Last week saw oil prices fall again for the third consecutive week amid concerns of escalating U.S. interest rates and a slowdown in worldwide demand in the wake of disappointing trade data from China, the world's largest oil importer. Once again WTI crude oil prices dropped, down 4.15% to $77.17 a barrel while those of the Brent lost 3.76% to $81.70 a barrel. Both benchmarks are currently on course for the longest and hardest weekly losing streak since a four-week drop from mid-April to early May.

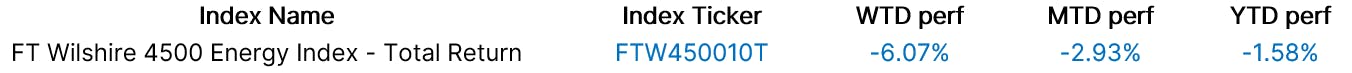

Unsurprisingly, the energy sector was hit hard by this bearish trend with the S&P energy index down 3.82% for the week, while the S&P benchmark index was up 1.31%.

The situation is further complicated by natural gas prices also experiencing a sharp drop due to record-level production and a lack of demand driven by current mild temperatures. The December 2023 Nymex futures contract saw a 14.17% weekly depreciation, closing at $3.017 per million British thermal units (MMBtu). The United States Natural Gas Fund (UNG) lost -13.68% last week, bringing its year-to-date performance to -55.64%.

That said, it's not just the fossil fuel sector feeling the pinch. Clean energy stocks also had another challenging week in the wake of disappointing quarterly results posted by the upstart hydrogen producer and fuel cell developer, Plug Power Inc, which fell short of analysts’ estimates. The company faced “enormous challenges associated with the availability of hydrogen, primarily due to downed plants, including their Tennessee facility, and temporary plant outages across the entire hydrogen network” and warned it will struggle to stay afloat in 2024. Its shares plunged 46.68% on the back of the news although CFO Paul Middleton sought to reassure investors of the company’s ability to raise financing during the earnings call.

As an illustration of this trend at a fund level, the ALPS Clean Energy ETF (NYSE:XLE) (ACES) declined by -11.43% over the week, with approximately -$10 million of outflows.

Group Data

Index Data

Funds Specific Data: XOP, UNG, QCLN, FXN, FCG, PBW, ACES

This content was originally published by our partners at ETF Central.