plans from the Biden administration to replenish its strategic oil reserves have also likely contributed to this rise, with the West Texas Intermediate (WTI) crude price rounding off at approximately $89 a barrel (+1.21%), after surpassing the $90 mark. Consequently, the energy sector was up 0.68% for the week, despite most of the S&P sectors suffering heavy losses.

Over the course of the week, energy funds gained +0.49% and attracted $31 million of inflows. As an example, the Ninepoint Energy Fund (NNRG.U) increased by +1.66% over the week, collecting almost 6 million of positive flows.

Geopolitical issues often influence global oil markets due to the potential impact on supply chains and production capacities. Currently, heightened tensions in the Middle East - a region abundant with oil reserves - are contributing to market uncertainties which subsequently drive up commodity prices.

Additionally, there are indications of a strategic move by the U.S authorities to safeguard their national oil reserves. According to information released by the US Department of Energy on Thursday, the government

intends to acquire 6 million barrels of crude oil, with the purchase set for delivery to the Strategic Petroleum Reserve (SPR) through December 2023 and January 2024.

Group Data: Energy, Crude Oil

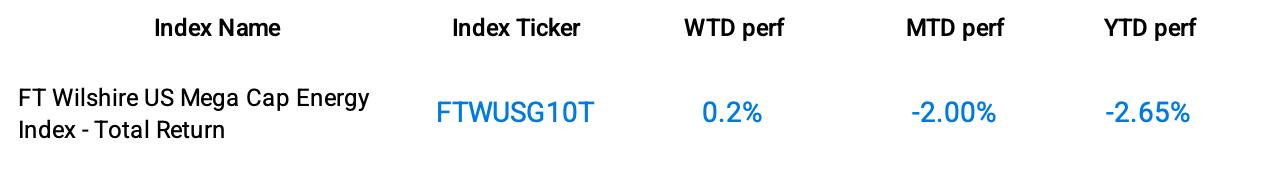

Index Data

Funds Specific Data: NNRG.U, NRGI, HXE, HUC, RENG

This content was originally published by our partners at the Canadian ETF Marketplace.