Oil prices surged for the sixth week in a row (WTI crude up 2.78%) after a significant drop in U.S. inventories, pointing to vigorous demand from the world's biggest fuel consumer. Data from the American Petroleum Institute, released on Tuesday, showed that U.S. crude inventories shrank by 15.4 million barrels in the week to July 28, the largest draw seen in data stretching back to 1982.

Furthermore, on Thursday Saudi Arabia extended a voluntary oil production cut of one million barrels per day until the end of September, while Russia has also said it will cut its oil exports by 300,000 barrels per day next month.

Oil markets were initially slow to respond to bullish catalysts such as supply reductions, declining stockpiles and increasing demand. But, as Saudi Energy Minister Abdulaziz bin Salman cautioned speculators of an upcoming short squeeze, the recent rally has gained significant momentum, with WTI crude oil jumping 19.75% over the last six weeks.

Despite this significant rebound, many commodity analysts believe the oil price rally still has sufficient energy to continue, with deficits expected to endure until the first quarter of 2024.

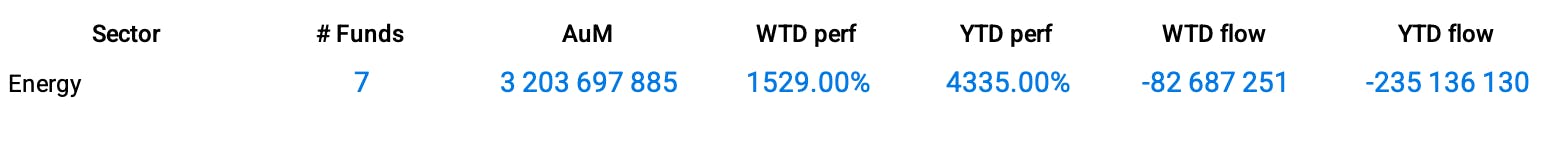

Group Data: Energy

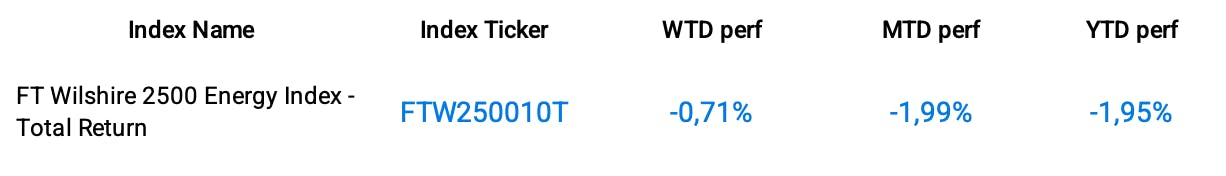

Index Data

Funds Specific Data: XEG, NNRG, ZEO

This content was originally published by our partners at the Canadian ETF Marketplace.